REITs

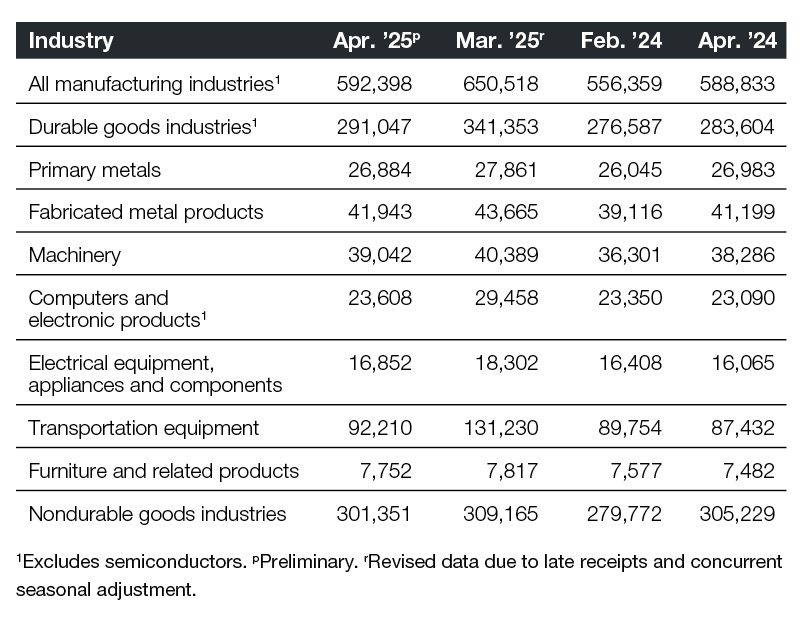

2025 New Orders

The latest update based on U.S. Census Bureau data.

