Investors Brace for the Future: Dissecting Returns

With the peak of the CRE cycle on its way, investors' expectations for total returns will likely not be met, argues Situs RERC President Ken Riggs. But not to fear: Solid fundamentals should keep the income component of returns stable.

By Ken Riggs, President, Situs RERC

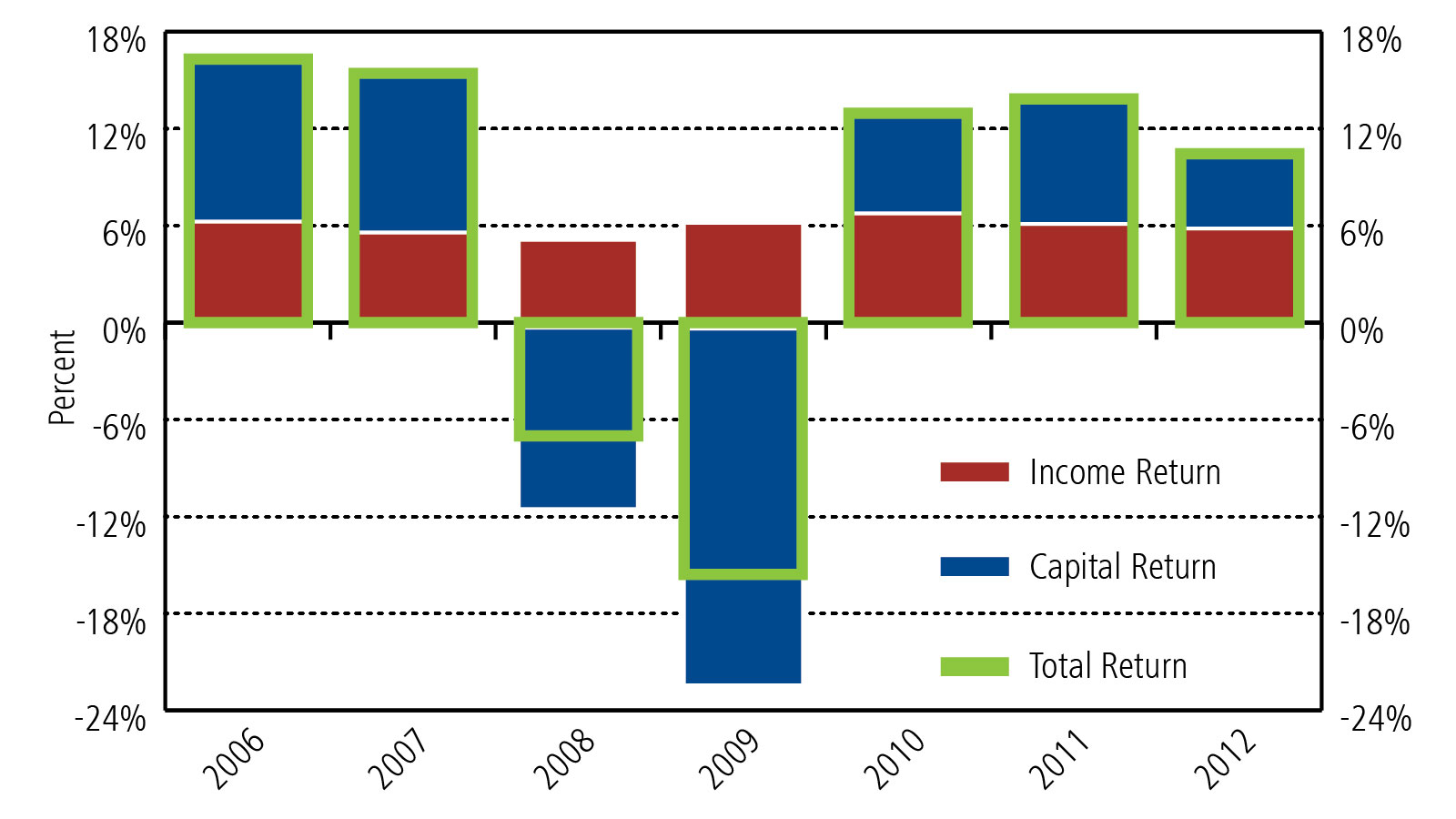

As the CRE industry edges into the peak of this cycle, investors continue to think about, plan for and speculate on when the market will turn down and how abruptly this cycle will end. To help understand expectations, investors are carefully eyeing the appreciation or depreciation of asset values. The annual income component of realized returns for institutional real estate investments over the past 10 years has been relatively consistent (see Exhibit 1). The asset value gain or value loss (i.e., capital appreciation or capital depreciation) has been the key driver of the volatility in total returns.

As the CRE industry edges into the peak of this cycle, investors continue to think about, plan for and speculate on when the market will turn down and how abruptly this cycle will end. To help understand expectations, investors are carefully eyeing the appreciation or depreciation of asset values. The annual income component of realized returns for institutional real estate investments over the past 10 years has been relatively consistent (see Exhibit 1). The asset value gain or value loss (i.e., capital appreciation or capital depreciation) has been the key driver of the volatility in total returns.

