Investment Activity to Decline in 2023: CBRE

Few buyers expect to make more deals this year.

Citing rising interest rates, a potential recession and limited credit, more than half of the investors who participated in a new CBRE 2023 U.S. Investor Intentions Survey said they expect to buy fewer assets this year compared to 2022.

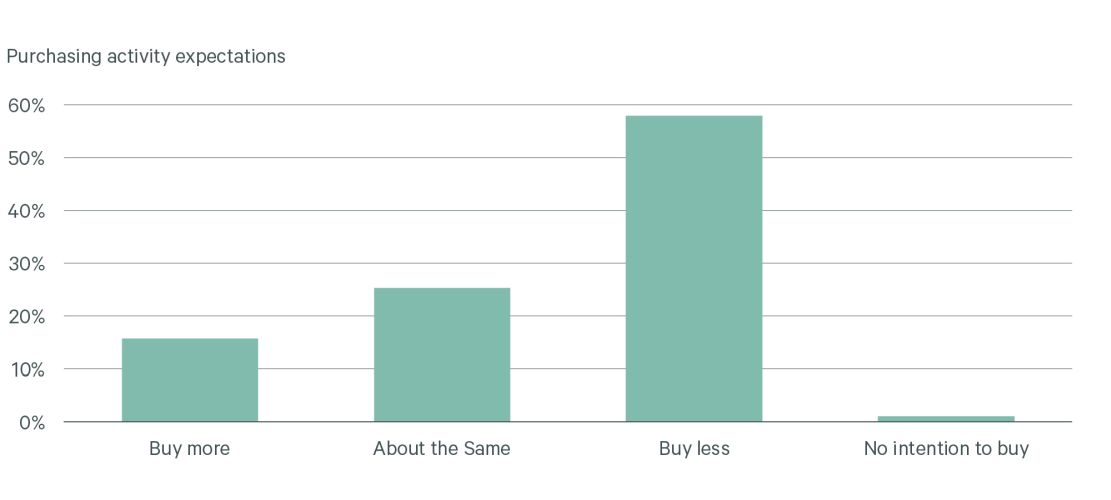

Nearly 60 percent of respondents expect to purchase less real estate than last year, with almost half saying they could decrease their spending by more than 10 percent. The survey found only 15 percent expect to purchase more than last year.

READ ALSO: What Will Retail Look Like in 2023?

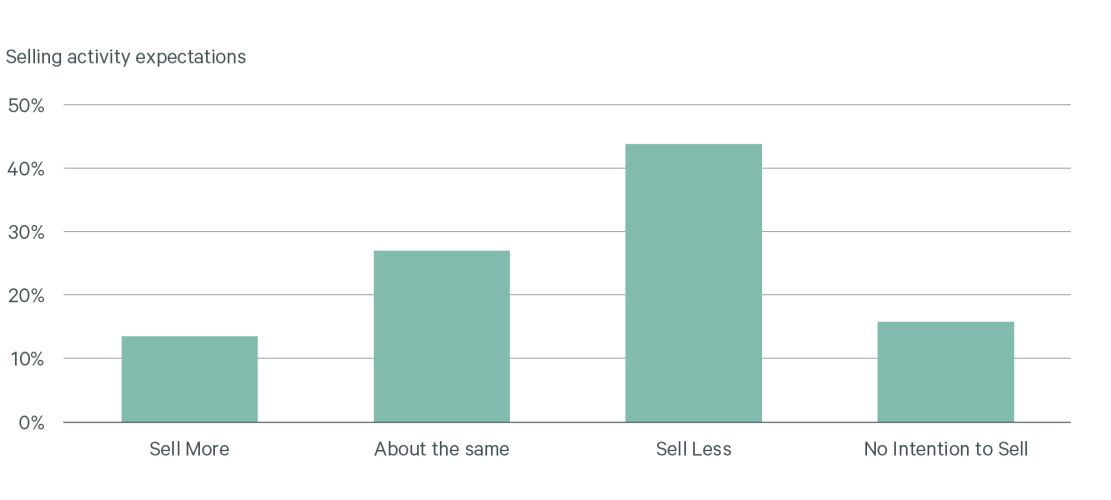

The macroeconomic conditions that led to decreases in transaction volumes in the second half of 2022 and uncertainty about what’s ahead for 2023 may be causing commercial real investors to hit pause on selling this year too.

