The Debt Yield Test: A Great Equalizer

By Jay Maddox, Principal, Avison Young: How this alternative measurement levels the playing field compared to traditional underwriting ratios.

By Jay Maddox, Principal, Avison Young

Commercial real estate lenders customarily deploy two key loan underwriting ratios: the debt coverage ratio (DCR) and the loan-to-value ratio (LTV). But these ratios don’t necessarily paint a complete picture and can in some cases provide misleading results. Consequently, lenders are increasingly using a debt yield calculation as an additional loan sizing parameter. However, it isn’t being used universally and is often misunderstood. A deeper understanding reveals the debt yield can be the “equalizer” that levels the playing field compared to traditional underwriting ratios.

Commercial real estate lenders customarily deploy two key loan underwriting ratios: the debt coverage ratio (DCR) and the loan-to-value ratio (LTV). But these ratios don’t necessarily paint a complete picture and can in some cases provide misleading results. Consequently, lenders are increasingly using a debt yield calculation as an additional loan sizing parameter. However, it isn’t being used universally and is often misunderstood. A deeper understanding reveals the debt yield can be the “equalizer” that levels the playing field compared to traditional underwriting ratios.

What is the Debt Yield?

Debt yield is the lender’s underwritten net operating income divided by the loan amount. For example, if the required minimum debt yield is 10 percent and the project NOI is $500,000, the maximum loan amount would be $5 million. A low debt yield requirement results in higher leverage and implies increased risk, while a high debt yield limits proceeds and implies less risk for the lender. Debt yield requirements are typically higher for bridge and construction loans than for permanent loans on stabilized properties.

Debt Yield vs. Traditional Underwriting Ratios

The LTV ratio is the loan amount divided by the property value. A low LTV ratio implies low risk, and vice versa for a high LTV ratio. However, the LTV ratio can be higher or lower for the same loan amount depending upon the valuation, while the debt yield would remain constant and independent of the valuation. As we experienced during the Great Recession, valuations can be overstated and volatile, and they can decline rapidly. Loans underwritten in 2006 and 2007 that appeared to be an acceptable risk based on 70 to 75 percent LTV ratios were suddenly underwater in 2008 and 2009, when values collapsed by 40 percent and a wave of foreclosures ensued. The obvious lesson learned is that today’s LTV may not be a reliable indicator of tomorrow’s risk.

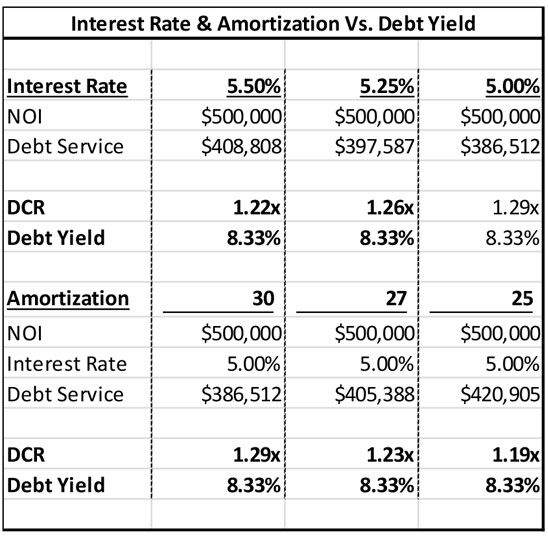

The DCR is the lender’s underwritten NOI divided by debt service. For example, NOI of $500,000 with debt service of $400,000 would equate to a DCR of 1.25-to-1. However, the DCR can be manipulated by varying the principal amortization, the interest rate or both (see table at left.) In the table example, the lender’s threshold DCR is 1.25x for a proposed $6 million loan. By simply reducing the interest rate from 5.50 percent to 5.25 percent, the loan underwriting passes the DCR test, since the ratio increases from 1.22x to 1.26x. In the second example, the loan fails the DCR test at 25- or 27-year amortization but passes the test using 30-year amortization.

The DCR is the lender’s underwritten NOI divided by debt service. For example, NOI of $500,000 with debt service of $400,000 would equate to a DCR of 1.25-to-1. However, the DCR can be manipulated by varying the principal amortization, the interest rate or both (see table at left.) In the table example, the lender’s threshold DCR is 1.25x for a proposed $6 million loan. By simply reducing the interest rate from 5.50 percent to 5.25 percent, the loan underwriting passes the DCR test, since the ratio increases from 1.22x to 1.26x. In the second example, the loan fails the DCR test at 25- or 27-year amortization but passes the test using 30-year amortization.

Despite the above manipulations, the debt yield calculation remains constant at 8.33 percent and provides a static risk measure independent of the interest rate or amortization period. If the lender’s debt yield requirement is less than 8.33 percent, the loan amount would meet the test, and if greater than 8.33 percent, the loan would not meet the test. The debt yield test is the “equalizer” because it doesn’t rely on these factors and therefore is an objective risk measure.

Assessing Repayment Risk

When underwriting any loan, the lender must assess the future likelihood of repayment via refinancing the loan at maturity. Lenders typically assume higher exit cap rates and interest rates, and may also assume more conservative DCR or LTV ratios than the initial loan underwriting. However, as discussed, these ratios can be manipulated by varying the interest rate, amortization period or market value. On the contrary, using an exit debt yield provides a static risk measure that is independent of these factors.

To be sure, commercial real estate loan underwriting involves a much deeper assessment than financial ratio analysis, which does not take into account the borrower’s financial strength, tenant credit quality, property location or the impact of competing developments (to name a few considerations). However, lenders are increasingly deploying the debt yield in their underwriting, and borrowers need to clearly understand how the lender uses it early in the loan underwriting process in order to avoid surprises later.

You must be logged in to post a comment.