Consumer Spending Leading Economic Growth, Says Moody’s

By Paul Fiorilla, Associate Research Director, Yardi Matrix: Consumer spending continues to grow. So why are some retailers struggling so much?

By Paul Fiorilla, Associate Research Director, Yardi Matrix

U.S. consumers are likely to continue buying goods and services at a steady rate, though that may not be enough to save some struggling retailers, according to an analysis by Moody’s Analytics.

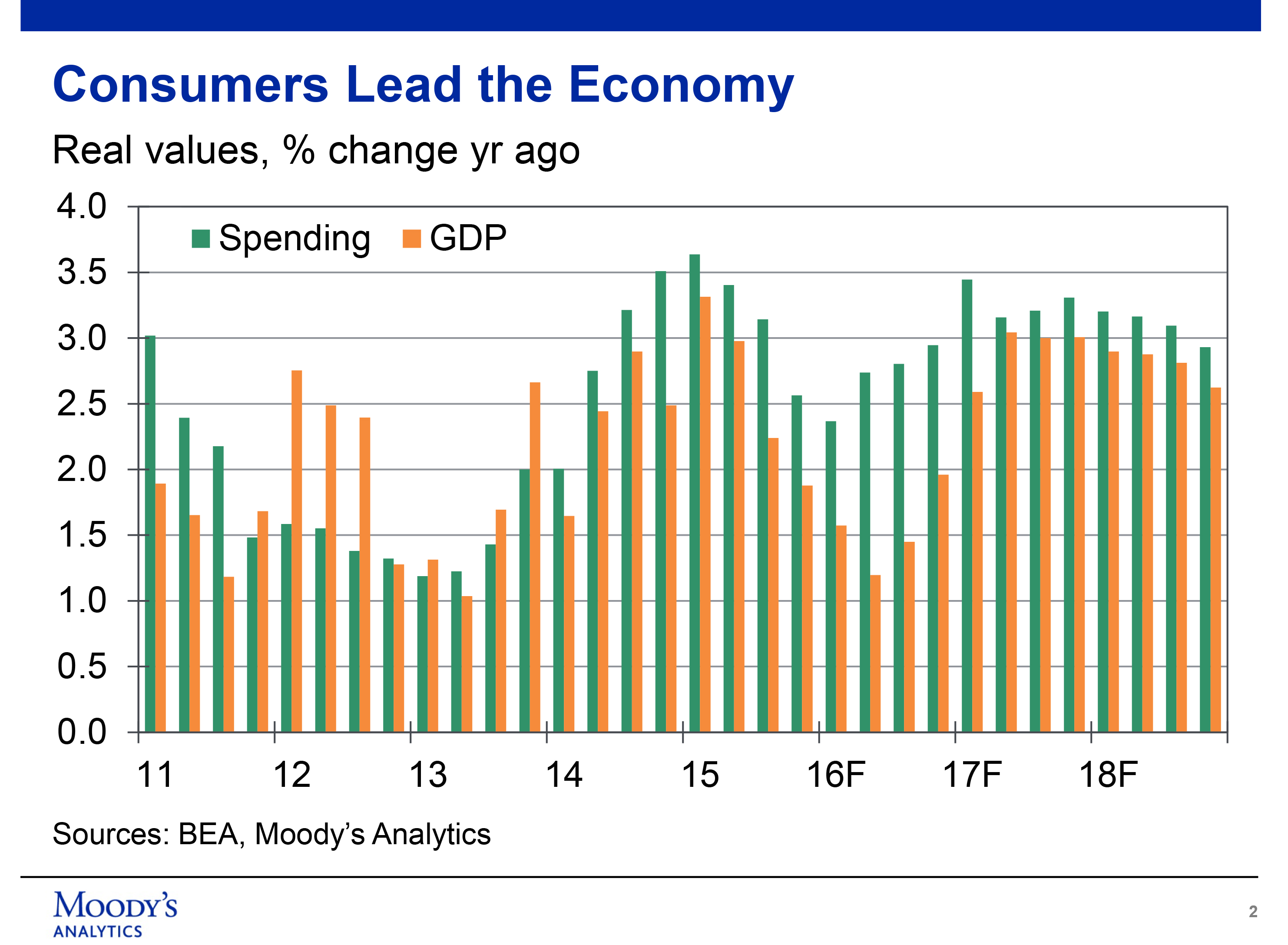

Consumer spending in the U.S. has been growing by about 3 percent year-over-year, which is weak by historical standards when the country is not in a recession. However, the risks going forward are weighted to the upside, says Moody’s Senior Director Scott Hoyt.

