Past Storms Offer Clues About Impact on CRE

It is too early to make definitive conclusions about Harvey and Irma's impact on CRE valuations, but it is reasonable to expect CRE investment conditions to return to normalcy in the long term, argues Situs RERC President Ken Riggs.

By Ken Riggs, President, Situs RERC

First, I would like to extend my deepest sympathies to those affected by Hurricanes Harvey and Irma. In the wake of these natural disasters, it’s difficult to make predictions because there is so little precedent for two hurricanes of such magnitude hitting two different areas of the United States in one year, much less within two weeks. The most recent corollary is 2005, when Hurricane Katrina was followed three weeks later by Hurricane Rita only a few hundred miles away. And while it is too early to make any definitive conclusions about how Harvey and Irma will affect CRE valuations, the past can offer clues.

First, I would like to extend my deepest sympathies to those affected by Hurricanes Harvey and Irma. In the wake of these natural disasters, it’s difficult to make predictions because there is so little precedent for two hurricanes of such magnitude hitting two different areas of the United States in one year, much less within two weeks. The most recent corollary is 2005, when Hurricane Katrina was followed three weeks later by Hurricane Rita only a few hundred miles away. And while it is too early to make any definitive conclusions about how Harvey and Irma will affect CRE valuations, the past can offer clues.

It is important to distinguish between immediate, but temporary, effects of hurricanes (or any other major storm) and the longer-term effects. In the short term (i.e., six months out), CRE owners and occupiers will have to pour an astronomical amount of money into renovations. The supply/demand relationship will be altered as people and businesses are temporarily displaced. However, in the long term, it is reasonable to expect that CRE investment conditions will return to normalcy. I also want to make the clear distinction that I am discussing the impact on CRE (including multifamily) and not residential homes.

Property valuations

Commercial property valuations are dependent not only on characteristics of the property, but also characteristics of the neighborhood and the market as a whole. For example, the property may be near waterways that are prone to flooding. Storm damage might restrict access to property. Metro-level effects can include rising insurance costs and the mass migration of individuals and businesses, as we saw during Hurricane Katrina; the population of Orleans Parish decreased by more than half from 2005 to 2006, according to the Federal Reserve.

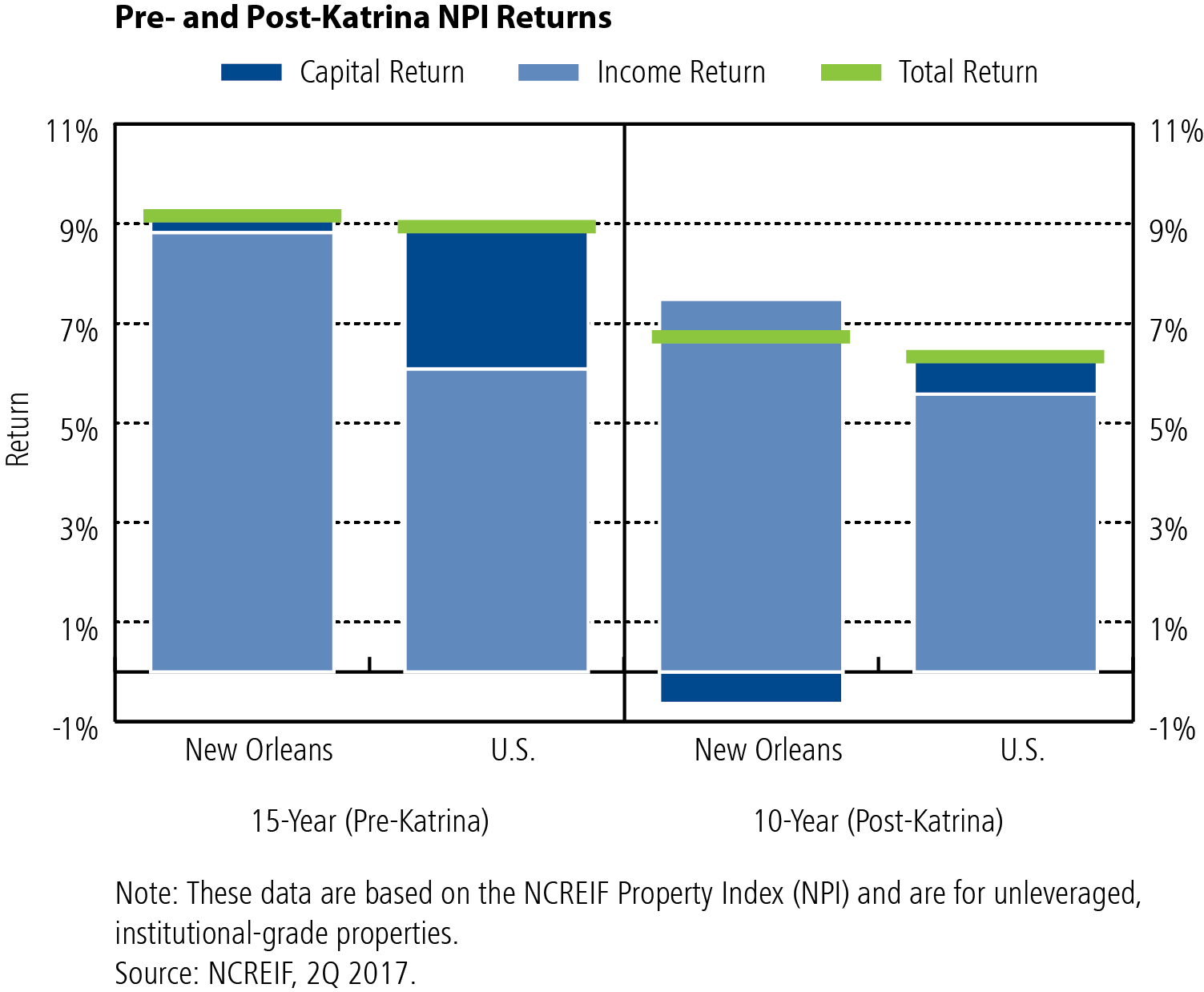

Yet, as evidenced by second quarter 2017 NCREIF Property Index (NPI) historical returns for the New Orleans metro area and the U.S., any negative impacts on property valuations appear to be short-lived.

The 15-year NPI returns show the performance of the New Orleans market (which includes the metro area) relative to the U.S. benchmark, pre-Katrina (i.e., in 2002). The 10-year returns show the performance of New Orleans post-Katrina (i.e., 2007). From the chart below, we can see that the New Orleans market slightly outperformed the U.S. prior to Katrina, driven by strong income returns. Post-Katrina, the New Orleans market continued to outperform the U.S. market, again driven by income returns. Beyond 2007, it is difficult to find any more clues from Katrina because the lead-up to the Great Recession was underway.

The occupancy rate in New Orleans in 2002 was 87.5 percent, slightly above the long-term average of just above 85 percent. There was an immediate drop in occupancy in third quarter 2005 to 80.8 percent, but the occupancy rate returned to the long-term average over 2006 and 2007. Again, the negative effect of the hurricane appears to be brief.

There was a small amount of capital depreciation for the New Orleans market post-Katrina; however, an analysis of capital appreciation since the NPI’s inception reveals that the New Orleans market has consistently underperformed the U.S. In fact, capital appreciation differences between New Orleans and the U.S. were greater pre-Katrina (2.43 percent) than post-Katrina (1.48 percent).

Essentially, there was little overall effect on New Orleans CRE performance due to the Katrina and it is likely that the impact of Harvey and Irma will be similar. One caveat, however, is there will be certain assets and particular pockets or areas that will be permanently impacted given their flood prone locations.

You must be logged in to post a comment.