Economic Costs of Twin Disasters

The two storms will rank among the costliest in U.S. history, and that goes for the real estate industry, too, notes Avison Young Principal Jay Maddox.

By Jay Maddox, Principal, Avison Young

The economic impact of twin monster storms wreaking havoc on Texas and Florida will be with us for many years to come. Most economists agree that these two storms will rank among the costliest in U.S. history, with Harvey likely to be as catastrophic as Katrina in 2005 ($100 billion+) and Sandy in 2012 ($70 billion+).

The economic impact of twin monster storms wreaking havoc on Texas and Florida will be with us for many years to come. Most economists agree that these two storms will rank among the costliest in U.S. history, with Harvey likely to be as catastrophic as Katrina in 2005 ($100 billion+) and Sandy in 2012 ($70 billion+).

The massive reconstruction effort will likely result in higher GDP and employment growth for the U.S., however, this isn’t necessarily real growth; We will be replacing what we previously had—and borrowing upwards of $200 billion to do it—increasing the Federal debt and the deficit. The ripple effect for commercial real estate will also be substantial.

Harvey’s Impact

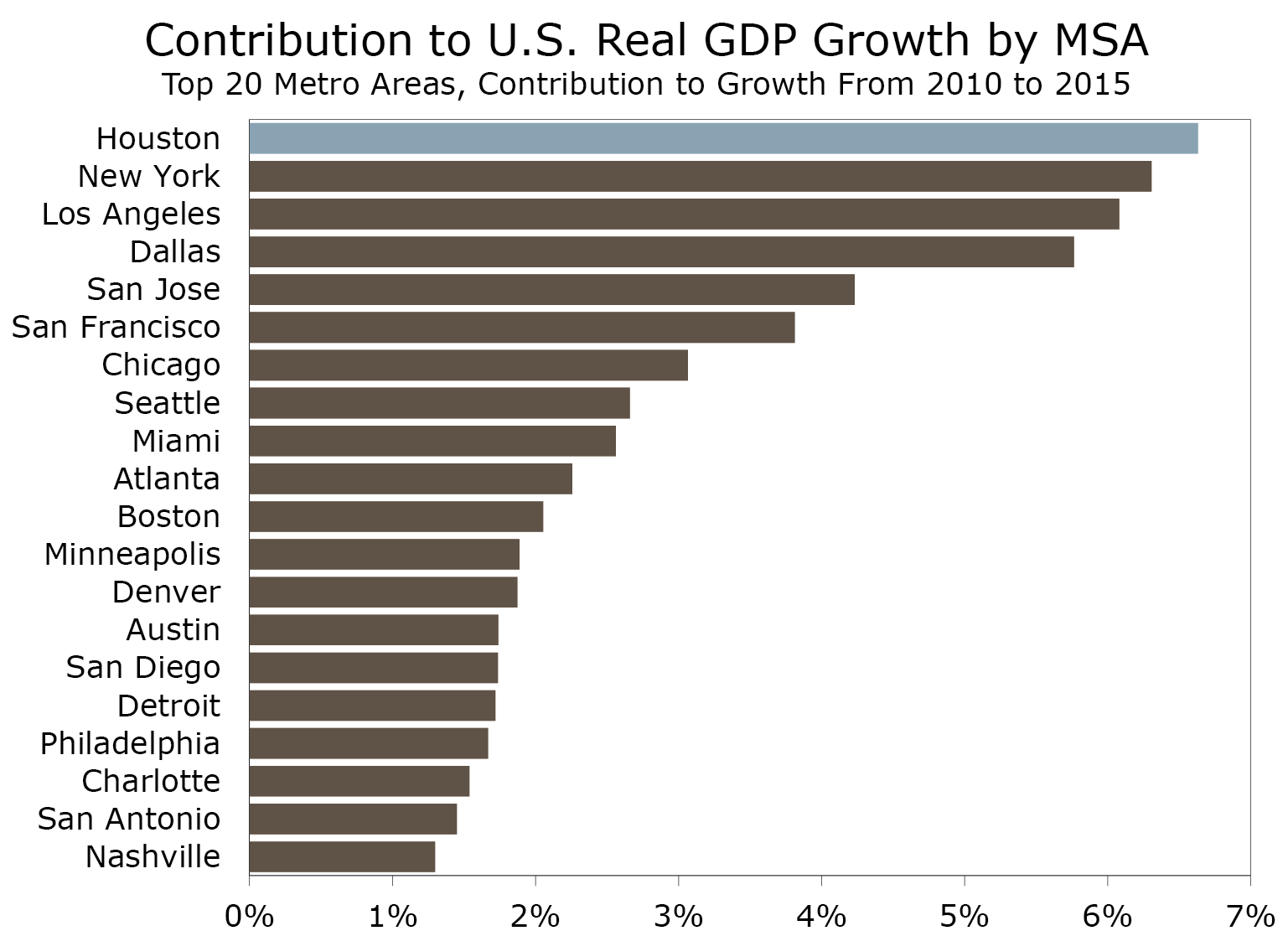

The economic impact from Harvey may be greater than Katrina. It hit the Houston area just as it was emerging from the 2015 to 2016 energy exploration downturn. Houston was the nation’s leading engine of economic growth emerging from the Great Recession, accounting for 6.6 percent of U.S. GDP growth since 2010—the best in the nation. GDP for the greater Houston area exceeds $550 billion, accounting for about 3 percent of U.S. GDP. Further, Houston was also the nation’s leading new single-family home building market before the storm hit.

Astronomical Out-of-Pocket Costs

The uninsured loss to personal and real property in Houston will be catastrophic and devastating. Most homeowners don’t carry flood insurance unless it was required by the lender, and FEMA grants will only provide temporary help. Private homeowner’s insurance typically doesn’t cover damage from floods. Over 90 percent of all flood insurance is provided by the government’s National Flood Insurance Program (NFIP), which was created primarily to provide insurance to homeowners in flood prone areas, while discouraging new home building in such areas. The majority of homes in the hardest hit areas of Houston damaged by flooding are not covered by NFIP. For example, in Harris County, which is the most populous in the Houston area with about 1.6 million housing units, only about 15 percent have NFIP insurance. In contrast, New Orleans had about one-fourth of the population of the Houston area pre-Katrina and about half the properties had NFIP insurance. At the time Katrina hit, the NFIP was underfunded due to previous disasters (notably Sandy in 2005), and had borrowed billions of dollars from the U.S. government to help fund losses. NFIP will once again have to go to the well.

