How Instability Can Create Stability

By Ken Riggs, President, Situs RERC: Why commercial real estate remains attractive to investors, even in times of economic uncertainty.

By Ken Riggs, President, Situs RERC

A lesser known but thought-provoking economist, Hyman Minsky, developed the Financial Instability Hypothesis, which essentially states that booms create busts in financial markets. During times of perceived financial stability, a euphoria develops among investors that leads to irrational investment behaviors, plagued by cognitive and emotional bias, which causes a bubble to form–and eventually bust. In short, stability creates instability in financial markets, according to Minsky.

A lesser known but thought-provoking economist, Hyman Minsky, developed the Financial Instability Hypothesis, which essentially states that booms create busts in financial markets. During times of perceived financial stability, a euphoria develops among investors that leads to irrational investment behaviors, plagued by cognitive and emotional bias, which causes a bubble to form–and eventually bust. In short, stability creates instability in financial markets, according to Minsky.

However, we live in a world where external shocks to the market occur more frequently than expected, and we are now re-setting our expectations. The last quarter and the current one have been rife with geopolitical events such as Brexit, concerns about Chinese debt, terrorism and a tumultuous U.S. presidential election season. These events have heightened investor anxiety and eroded investor, business and consumer confidence. From this turbulence rises an uneasy sentiment that we are not as smart as we think at predicting the world around us.

During times of uncertainty, real assets such as commercial real estate become more attractive to investors. In addition to the tangible nature and relative stability of this asset class, CRE offers a significant amount of return through cash flow. These attributes make the decision clear for an investor.

Even if the Fed decides to increase short-term interest rates in the near future, rates are at historic lows. Uncertainty in the global markets will continue to place downward pressure on long-term interest rates, also fueling demand for CRE. With rates remaining low for the foreseeable future, the cost of borrowing is expected to stay relatively cheap. Therefore, similar to Minsky’s hypothesis, instability actually creates stability for the CRE market.

Even if the Fed decides to increase short-term interest rates in the near future, rates are at historic lows. Uncertainty in the global markets will continue to place downward pressure on long-term interest rates, also fueling demand for CRE. With rates remaining low for the foreseeable future, the cost of borrowing is expected to stay relatively cheap. Therefore, similar to Minsky’s hypothesis, instability actually creates stability for the CRE market.

