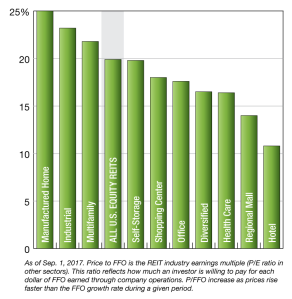

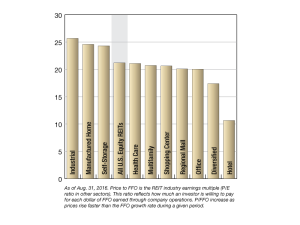

Price/LTM FFO

REIT Values

As of Sept. 1, 2017, the manufactured homes sector led all publicly traded U.S. Equity REIT sectors in terms of the last twelve months funds from operations (LTM FFO) multiple.

Industrial, Self-Storage REITs Performing Well

The two sectors were among the leaders of all publicly traded U.S. equity REITs in terms of the last 12 months funds from operations, according to S&P Global Market Intelligence data.

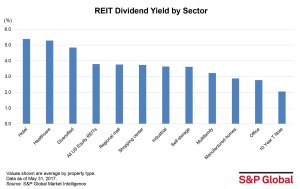

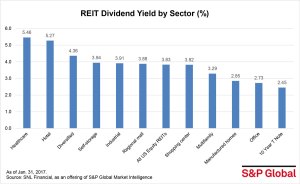

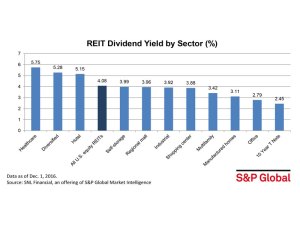

Hotels Hit Highest Dividend Yields

The hotel sector posted the highest one-year average dividend yield among all U.S. equity REIT sectors, according to S&P Global Market Intelligence data, outperforming the broader SNL U.S. REIT Equity Index.

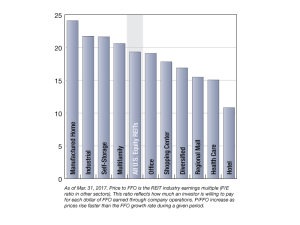

REIT Values

Among the REITs focused on manufactured homes, Sun Communities, Inc. had the highest multiple of 24.9x, and finished March 31 with an $80.3 price per share.

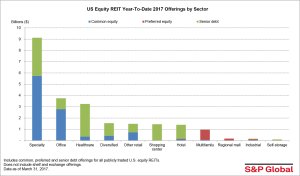

Specialty REITs Top Capital Raising

Publicly traded U.S. REITs raised some $23.4 billion through capital offerings in the first three months of 2017, with senior debt offerings making up the majority of the capital raises.

REIT Capital Access Split Between ‘Haves’ & ‘Have Less’

By Britton Costa, Director, U.S. REITs, Fitch Ratings: Why larger issuance sizes are needed to attract public bond investors in today’s market.

You must be logged in to post a comment.