“Consumer spending is growing at a healthy pace and powerfully leading economic growth,” Hoyt said. “Tightening labor markets and faster wage growth are among the factors that will propel spending forward, allowing real growth to maintain its healthy pace and retail sales growth to gradually improve.”

There are a number of reasons that overall growth of consumer spending is likely to be strong going forward. Those include:

- Job growth remains strong. The economy has produced about 200,000 jobs per month since 2010, dropping the unemployment rate below 5 percent. However, workforce participation levels remain off historical highs and the number of underemployed workers remains at a level that is less than full employment.

- Wage growth is likely to accelerate as workers get more bargaining power. Hoyt suggested that one way to measure this is the rate of workers who quit jobs, which historically has been correlated with higher wages. If historical patterns hold, wage growth should rise to more than 3 percent from its current level of 2.4 percent.

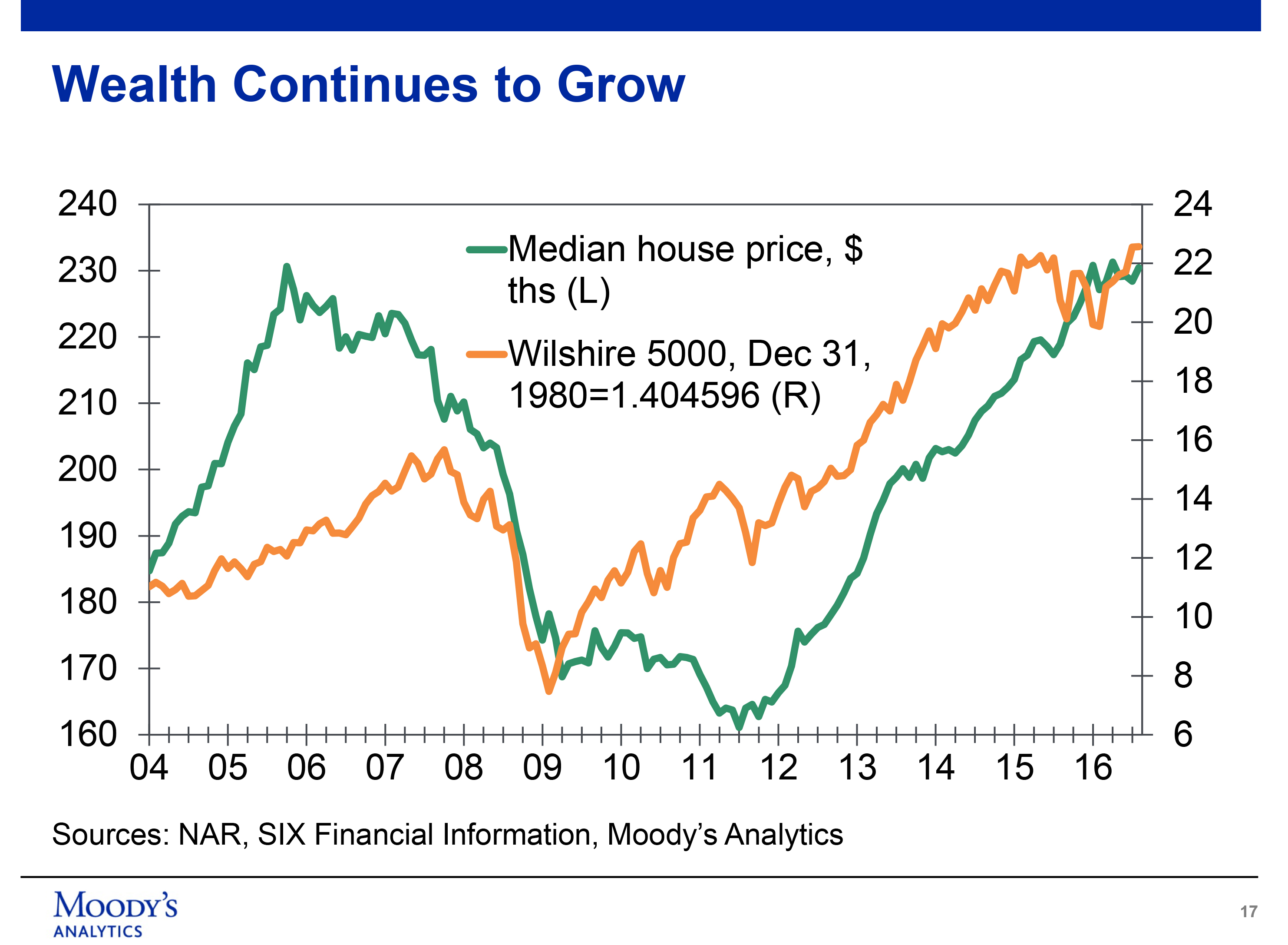

- Household disposable income is set to rise. This is due to growth in non-wage income, such as home values and investment income.

- Household savings are above 5 percent. Consumers might continue to pocket the savings, which are currently above historical norms, due to uncertainty about the economy or just a decision not to spend, but the potential exists to spend the savings.