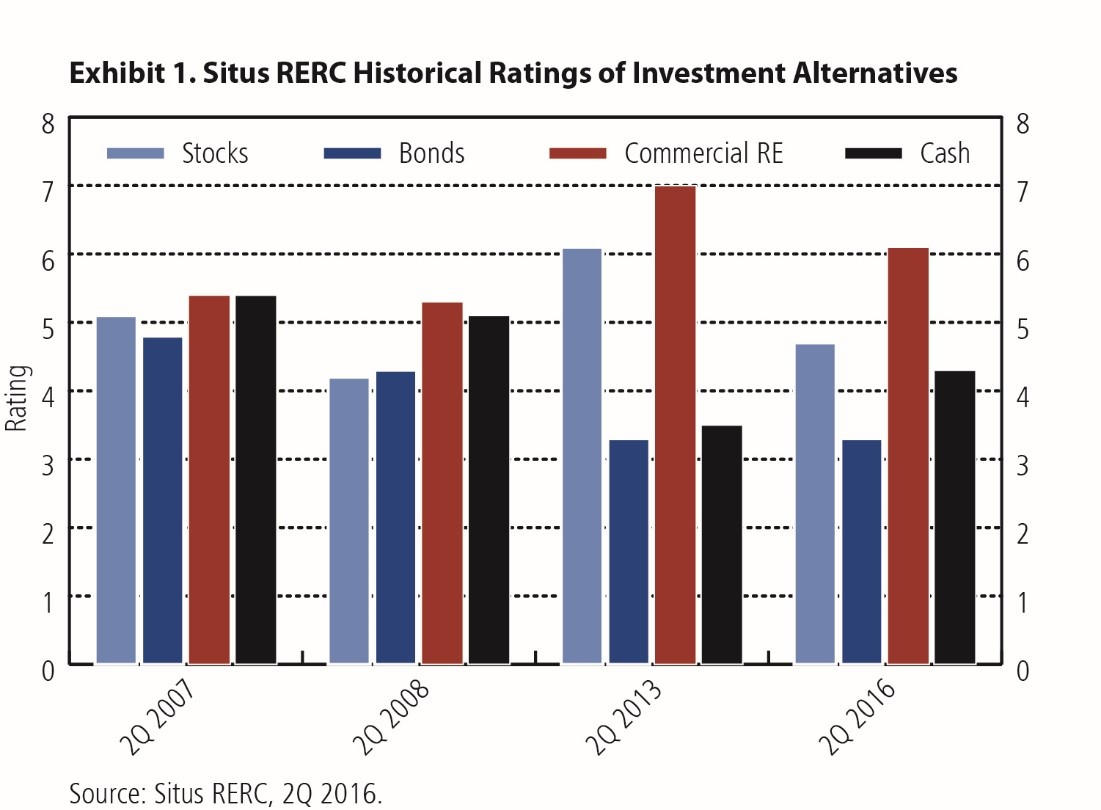

U.S. CRE also continues to be one of the preferred investments among the alternatives of stocks and bonds. Prices for commercial property remain fairly aligned with valuations, solidifying its place as a top investment alternative. Therefore, it is not surprising that, according to research conducted by Situs RERC, investor preference for CRE compared to stocks, bonds or cash has greatly increased since the Great Recession (see Exhibit 1). A clear reason for this increase is that CRE return characteristics are attractive due to their solid income component and long-term leases.