MSCI Real Assets reported investment sales dropped 43 percent in October 2022 from the previous year, to $42.8 billion—the third straight month of year-over-year declines. Pricing concerns, especially the widening bid-ask spread between sellers and buyers, appear to be impacting plans for dispositions as well. About 60 percent of the respondents said they will either sell less real estate this year than last year or not sell at all. Only 27 percent told CBRE they expect to sell the same amount as last year.

With less buying and selling activity anticipated, CBRE is forecasting the total investment volume to be down by 15 percent from 2022. But the firm’s research team expects investment activity to increase in the second half of 2023, as interest rates and economic conditions stabilize.

In an effort to cool inflation, which hit nearly 40-year highs last year, the Federal Reserve implemented seven consecutive rate hikes in 2022, raising the target federal funds rate range to 4.25-4.5 percent. The federal funds rate could surpass 5 percent this year as the Fed, which is aiming to get inflation back to a 2 percent range, is expected to seek additional interest rate hikes at least in the early part of 2023.

Investment strategies

CBRE’s survey found more investors expect to adopt opportunistic and debt strategies this year than last year, because of attractive returns due to the higher interest rates and tighter financial conditions. Many also expect to begin to see pricing discounts, perhaps as much as 30 percent, across commercial real estate sectors, with shopping malls and value-add office assets expected to provide the greatest discounts.

Multifamily, particularly apartment complexes, and modern industrial and logistics facilities in major markets are still expected to be the most sought-after assets for investment in 2023, according to the CBRE survey. Retail investors prefer grocery-anchored centers and office investors are following the flight to quality trend and seeking mostly Class A assets in prime locations.

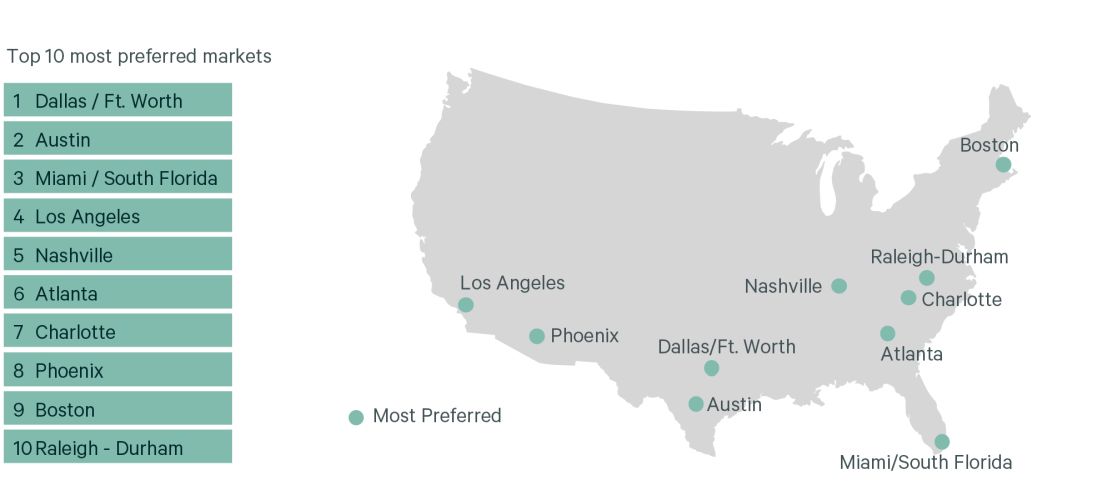

Of those surveyed, almost 70 percent said they don’t expect to change their fund allocations this year due to market conditions. And most investors are still anticipating making investments in high-performing Sun Belt markets, led by Dallas-Fort Worth and Austin in Texas, Miami, Los Angeles and Nashville, Tenn.

You must be logged in to post a comment.