Investment Column: 2007 Déjà Vu?

By Ken Riggs, President, Situs RERC: Is today's real estate investment environment more promising than 2007 despite the high property prices?

By Ken Riggs, President, Situs RERC

We certainly need to ponder the current state of the capital flows into commercial real estate when Blackstone buys Stuyvesant Town and Peter Cooper Village in New York City for $5.3 billion. Another recent headline is Sam Zell’s Chicago-based Equity Residential sale of 23,000 apartment units for $5.27 billion to Starwood Capital. Also of note is that Hyatt Hotels is in talks to purchase — and several Chinese firms are competing to win Beijing’s approval for them to bid on — Starwood Hotels & Resorts Worldwide Inc., which according to most experts is expected to be one of the largest-ever hotel deals when actually transacted.

We certainly need to ponder the current state of the capital flows into commercial real estate when Blackstone buys Stuyvesant Town and Peter Cooper Village in New York City for $5.3 billion. Another recent headline is Sam Zell’s Chicago-based Equity Residential sale of 23,000 apartment units for $5.27 billion to Starwood Capital. Also of note is that Hyatt Hotels is in talks to purchase — and several Chinese firms are competing to win Beijing’s approval for them to bid on — Starwood Hotels & Resorts Worldwide Inc., which according to most experts is expected to be one of the largest-ever hotel deals when actually transacted.

Each time we hear of such high property prices, it is a vivid reminder of the prices leading up to the 2008 credit crisis. No wonder commercial real estate investors are becoming more jittery as they spot such similarities to 2007. In fact, over the past year or so, Situs RERC has noted many such comparisons in our forward-looking investment research, and as we go further into the cycle, such similarities are likely to increase. However, even though it is looking a lot like 2007, it is important to note that there are key differences in today’s investment environment that should help reassure investors that commercial real estate still has room to run.

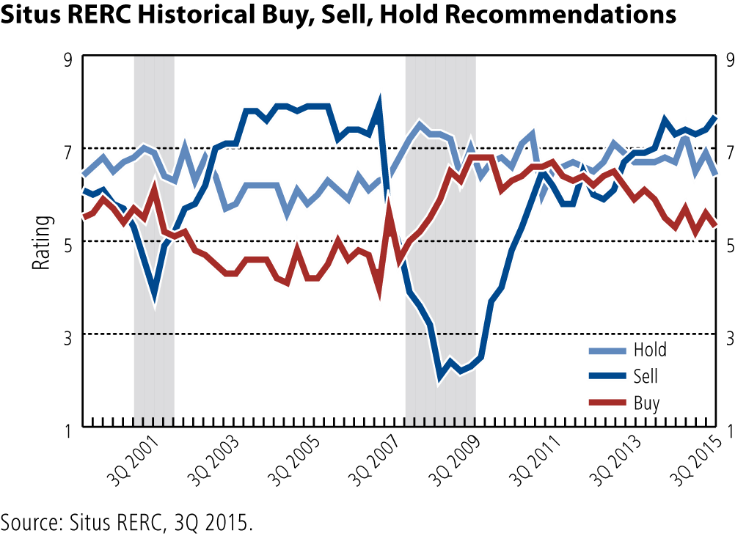

For example, Situs RERC’s “sell” recommendation has been moving upward over the past year and a half, increasing to a rating of 7.7 on a scale of 1 to 10, with 10 being the highest, in third-quarter 2015, at the same time that the “hold” recommendation has been declining to a rating of 6.4 (see below right). While these ratings do, in fact, approach the level of those prior to the credit crisis, it is interesting that these levels had been reached and continued for several years before the actual credit crisis occurred.

Given the attractive prices and the amount of capital flowing to commercial real estate, it is not surprising that investors have been taking the sell recommendation to heart and bringing properties to market. However, the spread between the buy-sell-hold ratings is much tighter than that of pre-2007, and this narrower spread between the ratings indicates that the market remains relatively healthy compared to the pre-2007 era.

Given the attractive prices and the amount of capital flowing to commercial real estate, it is not surprising that investors have been taking the sell recommendation to heart and bringing properties to market. However, the spread between the buy-sell-hold ratings is much tighter than that of pre-2007, and this narrower spread between the ratings indicates that the market remains relatively healthy compared to the pre-2007 era.

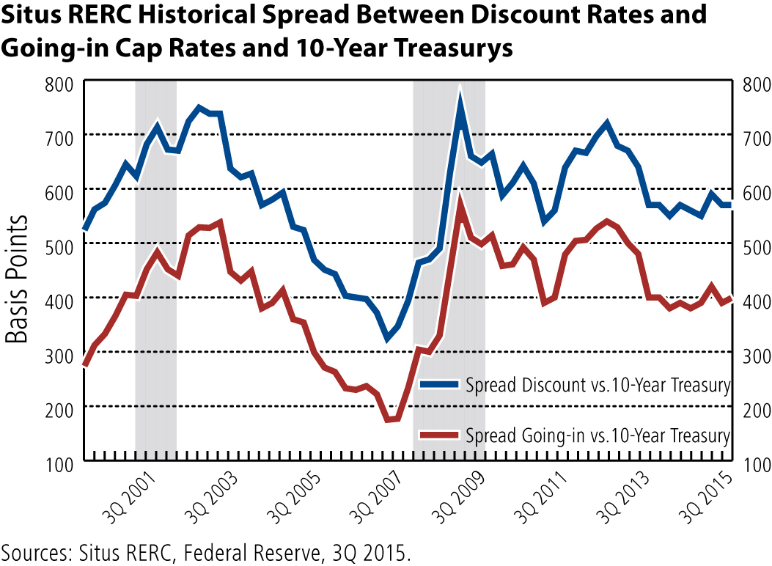

In addition, while cap and discount rates have been compressing to lows not reached since pre-2007, interest rates remain much lower than they were at that time. As a result, the spreads between Situs RERC’s third-quarter going-in cap rate and discount rate averages for all property types versus the 10-year Treasury rates are 400 and 570 basis points, respectively, which remains reasonable in light of the alternatives (see below left). This is compared to fourth- quarter 2007, when the spreads were 230 and 390 bps, respectively.

As long as interest rates remain low — and we expect they will not increase greatly in the near term, even if the Federal Reserve begins to increase the federal funds rate this year — the risk to commercial real estate remains relatively low.

As long as interest rates remain low — and we expect they will not increase greatly in the near term, even if the Federal Reserve begins to increase the federal funds rate this year — the risk to commercial real estate remains relatively low.

In addition, it appears that institutional commercial real estate investors will have another good year in 2016, despite the slowdown in global economic growth. Specifically, we expect that:

- Commercial real estate values and prices are unlikely to increase at the same pace in 2016, unless outside forces or events demonstrate the increased value in property as a safe harbor investment.

- Although value and price growth may slow in 2016, Situs RERC expects them to remain generally flat rather than decreasing significantly. New construction has mostly been contained and is not in a speculative state across all sectors and markets.

- For now, the climate is not conducive to a major correction in the commercial real estate market. If there is a correction, especially one triggered by higher long-term interest upward movements, in 2016, and value and price appreciation does decline, commercial real estate will likely fare better than other asset classes, given the resilience of commercial real estate in combination with low interest rates, the tangible nature of real estate, and the still reasonable returns in the form of income from investment properties.

You must be logged in to post a comment.