Economy Watch: September Jobs Report Better Than Nothing, Not Great

The middling jobs report on Friday might not have inspired optimism, but at least it didn't inspire a mini-panic. France and Germany hinted at plans for euro-zone debt restructuring. And the Fed reported that U.S. consumer credit dropped across the board in August.

October 10, 2011

By Dees Stribling, Contributing Editor

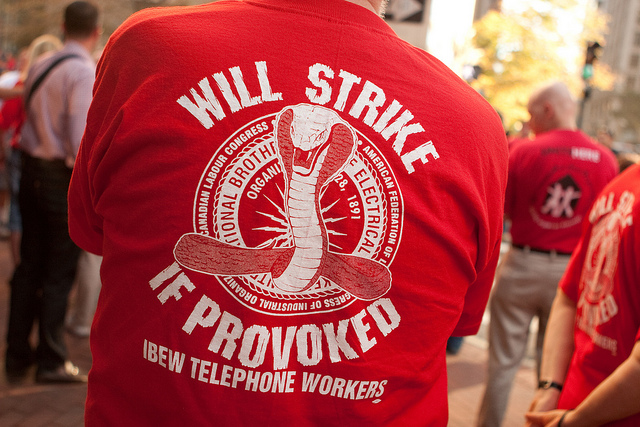

The middling jobs report on Friday – a gain of 103,000 net jobs in September, including 45,000 provided by Verizon workers winding up a strike — might not have inspired optimism, but at least it didn’t inspire a mini-panic, as the zero number in August did. It doesn’t take much to inspire panic these days, mini- or otherwise.

Still, recent employment trends haven’t been particularly positive. Since April, payroll employment has increased by an average of 72,000 jobs per month, compared with an average increase of 161,000 during the seven months before this April. Much of the drag comes from the firing of people in state and local governments. During September, some 34,000 non-federal government workers lost their jobs, and the U.S. Postal Service continued to lose jobs too — 5,000 in September, with presumably more to come. Local government employment has fallen by a total of about 535,000 positions since September 2008.

But there were bits of good news, besides the headline number, here and there in the September jobs report. One such glimmer involved worker earnings. According to the BLS, average hourly earnings for all employees on private nonfarm payrolls increased by 4 cents, or 0.2 percent, to $23.12 during the month. This increase followed a decline of 4 cents in August. Over the past 12 months, average hourly earnings have increased by 1.9 percent. That’s not quite enough to catch up with inflation, but (like the hiring number) better than nothing.

French and Germans Promise Euro-Crisis Action This Month

Angela Merkel and Nicolas Sarkozy, speaking jointly over the weekend in Berlin, asserted (in effect) that Germany and France were going to knock some heads together soon to try put a stop to the euro-zone crisis, though their language was somewhat more diplomatic. The English version of President Sarkozy’s statement mentioned responding to “the crisis issue” and “the vision issue.” (Perhaps he was more eloquent in French.) The two heads of state said that by the time the Group of 20 meets on Nov. 3, they’ll have a plan.

The outline of the plan isn’t clear yet, of course, but prognosticators say that to begin with, holders of Greek debt are going to have to take a bigger haircut under a “debt restructuring.” Sarkozy also offered hints of the plan when he said that “we will recapitalize the banks” in “complete agreement with our German friends.”

It’s good to know, at least, that France and Germany have put their 20th-century spats behind them in the common cause of being the co-bosses of the euro-zone — unless a report by Reuters on Friday that the French and Germans can’t agree on how to recapitalize those banks turns out to be true, official protestations notwithstanding. Another wild card in the euro-zone crisis in the near future is whether Slovakia’s parliament will vote aye on expanding the European Financial Stability Facility, that is, the EU transnational bailout fund. Even the smallest euro-using nations have to go along with it, and Slovakia might not.

Consumer Credit Dips

The Federal Reserve reported on Friday that U.S. consumer credit dropped across the board in August, decreasing at an annualized rate of 4.6 percent. Both revolving and non-revolving credit contracted at 3.4 percent and 5.2 percent annualized rates, respectively. The drop in non-revolving credit — especially car and school loans — came after an unusually large spike of 11.3 percent (annualized) in July.

Wall Street ended down after a day of seesawing on Friday. The Dow Jones Industrial Average lost 20.21 points, or a slight 0.18 percent, while the S&P 500 and the Nasdaq lost more sizable amounts, 0.82 percent and 1.1 percent, respectively.

You must be logged in to post a comment.