Top Southwest Markets for Industrial Construction

Dallas leads the nation in this category, according to CommercialEdge data.

During the height of the pandemic, e-commerce had a remarkable run, becoming a cornerstone for the economy and households in need of safe shopping. The industrial construction scene has experienced remarkable expansion, which prompted developers to adhere to green building practices and energy-efficient features. An illustrative example is the partnership between Stream Realty Partners and Catalyze.

The national in-place average rent rose 4.7 percent year-over-year through April to $6.5 per square foot, while the vacancy rate stood at 4.7 percent in May, according to CommercialEdge data. Overall, in late June, the industrial market totaled nearly 17.3 billion square feet of industrial space, while nearly 700 million square feet of space was under construction. The absolute leader of all markets was Dallas, followed by Phoenix (43 million square feet underway) and the Inland Empire (37 million square feet).

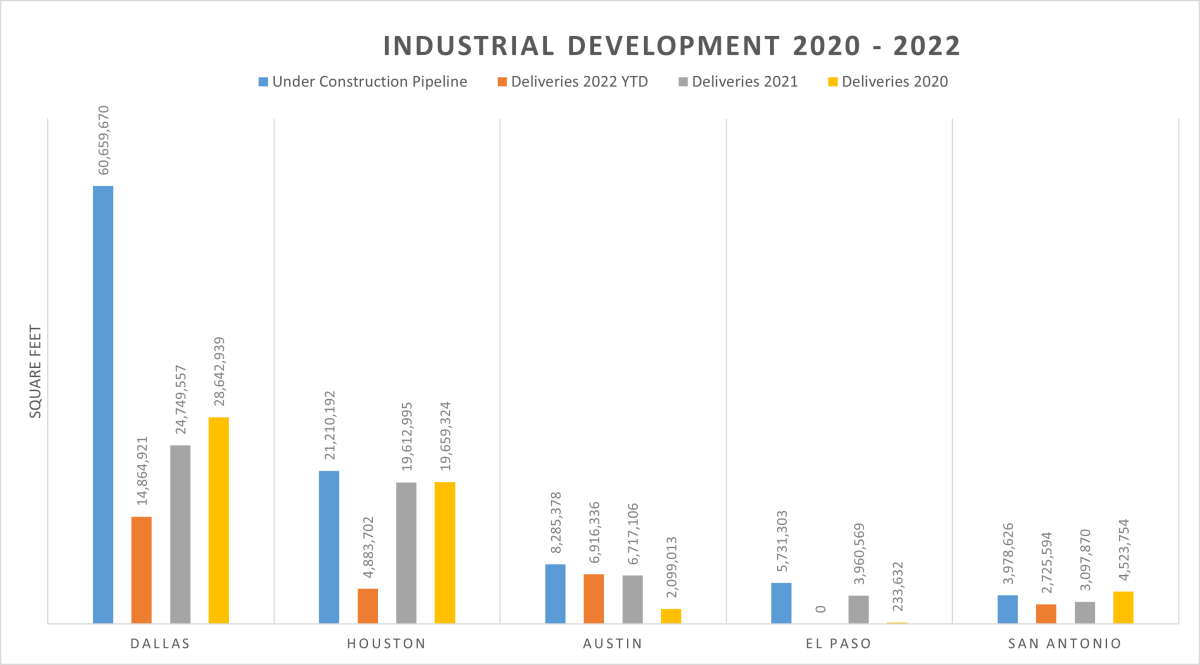

In the ranking below, we will be focusing on the top five markets for industrial construction in the Southwest, based on their construction pipelines. All five metros are in Texas, the markets combined will expand the national industrial stock by 100 million square feet.

| Rank | Market | Under Construction Pipeline | Current Total Stock | Under Construction as % of Stock | Deliveries 2022 YTD (June) |

| 1 | Dallas | 60,659,670 | 840,028,013 | 7.22% | 14,864,921 |

| 2 | Houston | 21,210,192 | 547,769,412 | 3.87% | 4,883,702 |

| 3 | Austin | 8,285,378 | 114,487,987 | 7.24% | 6,916,336 |

| 4 | El Paso | 5,731,303 | 52,666,828 | 10.88% | 0 |

| 5 | San Antonio | 3,978,626 | 116,414,818 | 3.42% | 2,725,594 |

1. Dallas

DFW has one of the largest industrial stocks in the country and the largest industrial construction pipeline, not just in the Southwest, but in the U.S. In late June, the metro had more than 61 million square feet underway, the equivalent of 7.2 percent of its total stock, which is slightly above 840 million square feet.

