Carter Phillips

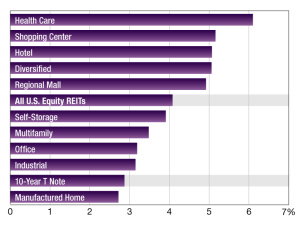

Health Care REITs Outperform

This property type posted the highest one-year average dividend yield in the sector and outperformed the broader SNL U.S. REIT Equity Index by 1.78 percentage points.

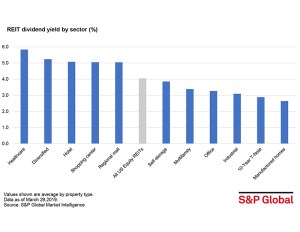

2018 REIT Dividend Yields

S&P Global Market Intelligence measures REITs’ one-year average dividend yield across asset categories, as of November 30.

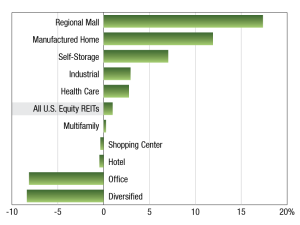

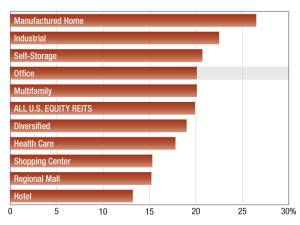

2018 REIT Returns

As of October 31, publicly traded U.S. Equity REITs posted a 0.98 percent one-year total return.

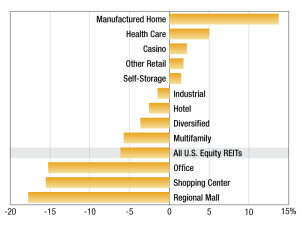

2018 REIT Trading Trends

As of Sept. 28, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value of 6.14 percent.

2018 REIT Values

The multifamily sector had a 20.1x last 12 months funds from operations multiple as of Aug. 31, outperforming the broader US REIT index and six other REIT sectors.