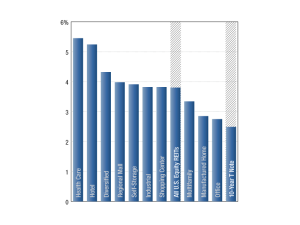

Dividend Yield

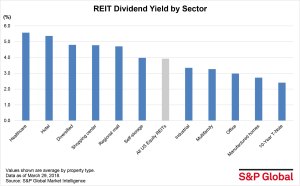

Health Care REITs Outperform

This property type posted the highest one-year average dividend yield in the sector and outperformed the broader SNL U.S. REIT Equity Index by 1.78 percentage points.

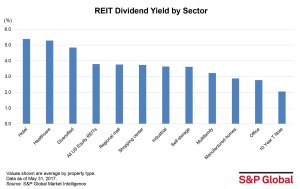

2018 REIT Dividend Yields

S&P Global Market Intelligence measures REITs’ one-year average dividend yield across asset categories, as of November 30.

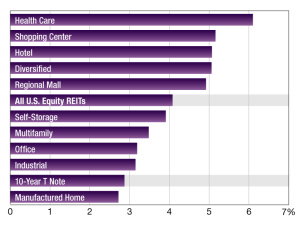

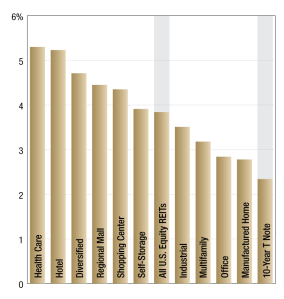

Health-Care REITs Hit Highest Dividend Yields

The hotel and diversified REIT sectors also had strong one-year average dividend yields, according to S&P Global Market Intelligence data.

REIT Dividend Yields

The Health Care sector posted the greatest one-year average dividend yield among the group, at 5.3 percent, outperforming the broader SNL U.S. REIT Equity Index by 1.5 percentage points.

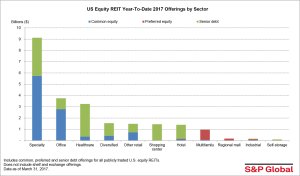

Specialty REITs Raise Most Capital Year-to-Date

The specialty sector raised $25.9 billion in capital year-to-date through Sept. 29, with communications REITs raising more than 40 percent of that total, according to S&P Global Market Intelligence data.

Industrial, Self-Storage REITs Performing Well

The two sectors were among the leaders of all publicly traded U.S. equity REITs in terms of the last 12 months funds from operations, according to S&P Global Market Intelligence data.

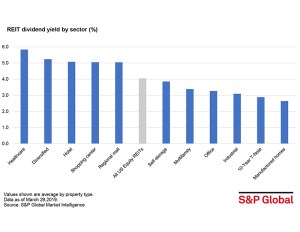

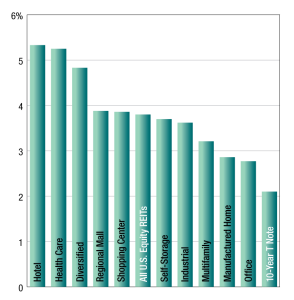

REIT Dividend Yields

The hotel sector posted the highest one-year average dividend yield among the group, at 5.3 percent, outperforming the broader SNL U.S. REIT Equity Index by 1.5 percentage points.

Hotels Hit Highest Dividend Yields

The hotel sector posted the highest one-year average dividend yield among all U.S. equity REIT sectors, according to S&P Global Market Intelligence data, outperforming the broader SNL U.S. REIT Equity Index.

Specialty REITs Top Capital Raising

Publicly traded U.S. REITs raised some $23.4 billion through capital offerings in the first three months of 2017, with senior debt offerings making up the majority of the capital raises.