The Case for Lower Interest Rates

Reduced growth expectations and a potential stock market correction could mean interest rates might not rise as much as previously thought, notes Avison Young Principal Jay Maddox. Lower rates combined with strong demand fundamentals and capital availability could bode well for commercial real estate values.

By Jay Maddox, Principal, Avison Young

Following the presidential election, the markets were euphoric. Interest rates rose and the stock market took off based on inflationary and growth expectations. Most real estate players also agreed that higher interest rates were here to stay. But now the “Trump Bump” is showing some signs of slacking off. The election-fueled stock market rally stalled in mid-March, and the bellwether 10-year Treasury yield, which soared from a low of 1.40 percent last summer to 2.60 percent in the weeks following the inauguration, has recently dropped to about 2.23 percent.

Following the presidential election, the markets were euphoric. Interest rates rose and the stock market took off based on inflationary and growth expectations. Most real estate players also agreed that higher interest rates were here to stay. But now the “Trump Bump” is showing some signs of slacking off. The election-fueled stock market rally stalled in mid-March, and the bellwether 10-year Treasury yield, which soared from a low of 1.40 percent last summer to 2.60 percent in the weeks following the inauguration, has recently dropped to about 2.23 percent.

These recent trends indicate that investors are increasingly concerned the actual fiscal stimulus will be watered-down versions of the grandiose reforms promised during the presidential campaign. With each setback, the market corrects a bit more.

Troubles Ahead for U.S. Stock Market?

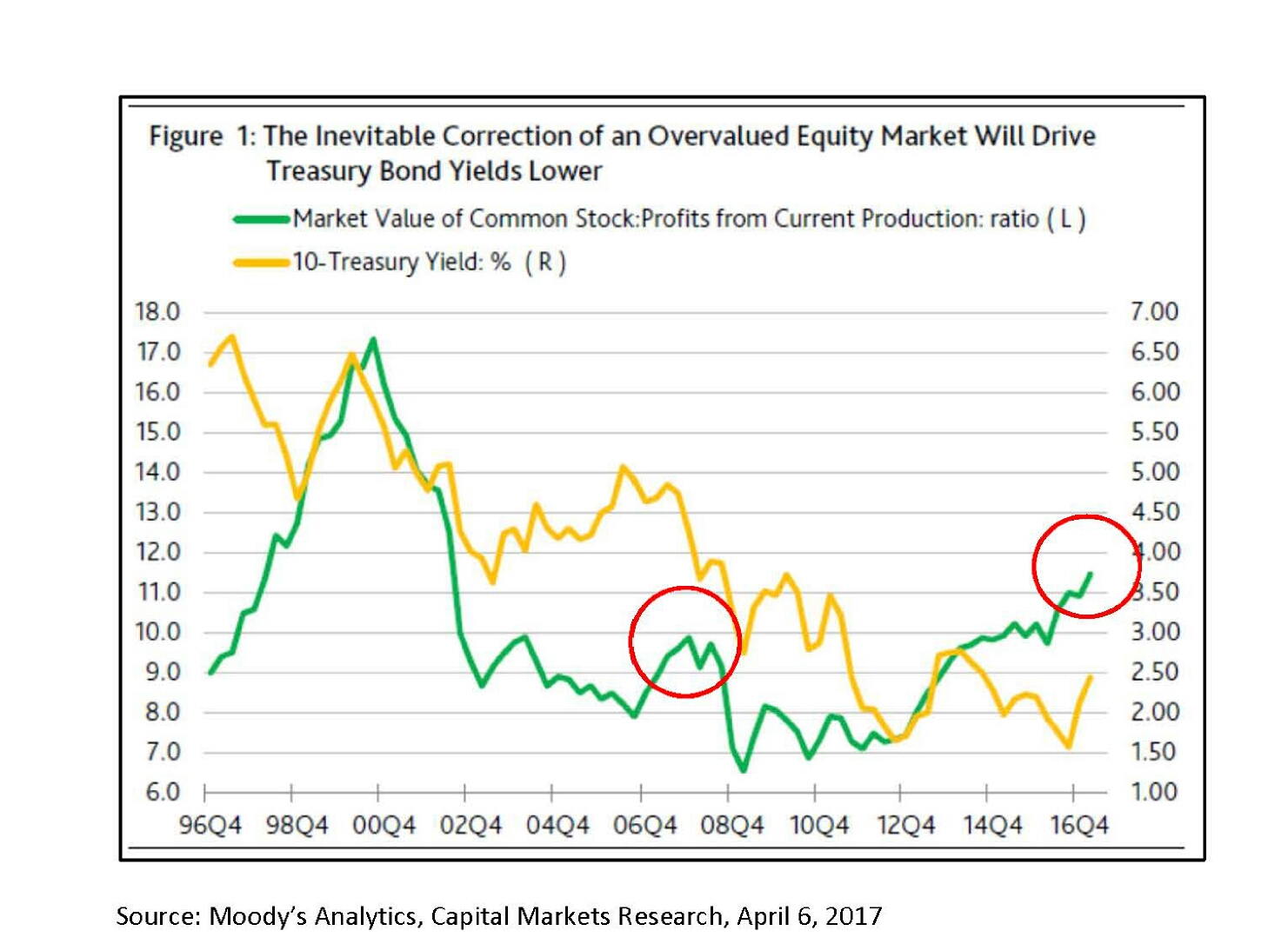

There is also troubling empirical evidence that U.S. equity markets are overheated and vulnerable to a correction, which would likely be coupled with an investor flight to quality (namely U.S. Treasury securities), thereby pushing interest rates down further. According to a recent capital markets research white paper published by Moody’s Analytics, U.S. stocks are significantly overvalued and a correction may be inevitable. Per Moody’s report, the overall stock market valuation as a multiple of pre-tax earnings is the highest it’s been in nearly 20 years and, major stock market corrections drive interest rates lower (see chart below).

