Finance

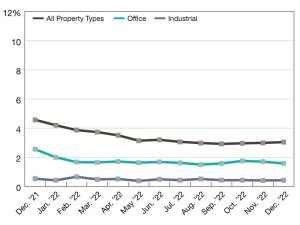

2022 CMBS Delinquency Rates

The Trepp CMBS Delinquency Rate in December was 3.04 percent, an increase of five basis points from November.

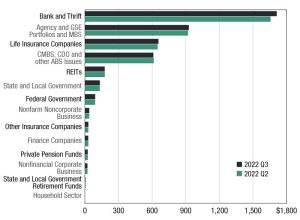

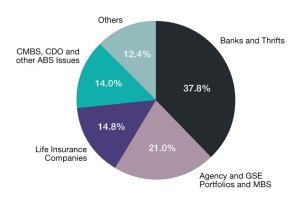

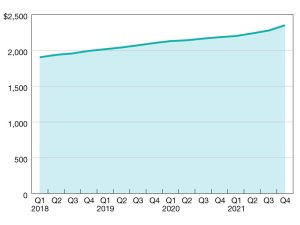

Commercial and Multifamily Mortgage Debt Outstanding Increased by $70 Billion in Third-Quarter 2022

Total commercial/multifamily mortgage debt outstanding rose to $4.45 trillion at the end of the third quarter.

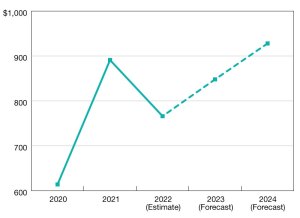

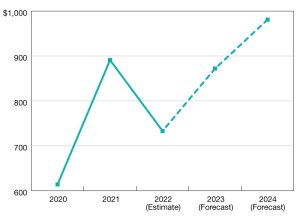

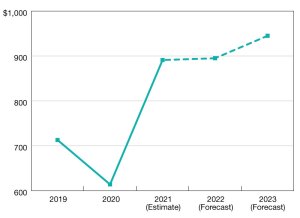

Commercial/Multifamily Lending Expected to Fall in 2022 Due to Ongoing Economic Uncertainty

Commercial/Multifamily borrowing and lending started the year on strong footing, but higher rates and economic uncertainty have impacted demand and activity during the second half of the year.

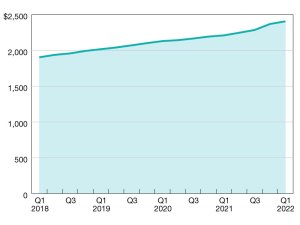

Commercial Mortgage Debt Outstanding Rises to New Record in Q1 2022

Total mortgage debt outstanding rose to $4.25 trillion, according to MBA’s latest report.

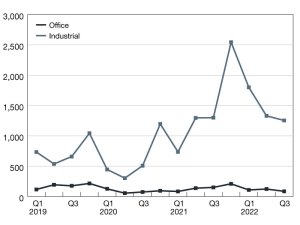

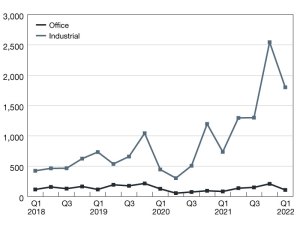

Commercial Originations Jumped 72% in Q1 2022

Those during the first three months of the year were 39 percent lower than the previous fourth quarter, according to MBA.