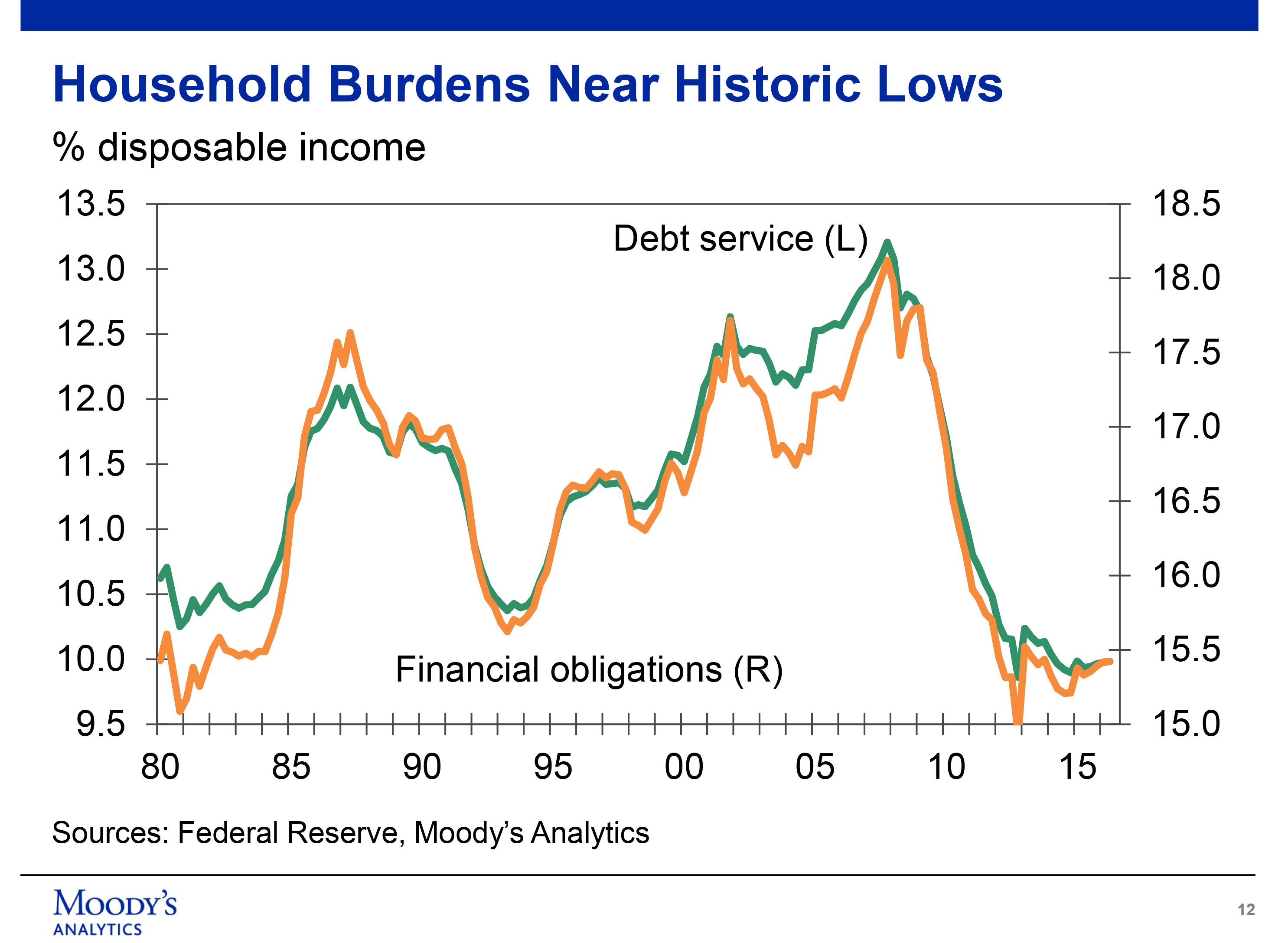

- Consumer credit is strong. Household debt service and financial obligations represent as small of a burden on families as they have since the Federal Reserve began tracking the data in 1980. That gives consumers the financial wherewithal to increase spending if they so choose.

- Bank credit standards are easing, albeit slightly.

- There is pent-up demand to replace aging goods. Data from the Bureau of Economic Analysis shows that goods such as vehicles, furniture and recreational materials are at or near historical highs in terms of replacement age.

There are also risks to the forecast that could keep consumer spending at sluggish levels. Those include:

- Consumer confidence. While it has been fairly strong, optimism has started to slip as the presidential election nears, and it could slide if job growth slows or the economy takes a turn for the worse.

- Rising energy prices. Oil is up over $50 a barrel, and while most analysts forecast little chance it gets much higher in the near term, it can be subject to rapid change.

- Increases in household net worth from the stock market and housing can slow or flatten. The stock market has had a long bull run, and housing prices have been rising steadily since the end of the Great Recession. A correction could come to either segment.

- Rising interest rates. An increase in rates would create uncertainty about the economy and increase borrowing costs. However, consumers have little floating-rate debt, so the immediate impact of this might be minimal.