The market is also overpriced relative to corporate revenues. Both measures are much higher than they were prior to the last recession.

Moody’s also points out that the consensus Blue Chip forecast for 10-year U.S. Treasury yields of 2.8 percent for the second half of 2017, and 3.1 percent for 2018, seems too high, as it is based on excessive expectations of 4.3 percent economic growth. Actual growth is likely to be much lower, in Moody’s view, which, if coupled with a significant correction in U.S. equities, would translate to lower bond yields.

To be sure, a collapse in stock prices is not necessarily imminent just because valuation multiples are at 20-year historical highs. That has been the case for quite some time, and the market hasn’t corrected. But if there is a shock to the system, for example an unforeseen geopolitical or economic crisis, the data portends a steep drop.

Now for the Good News

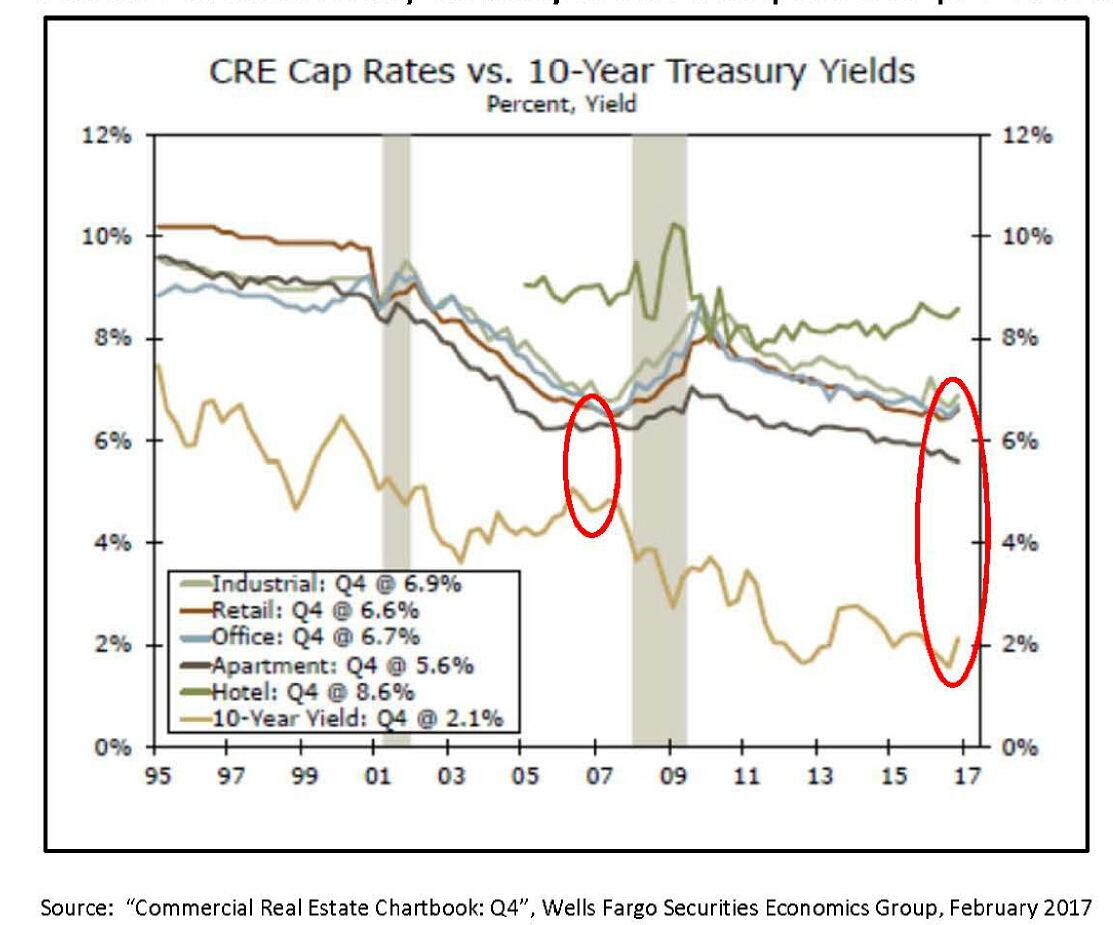

So, what is the likely impact on commercial mortgage interest rates, availability of credit and valuations? The good news is that, for the most part, risk premiums on commercial real estate are at healthy levels, especially compared to 2006 and 2007 when spreads were dramatically lower. Cap rates, while nominally low, are actually at historically attractive levels compared to U.S. interest rates. The same is true for CMBS mortgage spreads, which have decreased recently but still remain at historically healthy levels compared to pre-recession levels (see chart below).

With reduced growth expectations and perhaps a stock market correction, we would expect a change in demand fundamentals such as employment and wage growth—both important drivers of commercial property values. On the other hand, there is a possibility that, similar to bonds, U.S. commercial real estate may also be viewed as a safe-haven from the vicissitudes of the equity markets. To conclude, as long as mortgage interest rates are steady, demand fundamentals remain solid and capital flows are robust, the outlook for commercial real estate values should remain good.

You must be logged in to post a comment.