The Flattening Yield Curve

Industry participants can expect further softness in land values and increased difficulty in obtaining construction loans, as short-term interest rate increases are expected to continue, argues Avison Young Principal Jay Maddox.

By Jay Maddox, Principal, Avison Young

The stock market has continued to hit historic highs, and optimism regarding the U.S. economy’s growth prospects has paved the way for the Fed to raise short-term interest rates. However, long-term interest rates have not moved up in lock step with short-term rates, and, in fact, they have recently dropped, signaling a “flattening yield curve” that has important implications for both commercial real estate and the economy in general.

The stock market has continued to hit historic highs, and optimism regarding the U.S. economy’s growth prospects has paved the way for the Fed to raise short-term interest rates. However, long-term interest rates have not moved up in lock step with short-term rates, and, in fact, they have recently dropped, signaling a “flattening yield curve” that has important implications for both commercial real estate and the economy in general.

What is the Yield Curve?

The yield curve depicts interest rates or bond yields of similar risk or class by maturity. A normal (or so-called “positive”) yield curve reflects, other things being equal, short-term rates are typically lower than long-term rates.

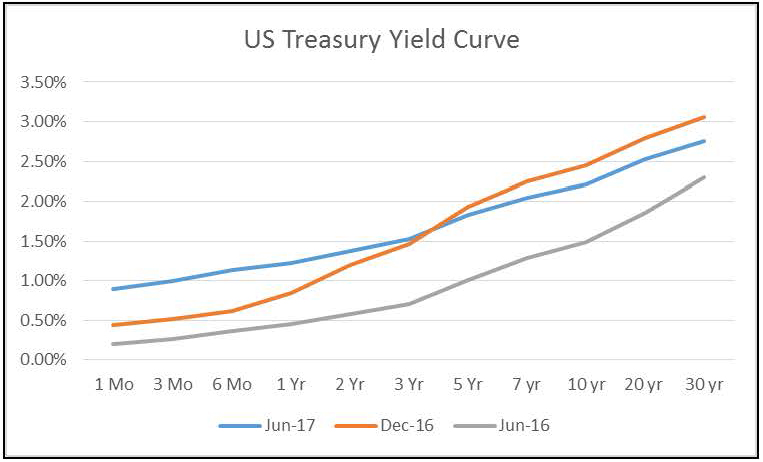

From June to December last year, interest rates moved higher across the board, and long-term interest rates increased faster than short-term rates, resulting in a steepening of the yield curve (see chart below). Most market observers agree this was due to increasing optimism regarding long-term growth prospects coupled with increased inflationary expectations. However, since December of last year, short-term interest yields have risen by about 0.45 percent to 0.50 percent, while the 10-year Treasury yield long-term rate has actually decreased by about 0.25 percent. Therefore, the yield curve has been “flattening” since the beginning of the year, as the Fed has bumped up short rates while long rates have dropped.

Is a Flattening Yield Curve Good or Bad?

Short-term rates are typically tied to market expectations about Fed policy, while longer-term rates reflect economic expectations. It is important to note that the Fed’s Quantitative Easing programs, no longer in effect, involved purchasing long-term Treasury and mortgage backed securities in large volumes, which kept long term interest rates at historically low levels for many years, helping to fuel the economic recovery. During that time, the Fed kept short term rates near zero.

The current market consensus is that the Fed is intent on increasing short-term interest rates now that its employment and inflation goals are in balance; meanwhile, the market is concerned about the macroeconomic impact of the rate increase, hence the softening of long-term rates. However, a flattening yield curve often transitions to an inverted yield curve wherein short-term rates exceed long-term rates, reflecting a poor long-term outlook. A yield curve inversion is a strong indicator of a pending economic recession; in fact, inverted yield curves have preceded the majority of recessions since World War II.

Impact on Commercial Real Estate

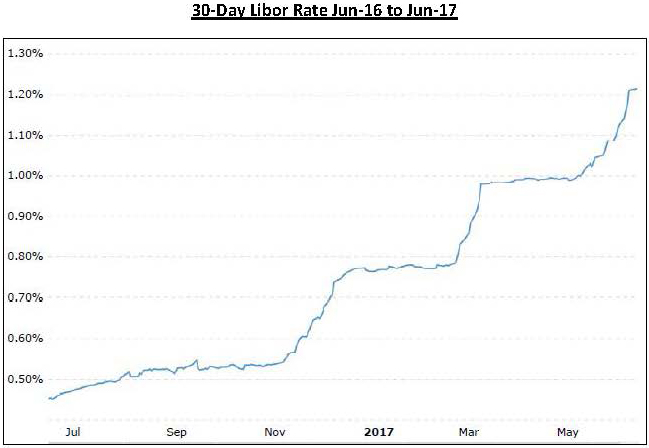

Rising short-term rates have and will continue to have a major impact on the pricing of floating rate commercial real estate bridge and construction loans, which are typically indexed to the 30-day LIBOR rate or short-term U.S. Treasury yields. Over the past year, the 30-day LIBOR rate has risen steadily from about 0.45 percent in June 2016 to about 1.2 percent in June 2017 (see chart below).

A rate increase of only 0.75 percent may not seem dramatic, but at today’s low nominal interest rates, it translates to a significant increase in the interest costs for such projects. For example, a typical construction loan priced at Libor + 3.00 percent would have had a nominal interest rate of 3.50 percent a year ago, but today’s rate would be 4.25 percent—an increase of more than 20 percent in financing costs. This cost increase is directly impacting residual land values since project costs have increased.

As short-term rate increases are anticipated to continue, one can expect further softness in land values and more difficulty in getting construction and value-added projects to pencil. This trend is coupled with a consensus that valuations may be peaking in many markets. All commercial real estate industry participants should be wary of these market trends.

You must be logged in to post a comment.