REIT Values

Among the REITs focused on manufactured homes, Sun Communities, Inc. had the highest multiple of 24.9x, and finished March 31 with an $80.3 price per share.

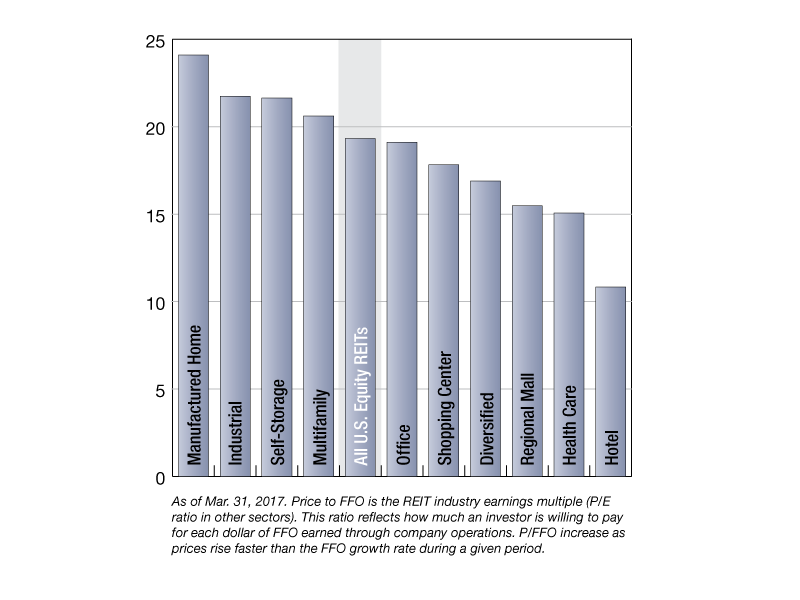

REIT industry earnings multiple (SNL U.S. REIT Index Price/LTM FFO [x])

As of March 31, the manufactured homes sector topped all publicly traded U.S. equity REIT sectors in terms of the last twelve months funds from operations (LTM FFO) multiple. Said sector posted a 24.1x LTM FFO multiple, beating the SNL US REIT Equity Index by 4.78 points. The industrial and self-storage REIT sectors followed with 21.8x and 21.6x, respectively. The hotel sector ranked last with a 10.8x price to LTM FFO.

Among the REITs focused on manufactured homes, Sun Communities, Inc. had the highest multiple of 24.9x, and finished March 31 with an $80.3 price per share.

Equinix, Inc., a data center REIT, had a 39.3x price to LTM FFO, the highest among the publicly traded U.S. equity REITs, and traded at a $400.4 price per share as of March 31.

Khamile Armhynn Sabas is an analyst in the real estate product operations department of S&P Global Market Intelligence.

You must be logged in to post a comment.