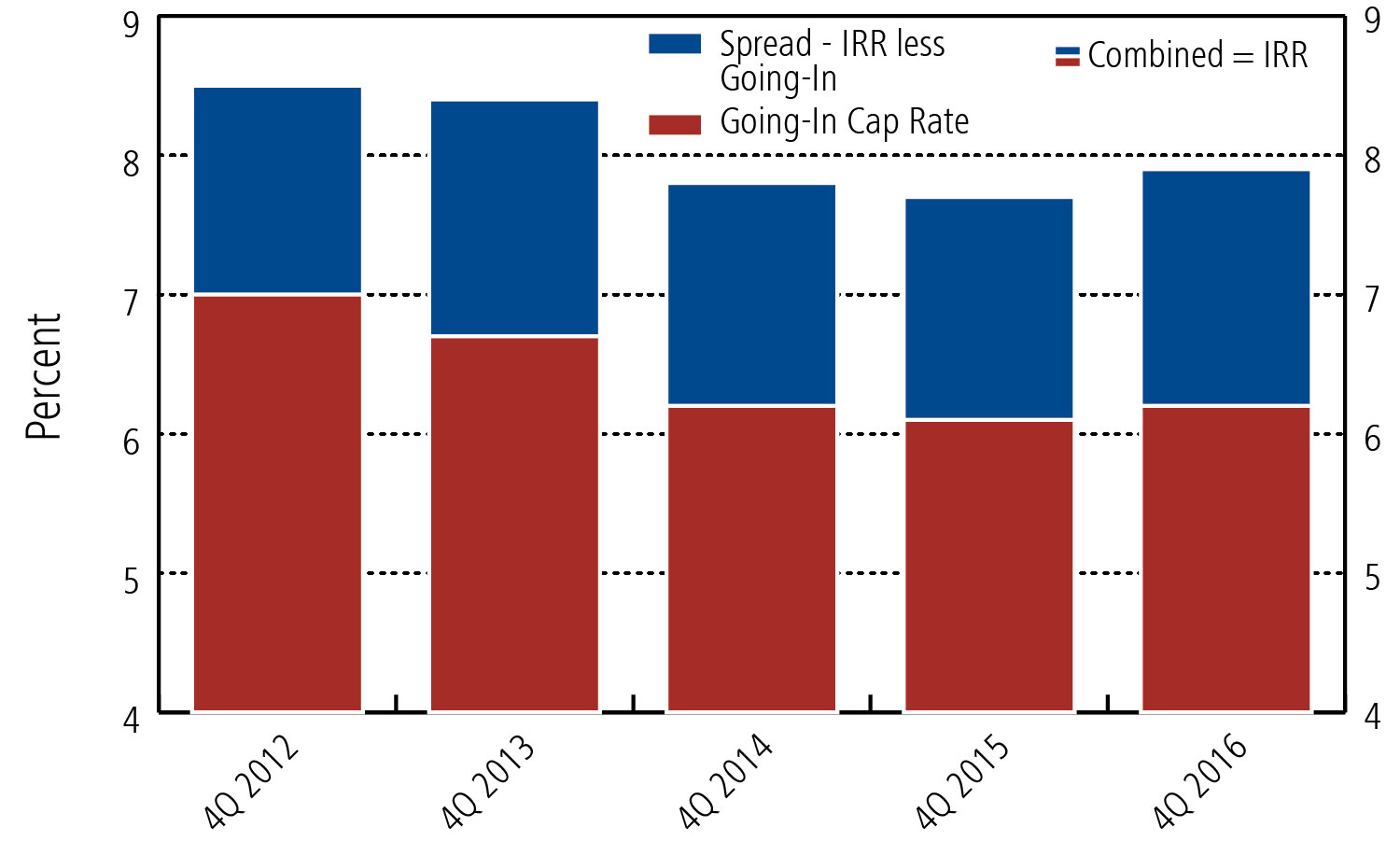

Situs RERC surveys institutional investors each quarter to examine “expected’ or “required” cap and discount rates (IRR) for the major property types. These rates allow us to provide a glimpse into investors’ targets for the future. Expected cap rates (i.e., the income component of returns) from 2012 to 2015 have averaged nearly 6.5 percent annually (see Exhibit 2), but more recently, the income component moved closer to 6.2 percent annually. It comes as no surprise that the income component has declined, as market dynamics pushed 10-year government bonds lower for much longer than most investors expected.

The spread between discount rates and going-in rates is a proxy for growth expectations for a particular asset: a widening spread indicates greater growth expectations. Situs RERC’s required rate of return in first-quarter 2017 was almost 8 percent. The historical spread between the discount rate and going-in rate has remained fairly steady, around 170 basis points. However, after a period of narrowing spreads from fourth-quarter 2015 through third-quarter 2016, the spread has widened slightly over the past two quarters and is approximately in line with pre-recession levels.