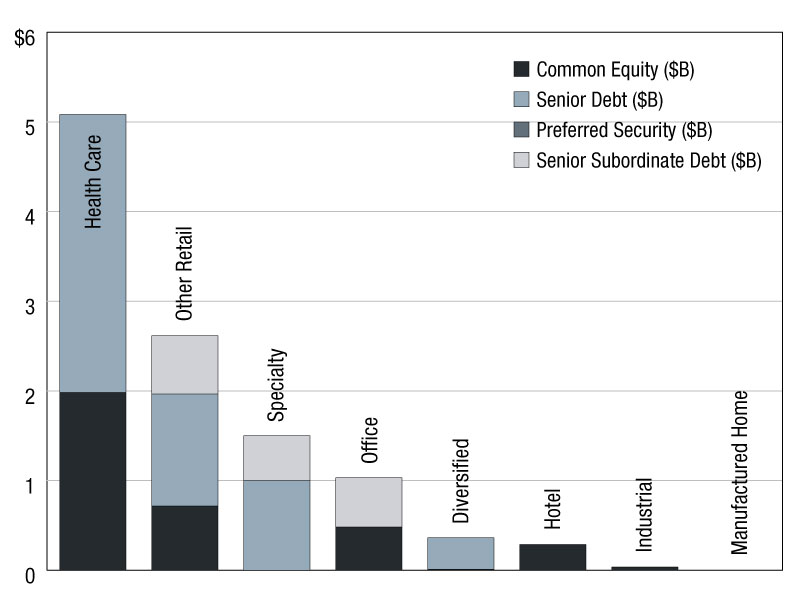

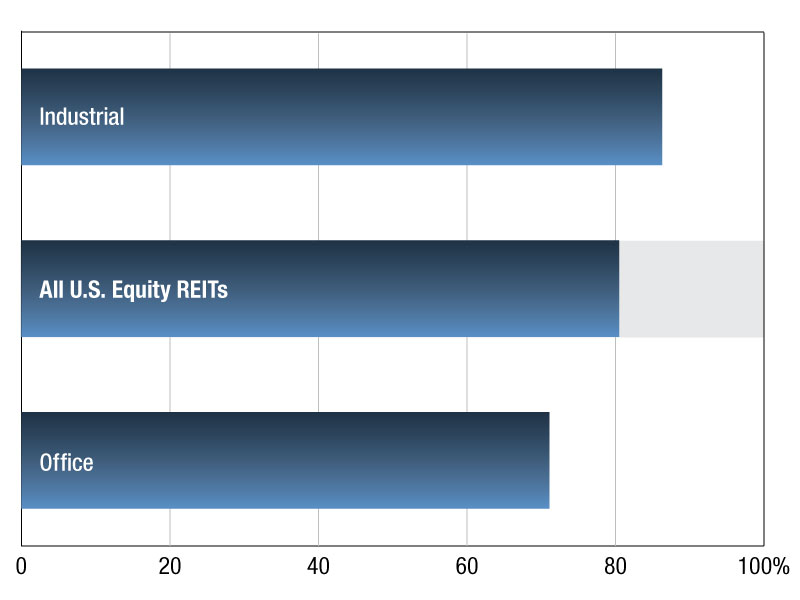

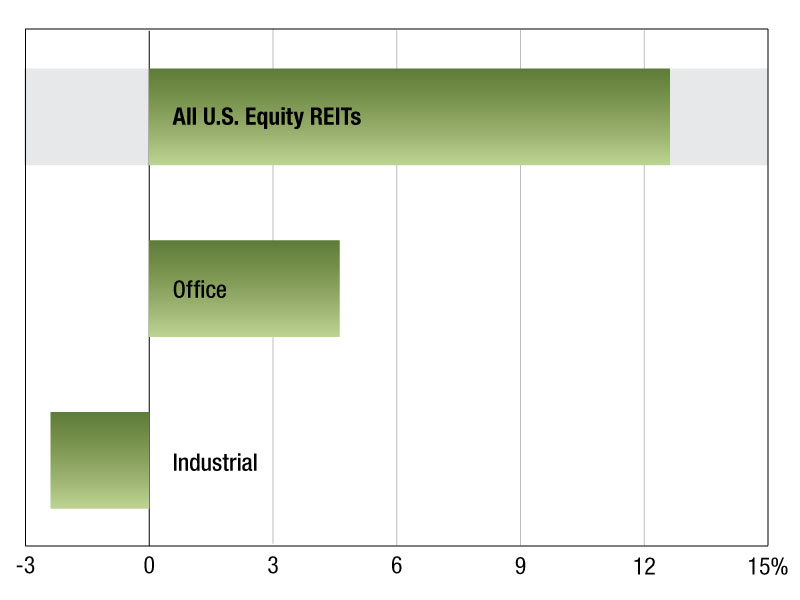

2025 Commercial REIT Values

S&P Global Intelligence’s latest snapshot of REIT performance. Read the report.

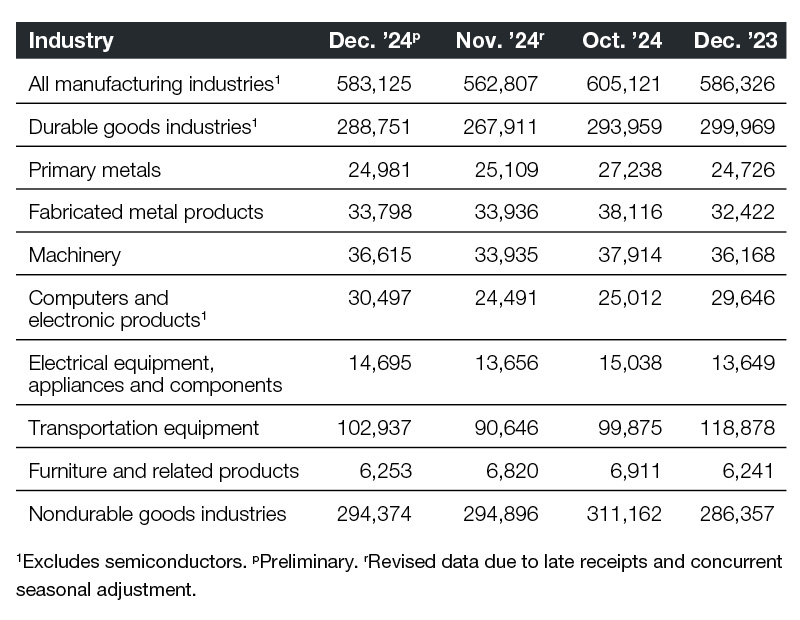

2024 New Orders

The latest update based on U.S. Census Bureau data.

2024 Commercial REIT Values

S&P Global Intelligence’s latest snapshot of REIT performance. Read the report.