Implications for Commercial Real Estate

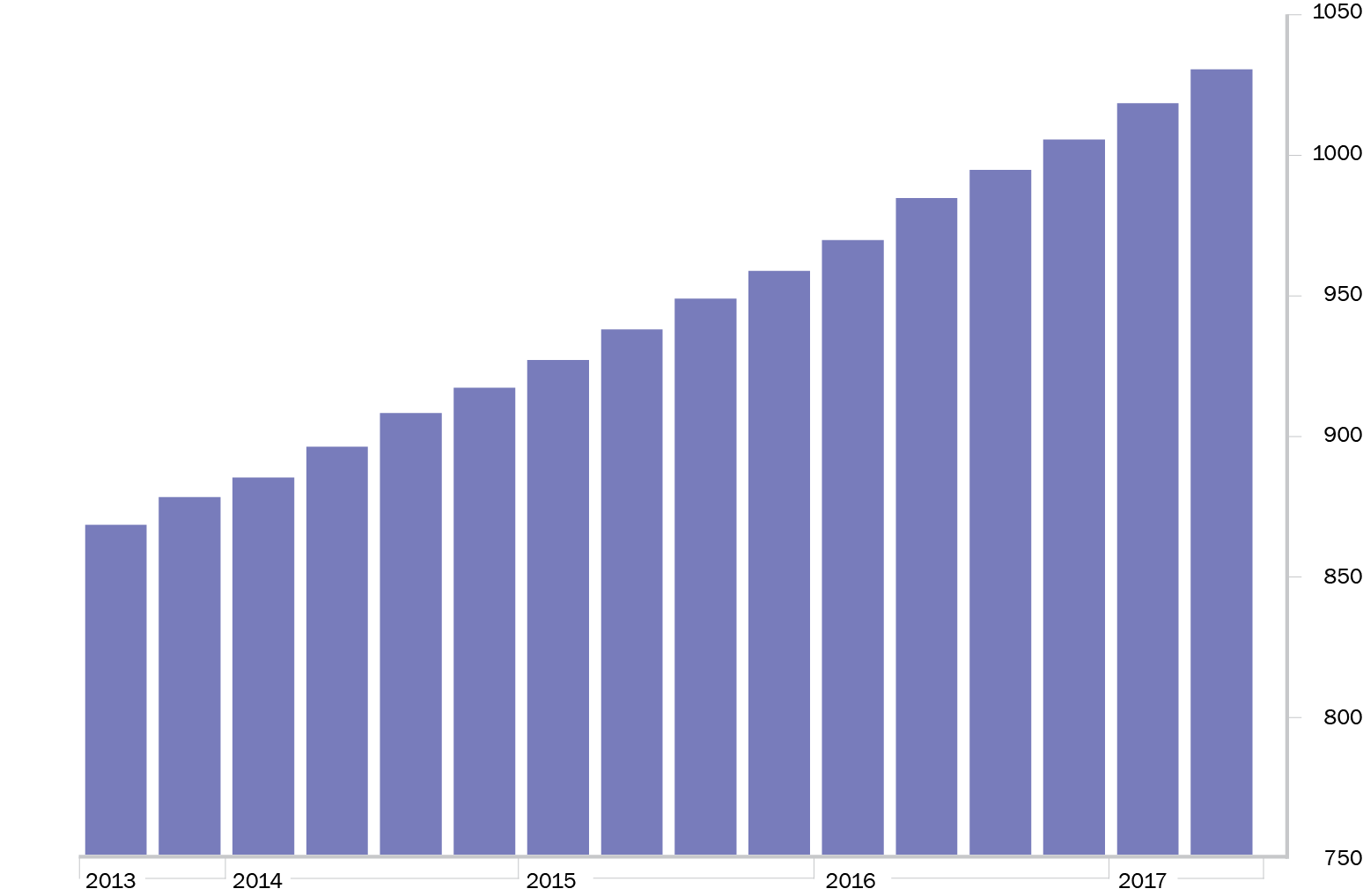

These twin disasters also occurred when construction costs for commercial real estate projects had already been increasing at a steady pace for many years, rising much faster than the overall inflation rate. Turner Construction, which tracks building costs for non-residential projects nationwide in its Building Cost Index reported cost growth well in excess of 4 percent annually since 2013, and even higher for residential projects. Fortunately, rent growth has kept up with (or exceeded) cost growth in many markets, enabling commercial developers to justify the higher costs. However, the overnight demand created by Harvey and Irma will undoubtedly drive construction costs even higher, triggering skilled labor and materials shortages and impacting the economic viability of many projects around the nation. (For example, construction costs jumped 10 percent in 2006, following Katrina.) Finally, the new administration’s more aggressive enforcement of immigration policies may also have a worsening impact, potentially creating a serious skilled labor shortage just when it’s needed the most.

To be sure, losses from these storms will be catastrophic not only in terms of property damage, but also the human cost. Much of the economic burden will fall to U.S. taxpayers. And unfortunately, the ripple effect could well be a slowdown in new construction around the nation.

You must be logged in to post a comment.