In 2022 through June, developers delivered nearly 15 million square feet and, if the pace of deliveries remains constant, this year’s volume is on track to outperform 2021 (24.7 million square feet, or 3.1 percent of stock) and at least match 2020 (28.6 million square feet, or 3.7 percent of stock).

Notable projects under construction include Stream Realty Partners’ 3.4-million-square-foot development in Mesquite, east of Dallas, and Texas Instruments’ 4.7-million-square-foot chip manufacturing plant in Sherman.

2. Houston

Houston occupies the second position in this ranking with more than 21.2 million square feet of industrial space under construction. The figure equates to 3.9 percent of the total stock, which increased to 547.8 million square feet.

In the first half of 2022, nearly 4.9 million square feet of industrial space came online, 0.9% of total stock. Although it is too early to say how much of the under-construction inventory will be completed by year-end, the volumes of the previous years have been similar and may end up leading this year’s volume: in 2021, 19.6 million square feet of industrial space, or 3.8 percent of total stock, was delivered, while in 2020, 19.7 million square feet, or 3.9 percent of total stock, was added.

Notable industrial developments in Houston include the 507,000-square-foot warehouse for Article, a Canada-based online furniture company, and TGS Cedar Port Industrial Park in Baytown, Texas. At more than 15,000 acres, it is the largest master-planned, rail-and-barge-served industrial park in the U.S.

3. Austin

The sustained performance of the industrial market adds to Austin’s already notorious versatility. As of June, the Texas capital had 8.3 million square feet of industrial space under construction, which with its 114.5 million-square-foot market represents 7.2 percent of total stock.

In 2022 through June, more than 6.9 million square feet came online, already above the annual deliveries of 2021 (6.7 million square feet, or 6.7 percent of total stock) and 2020 (2.1 million square feet, or 2.1 percent of total stock).

Although Austin is one of the metros where Amazon is pausing development plans indefinitely for a distribution center in Round Rock, the metro still has a great impact on the industrial market. Projects like Samsung’s semiconductor plant in Taylor and Tesla’s Giga Texas have been attracting more industrial development. Recently, Titan Development announced the 2.6 million-square-foot Hutto Mega TechCenter, and Alliance Industrial Co. is starting construction on Kyle/35 Logistics Park, a 1.4 million-square-foot park.

4. El Paso

Nestled between New Mexico and Mexico, El Paso shows increasing industrial construction activity. In mid-2022, the metro had some 5.7 million square feet of industrial space under construction, the equivalent of 10.9 percent of stock—the largest percentage of stock in this ranking. Still, the metro’s industrial inventory is the smallest of the metros on this list, at just 52.7 million square feet.

No projects were completed in 2022 through June, but El Paso saw incredible volume expansion over the past two years. Nearly 4 million square feet was delivered in 2021, or 8.1 percent of total stock, from 234,000 square feet (just 0.5 percent of total stock) in 2020.

5. San Antonio

With nearly 4 million square feet under construction, San Antonio rounds out the top five. The figure is the equivalent of 3.4 percent of total stock, which currently totals more than 116 million square feet.

By June, developers had delivered more than 2.7 million square feet, already close to the 3.1 million square feet of added volume in 2021 (2.8 percent of stock), and half of 2020’s volume, when the industrial inventory was expanded by 4.5 million square feet (4.3 percent of total stock).

Among the projects currently under construction is Cornerstone Commerce Center, VanTrust Real Estate’s 1 million-square-foot speculative development.

You must be logged in to post a comment.