Speaking during a recent webinar, Hoyt pointed to deflation in consumer goods and competition from e-commerce as key reasons that some retailers are having financial troubles at a time when sales are consistently growing. Prices have fallen in recent months in retail categories that include department store merchandise, furniture, groceries and appliances. Prices are increasing above historical levels in only a handful of sectors, such as drug stores and restaurants. Meanwhile, e-commerce is increasing 15 percent each year and now encompasses 8.1 percent of total retail sales.

The upshot is that retailers face higher expenses and less profit. “Because of pricing pressures and the shift to online selling, retail sales growth, which is measured in nominal terms, is sluggish, and many retailers are struggling,” Hoyt said.

To be sure, there are myriad reasons for the struggle of many retailers. Some chains–such as Sears, Kmart and Sports Authority–failed to evolve over time to meet consumer preferences and spending habits. Other reasons include the aging population (older people tend to buy fewer consumer goods), rising student debt and higher rent (which leaves Millennials with less pocket money to spend), the delay in child rearing and even the trends toward sustainability and simpler living.

Consistent growth in consumer spending would be good news for the commercial real estate market, as it points to continued strong economic and job growth, and demand for warehouses and retail space. Even so, property owners and individual retailers need to evolve to meet the demands of consumers and the marketplace in order to remain relevant.

You must be logged in to post a comment.