2024 Office Investment Update

Sales volume increased by 14.8 percent compared to the same period last year, according to CommercialEdge.

In the last quarter of 2024, office sales totaled $9.1 billion with 365 transactions closing, totaling 46.9 million square feet, according to the latest CommercialEdge data.

When compared to the previous quarter, there was a 37.1 percent decline in sales count nationally and a 25.3 percent drop in square footage. During the third quarter of 2024, there were 580 deals involving 62.8 million square feet. In terms of dollar amount, the last quarter showed a 9.9 percent decline in office sales volume when compared to the $10.1 billion recorded in the third quarter.

READ ALSO: What’s Defining Office in 2025?

Nevertheless, the average sale price per square foot recorded a 32.1 percent increase—jumping from the $174.03 in the third quarter to $229.93 in the last three months of 2024. Prices showed a consisted upward trend throughout the past year, despite a decline in overall sales count.

Year-over-year comparisons also show a decline in office investment activity. The last quarter of 2023 ended with $11.2 billion across 612 office sales—representing an 18.7 percent drop in sales volume and a 40.3 percent decline in transaction count, according to CommercialEdge. The same trend is reflected in square footage: in 2023’s last quarter 63.6 million square feet changed hands, marking a 26.2 percent drop when compared to the same period in 2024.

Fewer office sales transpired in 2024

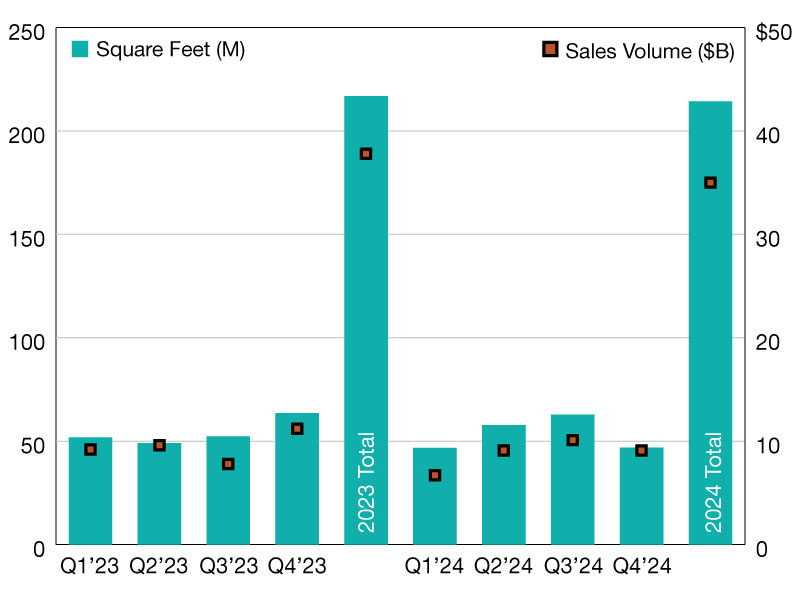

In terms of annual deal volumes, 2024 ended with 214.3 million square feet trading across 1,971 transactions. Last year’s square feet transacted showed only a 1.1 percent drop when compared to 2023’s 216.8 million square feet, while it reflects an approximately 9.1 percent drop in sales count when looking at the 2,168 office deals recorded in 2023.

Last year’s total office transaction volume reached $35 billion, showing a 7.4 percent decline when compared to the $37.8 billion recorded in 2023.

—Posted on January 28, 2025

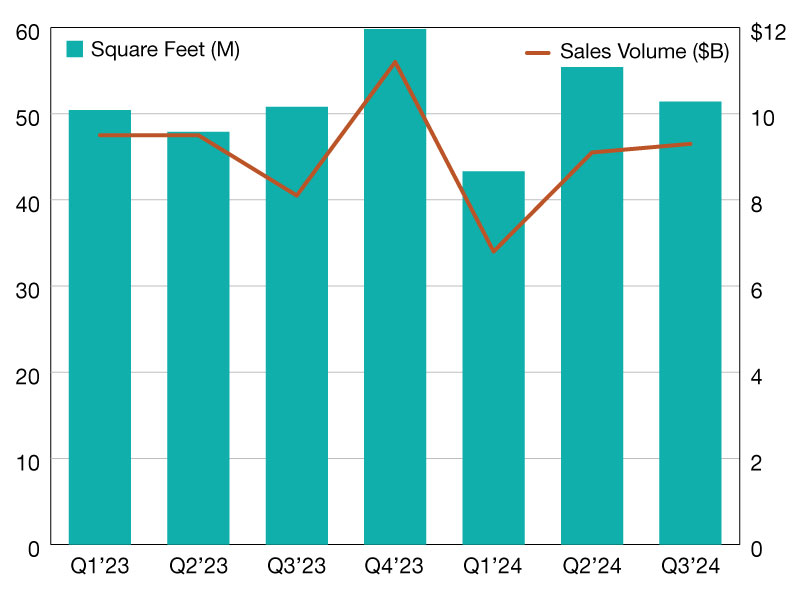

In the third quarter of 2024, office sales totaled $9.3 billion across 499 transactions, involving 51.4 million square feet of space, CommercialEdge data shows.

This reflects a 9.9 percent decrease in sales count and a 7.2 percent decline in square footage from the second quarter of the year, which encompassed 554 office transactions covering 55.4 million square feet. Nevertheless, total office sales volume increased by 2.2 percent, from $9.1 billion in the second quarter.

The average price per square foot also experienced a notable jump, increasing by 18.3 percent from $161.36 in the second quarter to $190.82 in the third quarter. This reflects higher-value deals despite the overall decline in activity.

READ ALSO: Investors Find Office Bargains

Year-over-year comparisons show some recovery in key areas. The third quarter of 2023 had a higher number of office transactions—584 compared to 2024’s 499—but the sales volume was lower, at $8.1 billion. This marks a 14.8 percent rise in sales volume in 2024, according to CommercialEdge. The square footage transacted in the third quarter of 2024 also saw a slight uptick year-over-year, increasing by 1.2 percent from 50.8 million square feet during the same period in 2023.

Looking at the first three quarters of 2024, the cumulative total of 154.9 million square feet transacted reflects a 25.9 percent drop compared to 2023’s 209 million square feet. Office sales volume in the first three quarters of the year totaled $26.5 billion and reflects a 30.6 percent decline compared to 2023’s $38.2 billion.

—Posted on September 30th, 2025

You must be logged in to post a comment.