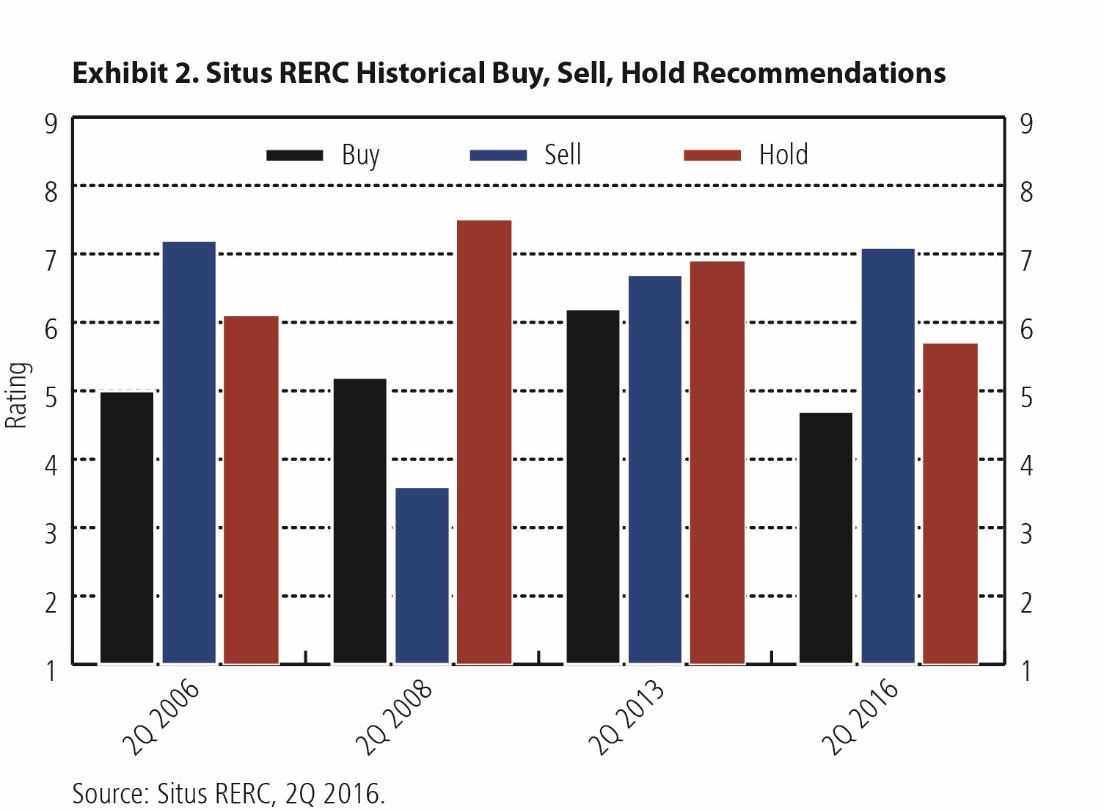

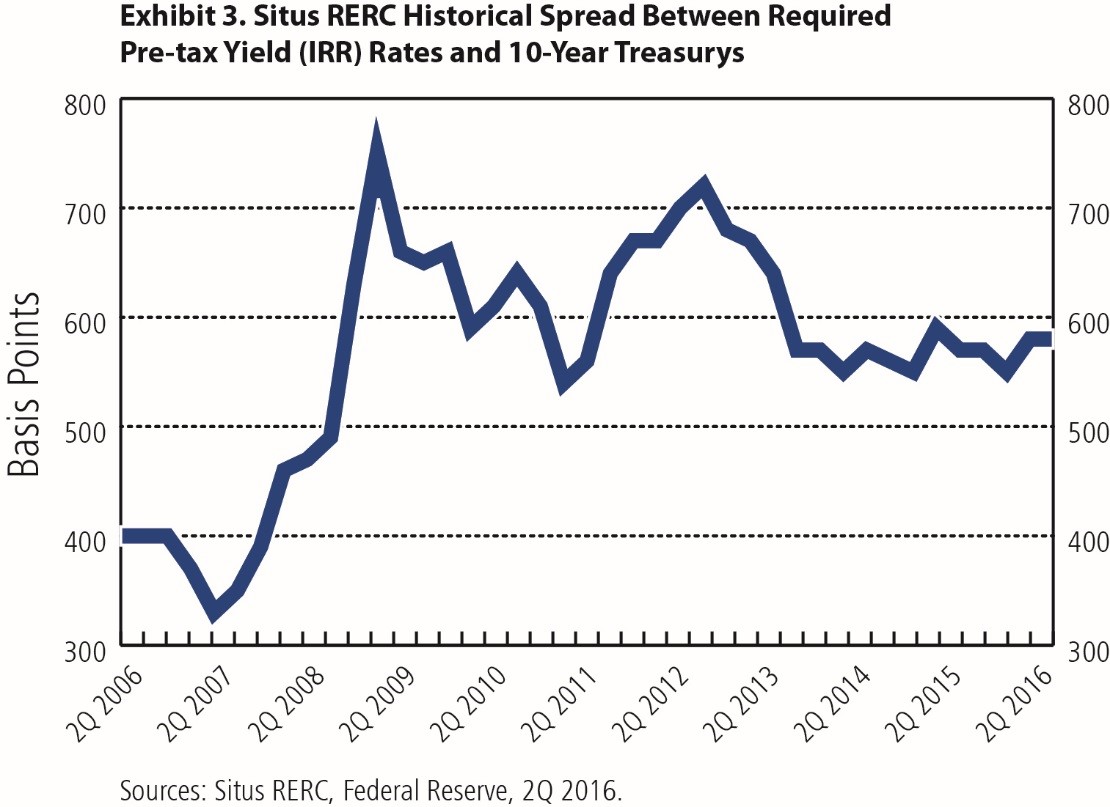

Among investment strategies, Situs RERC’s institutional investment survey respondents recognize that CRE is fully priced relative to valuation, and thus there is evidence in the market to prefer a sell recommendation (see Exhibit 2). Looking at demand for CRE in a different way, the spread between the pre-tax yield (i.e., internal rate of return or discount rate) and 10-year Treasuries is still at a very attractive level, around 600 basis points, and has remained relatively consistent over the past few years (see Exhibit 3).

Among investment strategies, Situs RERC’s institutional investment survey respondents recognize that CRE is fully priced relative to valuation, and thus there is evidence in the market to prefer a sell recommendation (see Exhibit 2). Looking at demand for CRE in a different way, the spread between the pre-tax yield (i.e., internal rate of return or discount rate) and 10-year Treasuries is still at a very attractive level, around 600 basis points, and has remained relatively consistent over the past few years (see Exhibit 3).

The future will continue to bring more expected and unexpected changes. The investment tempo is changing, and volatility in the financial and capital markets will likely continue in the foreseeable future. Yet CRE still offers investors stability in these times of instability, at least for now. Ironically, investors would be wise to show cautious optimism. While CRE has exhibited a long stretch of stability, if it continues on for too much longer, it will ultimately create instability, as Minsky hypothesized.

The future will continue to bring more expected and unexpected changes. The investment tempo is changing, and volatility in the financial and capital markets will likely continue in the foreseeable future. Yet CRE still offers investors stability in these times of instability, at least for now. Ironically, investors would be wise to show cautious optimism. While CRE has exhibited a long stretch of stability, if it continues on for too much longer, it will ultimately create instability, as Minsky hypothesized.

You must be logged in to post a comment.