Total Commercial Real Estate Borrowing and Lending Increased in 2024

The total volume grew by 16 percent from the previous year.

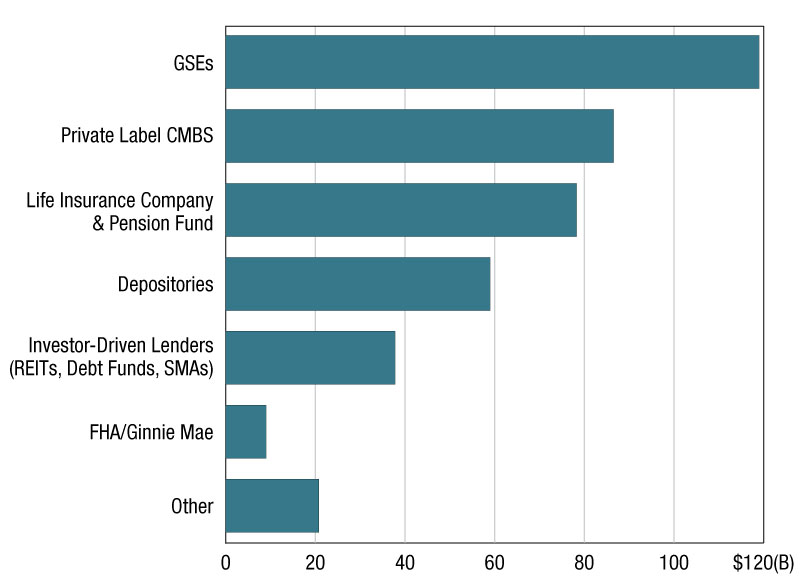

Total commercial real estate mortgage borrowing and lending is estimated to have totaled $498 billion in 2024, a 16 percent increase from the $429 billion in 2023, and a 39 percent decrease from $816 billion in 2022. This is according to the Mortgage Bankers Association’s 2024 Commercial Real Estate/Multifamily Finance Annual Origination Volume Summation.

MBA’s survey tracked $411 billion of loans closed by dedicated commercial mortgage bankers in 2024—a 34 percent increase from the $306 billion reported in 2023. Activity from smaller and mid-sized depositories is estimated from other data sources to arrive at the $498 billion estimate for the total market.

“Commercial real estate lending rebounded to $498 billion in 2024, up 16 percent from the prior year and driven largely by multifamily activity and continued strength from dedicated mortgage banking firms, which closed $411 billion in loans,” said Reggie Booker, MBA’s Associate Vice President of Commercial Real Estate Research. “While still below 2021’s record originations activity, the market showed renewed momentum. With an estimated $957 billion in CRE mortgage maturities coming due this year, demand for refinancing and new capital will be key drivers of market activity.”

Dedicated mortgage banking firms reported closing $411 billion of CRE loans in their own names and serving as intermediaries on $303 billion. Firms reported serving as investment sales brokers for $247 billion of deals.

—Posted on May 27, 2025

You must be logged in to post a comment.