CRE Returns Tapping on the Brakes in 2017

By Ken Riggs, President, Situs RERC: Despite an expected drop in average total returns, CRE remains favorable to other investment alternatives.

By Ken Riggs, President, Situs RERC

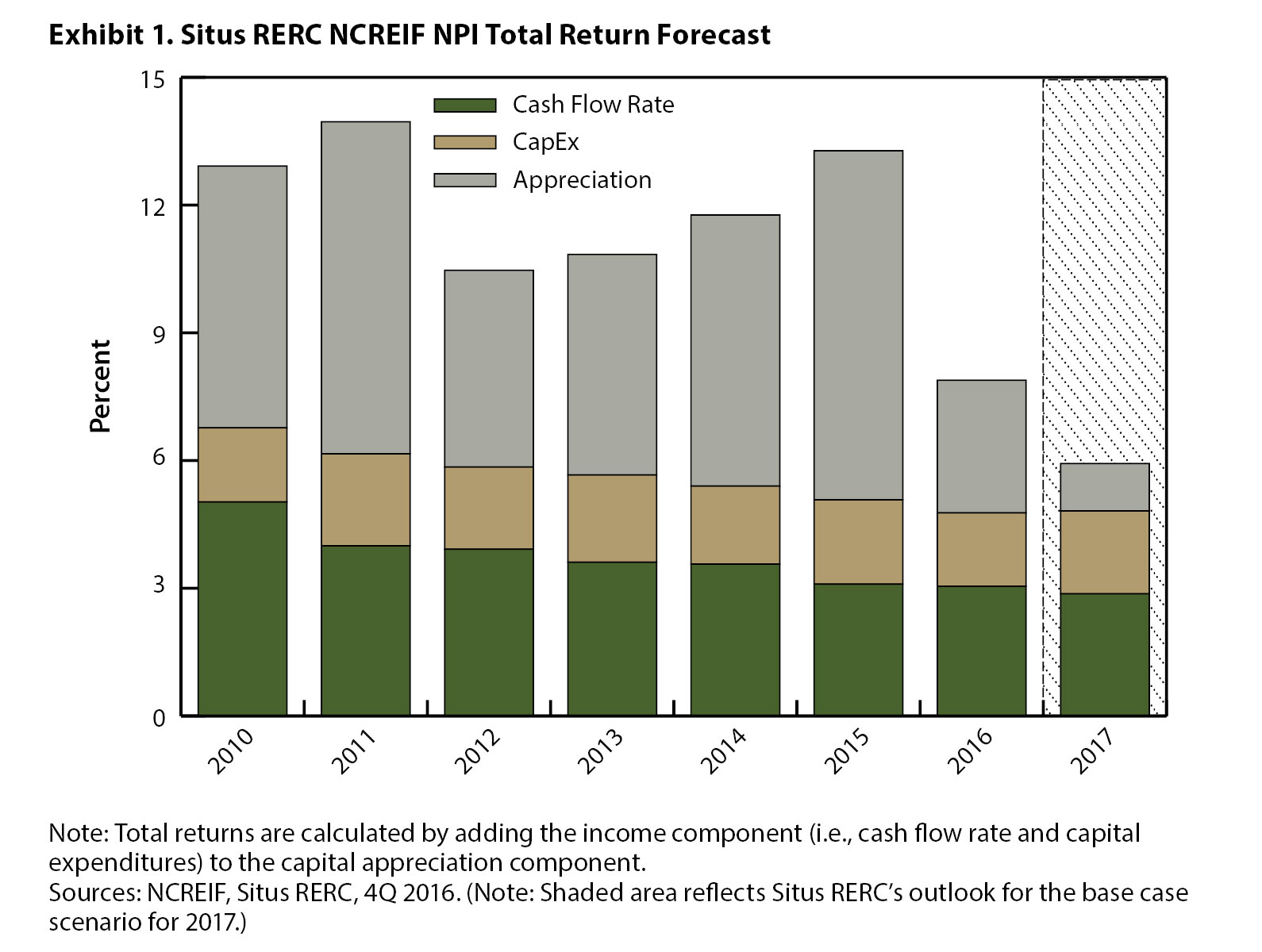

Commercial real estate has been driving in the fast lane throughout the current market cycle. The positive performance of the CRE market since the recession is attributable to a healthy and steady income return, coupled with strong price or value appreciation. Unleveraged CRE total returns have been taking the high road, with double-digit unleveraged returns from 2010 to 2015, per the National Council of Real Estate Fiduciaries (NCREIF). In 2016, however, average total returns dropped to around 8.0 percent. While this is still not too shabby, the deceleration in average total returns will continue to fall over the next two years, according to a recent forecast by Situs RERC. A primary question in investors’ minds is how low and how long returns will continue in this direction.

Commercial real estate has been driving in the fast lane throughout the current market cycle. The positive performance of the CRE market since the recession is attributable to a healthy and steady income return, coupled with strong price or value appreciation. Unleveraged CRE total returns have been taking the high road, with double-digit unleveraged returns from 2010 to 2015, per the National Council of Real Estate Fiduciaries (NCREIF). In 2016, however, average total returns dropped to around 8.0 percent. While this is still not too shabby, the deceleration in average total returns will continue to fall over the next two years, according to a recent forecast by Situs RERC. A primary question in investors’ minds is how low and how long returns will continue in this direction.

Based on Situs RERC’s valuation expertise and also using data from the NCREIF Property Index (NPI), Situs RERC created a proprietary model forecasting total returns derived from an income component and a capital appreciation component (see Exhibit 1). (All forecasts incorporate data from the NCREIF NPI and are for unleveraged, institutional-grade properties.) Situs RERC expects the base case NCREIF NPI unleveraged total returns to be around 6.0 percent for 2017, due to lowered expectations on the capital appreciation side of the balance sheet. Capital appreciation is expected to slow over the next several quarters until it becomes close to 1 percent by the end of 2017, as the cycle matures and the chance of a correction increases.