Exhibit 2: Situs RERC IRR (Discount Rate) and Cap Rate Composition – All Property Types (Source: Situst RERC, 1Q 2017)

Future forecasts

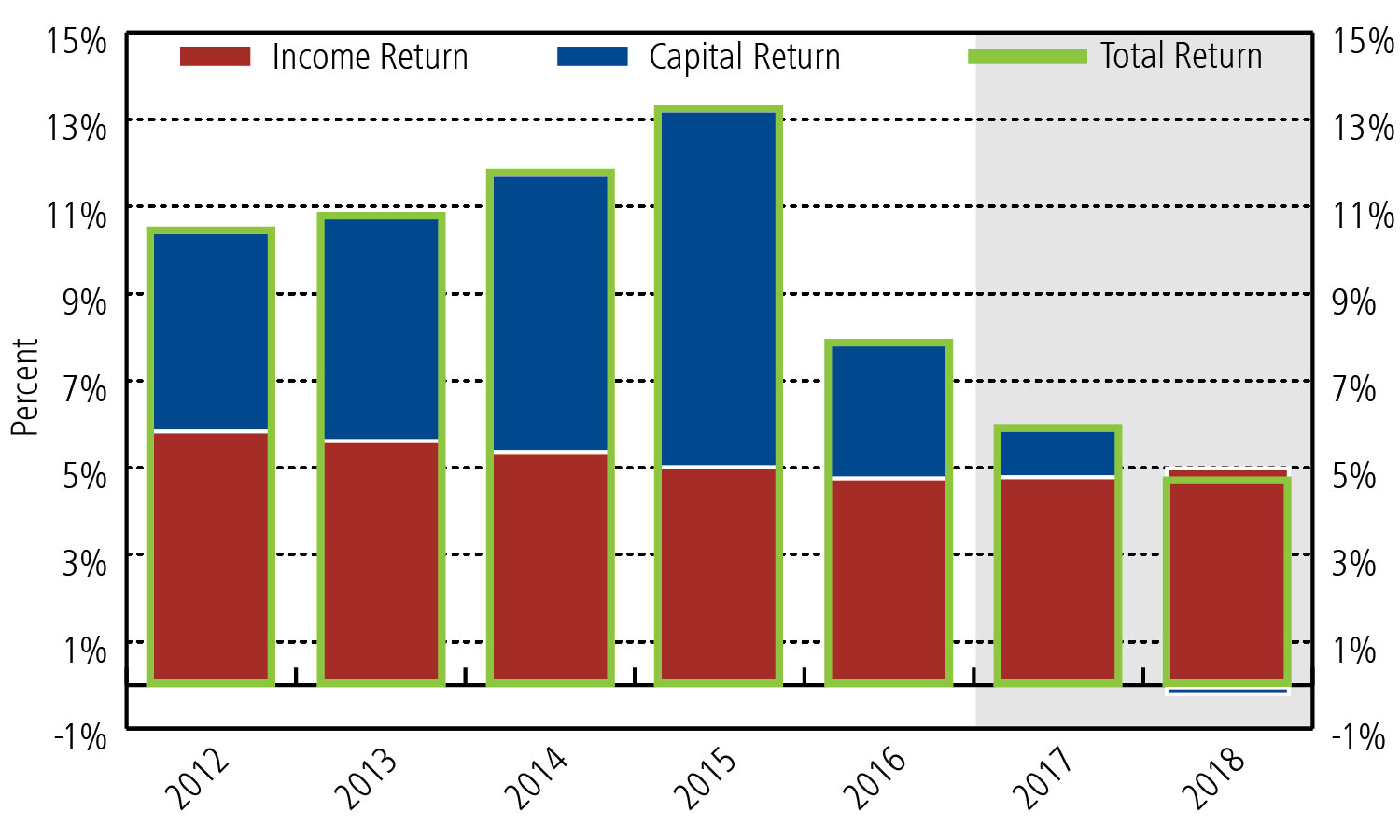

Looking into the future, Situs RERC forecasts total returns – and the income and capital components of total returns – for the NCREIF NPI. Situs RERC’s base-case scenario has the NCREIF NPI total return decreasing just below 6 percent by the end of 2017, and reaching under 5 percent by the end of 2018. This scenario has the income component constituting the majority of returns as capital appreciation is expected to decrease substantially (see Exhibit 3).

Dissecting the returns, we see that the high total returns since the Great Recession were driven by capital appreciation (Exhibit 1). Capital losses happened abruptly, as did the response of the financial markets to the global crisis. While investors’ required returns going forward are near 8 percent (Exhibit 2), Situs RERC forecasts returns to be about 5 percent by the end of 2018, as capital appreciation goes to zero or declines into negative territory (Exhibit 3).

In short, investors’ expectations for CRE total returns will come under stress, and it appears their projections will not be met. The peak of the CRE cycle is here. Despite this, Situs RERC does not believe history will repeat itself; asset price changes are expected to be more subdued compared to the last cycle and CRE is still an attractive investment alternative. Solid fundamentals are expected to keep the income component of returns stable, which is good news for investors seeking safe havens in this uncertain environment.

You must be logged in to post a comment.