Why Land Investment Is So Risky

By Jay Maddox, Principal, Avison Young: Because of the volatility of land values, it's crucial to take great care in underwriting land development projects.

By Jay Maddox, Principal, Avison Young

Development land is generally considered the riskiest form of real estate investment. But how do developers get comfortable with the sometimes astronomical prices that are being paid in today’s market, especially for coveted urban infill sites? A simple calculation, sometimes called a “developer’s land residual analysis” helps to illustrate this.

Development land is generally considered the riskiest form of real estate investment. But how do developers get comfortable with the sometimes astronomical prices that are being paid in today’s market, especially for coveted urban infill sites? A simple calculation, sometimes called a “developer’s land residual analysis” helps to illustrate this.

A land residual analysis tells the developer the maximum justifiable purchase price of the land given the value of the completed project as if it existed today minus all of the project’s estimated costs, excluding the land. What is often overlooked is how sensitive the residual land value is to certain key variables such as the required return on cost and the projected rents.

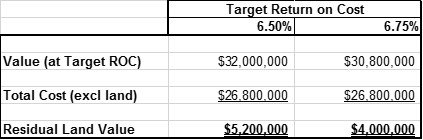

For example, let’s assume a developer is considering a 100-unit apartment project in Los Angeles. Current market rents are estimated at $3.00 per square foot, or about $2,500 per unit per month. The estimated value at completion based on today’s rents and assuming a required 6.5 percent return on cost is $32 million. If estimated project costs (excluding land) are $27.8 million, the estimated land residual value is $5.2 million. However, to provide a cushion in today’s rising interest rate environment, the developer might target a slightly higher return on cost of 6.75 percent, resulting in a land value of $4 million, a drop of more than 20 percent, as illustrated below:

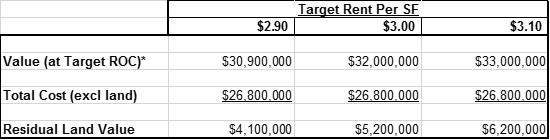

Another key driver of land values is the achievable rent. The above scenarios were based upon assumed market rents averaging $3.00 per square foot in today’s market. But suppose the developer has concerns that the maximum achievable rents might be slightly lower than $3.00, or perhaps he or she thinks rents have more upside, which could justify paying a higher price for the land. As the figures below demonstrate, a difference in estimated rent of only $0.10 per square foot (about $85 per unit per month) has a magnified effect of 20 percent or more on the land value:

As the above examples illustrate, land development isn’t for the faint of heart. Tiny variations in required project returns or estimated market rents can make all the difference. These variables are typically driven by market forces such as inflation and interest rates.

Land residual analysis helps to explain why land values are so volatile–other things being equal, land values will rise (or fall) much farther and faster than valuations of completed, cash-flowing projects. To be sure, there are many other factors that affect land value such as whether or not it is zoned and approved for the contemplated development; the impact of competing projects in the development pipeline; the configuration of the site; soils and grading requirements; or environmental or seismic issues. For these reasons, it is critical to take great care in underwriting land development projects.

You must be logged in to post a comment.