Any investment decision needs to factor in potential risks as well as returns. The world is a tumultuous place. While stocks have performed well since President Trump’s election, they are also fickle and subject to random walks and fluctuations in response to external shocks and random, unexpected events. CRE provides a relative safety net amid the uncertainty due to its tangible nature and continuing stable income from strong fundamentals and a relatively low interest rate environment (despite expected interest rate increases). CRE is also able to offer relative protection against inflation through rent increases, which is important in light of the Trump administration’s expected fiscal stimulus.

Any investment decision needs to factor in potential risks as well as returns. The world is a tumultuous place. While stocks have performed well since President Trump’s election, they are also fickle and subject to random walks and fluctuations in response to external shocks and random, unexpected events. CRE provides a relative safety net amid the uncertainty due to its tangible nature and continuing stable income from strong fundamentals and a relatively low interest rate environment (despite expected interest rate increases). CRE is also able to offer relative protection against inflation through rent increases, which is important in light of the Trump administration’s expected fiscal stimulus.

The Situs RERC Total Return Forecast for the NCREIF NPI is modest relative to the past seven years, which should not come as a surprise to investors since flashing caution lights have been appearing on several fronts. Situs RERC’s income component outlook for 2017 is relatively stable and is expected to be the primary driver for total real estate yields in the near term due to solid fundamentals and stabilizing cash flow. However, there are speed bumps ahead for the market. Situs RERC’s base case scenario of cap rates reflects that cap rate compression is likely to stall and reverse course, bottoming out by the end of 2017. The expected increase is primarily attributed to the slowdown in market value.

NCREIF total returns are expected to “tap on the brakes” in 2017; however, given the volatility of investment alternatives such as stocks and bonds, CRE remains favorable from a risk-adjusted return position.

You must be logged in to post a comment.