Upping Your Ground Lease Game, Part III

By Jay Maddox, Principal, Avison Young: The last of the three-part series explores why ground-lease financing is an attractive alternative to conventional financing or sale of a property.

By Jay Maddox, Principal, Avison Young

Parts I and II of this series addressed some of the key structural and legal considerations of ground-lease financing, but it’s also important to address some of the advantages ground-lease financing offers compared to traditional financing or a sale.

Parts I and II of this series addressed some of the key structural and legal considerations of ground-lease financing, but it’s also important to address some of the advantages ground-lease financing offers compared to traditional financing or a sale.

Ground-lease financing adds complexity and difficulty to real estate transactions, but can result in more cost-efficient financing over the long term and can be accretive to value. It can provide higher effective leverage than conventional financing since, rather than purchasing the underlying land, it is leased over a very long term, typically 50 to 99 years.

A Case Study

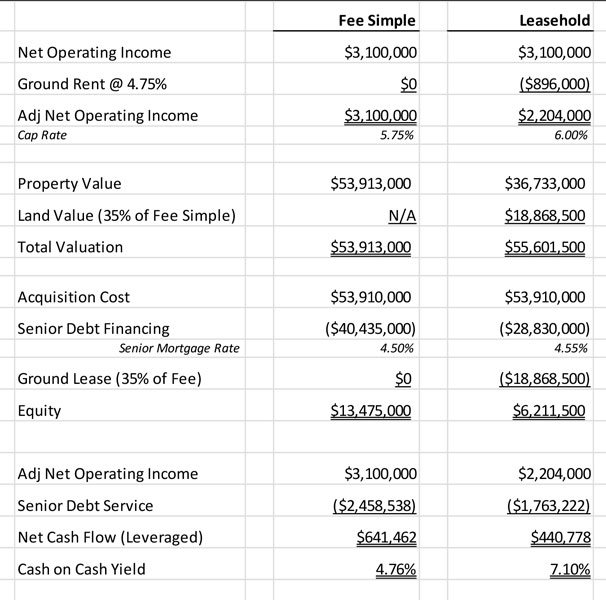

Let’s compare leasehold financing to fee simple conventional financing for a fully leased apartment building (see chart below). The ownership of the land and building are bifurcated. In the “Leasehold” scenario, a third-party investor buys the land and takes an unsubordinated fee position. The third-party investor simultaneously enters into a long-term ground lease with the owner/purchaser, who obtains a leasehold mortgage on the building.

The initial ground rent is typically established at a lower rate than the fee simple cap rate, resulting in a positive arbitrage. Why? Because the ground lease is unsubordinated and therefore represents the least risky portion of the capital stack. In this case, the ground rent is 4.75 percent of the land value, whereas the property would be valued at a 5.75 percent cap rate as fee simple. As a result, the value of the leasehold ($55.6 million) is $1.6 million more than the purchase valuation ($53.9 million). Therefore, in this example, the ground lease structure is accretive to value.

The initial ground rent is typically established at a lower rate than the fee simple cap rate, resulting in a positive arbitrage. Why? Because the ground lease is unsubordinated and therefore represents the least risky portion of the capital stack. In this case, the ground rent is 4.75 percent of the land value, whereas the property would be valued at a 5.75 percent cap rate as fee simple. As a result, the value of the leasehold ($55.6 million) is $1.6 million more than the purchase valuation ($53.9 million). Therefore, in this example, the ground lease structure is accretive to value.

Compared to a traditional loan, the going-in leveraged cash-on-cash yield is increased by 234 basis points, from 4.76 to 7.10 percent, and the equity required is reduced from $13.4 million to $6.2 million, resulting in effective leverage of 88 percent of the purchase price, as compared to 75 percent using conventional financing. If the owner had utilized mezzanine debt or preferred equity combined with traditional senior debt to achieve 88 percent leverage, the blended financing cost would be significantly higher. (Mezzanine debt or preferred equity would be priced at 8 to 12 percent, compared to 4.75 percent ground rent.) Also, the capital structure is more stable since the ground lease will have a term as long as 99 years, whereas mezzanine debt or preferred equity will have the same maturity as the senior mortgage, leaving the owner to refinance or sell the property at maturity of the mezzanine loan.

With a ground lease, there is no obligation to repay the land owner. However, the building improvements revert to the ground owner at the end of the lease term. (Some ground leases include a purchase option enabling the ground lessee to buy back the land and collapse the ground lease.) Finally, ground lease payments are fully tax deductible, whereas only the interest portion of mortgage installments is deductible.

Advantages for Sellers

Ground lease financing offers sellers a potentially attractive alternative. A prospective seller looking to cash out of a property might face a large capital gains tax liability or a 1031 exchange challenge. The seller could instead sell a long-term ground lease position to an investor and procure a leasehold mortgage on the property. This approach offers a potential tax advantage if properly structured, since the seller would incur a capital gain tax liability only on the land portion of the value, but not the improvements. Since the loan proceeds are not taxable, the total tax liability is greatly reduced compared to a sale. The owner also retains a substantial economic interest in the property, providing a continuing source of cash flow and a potential inflation hedge, because the owner still owns and leases the improvements and can depreciate the property for tax purposes.

The owner of a valuable, undeveloped parcel can also opt to ground lease the land to a developer rather than selling outright. The owner can then participate in the future economic value of the development and, if structured properly, avoid or defer any capital gains taxes. Further, most ground leases include periodic rent escalations intended as an inflation hedge.

Ground leases can also be a very effective tool for charitable giving. The donation of a long-term ground lease interest provides what many charities desire: a passive, stable, low-risk, long-term investment that produces regular cash distributions with a built-in inflation hedge. If the donor so chooses, it can continue to own and manage the property.

Ground-lease financing, while complex, offers an interesting and attractive alternative to conventional financing or a sale of the property. Of course, such solutions are unique and must be carefully structured. It may also be necessary to identify and attract a third-party investor to purchase the ground lease interest. Such investors have different requirements and often source their investments through expert intermediaries. When considering a ground-leased transaction, it pays to work with professionals with deep expertise in underwriting and structuring such transactions, as well as access to both debt and equity capital sources.

You must be logged in to post a comment.