REITs

Health Care REITs Outperform

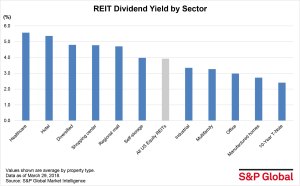

This property type posted the highest one-year average dividend yield in the sector and outperformed the broader SNL U.S. REIT Equity Index by 1.78 percentage points.

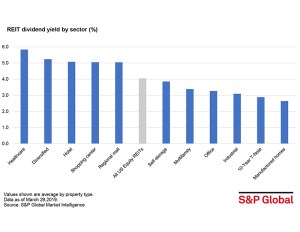

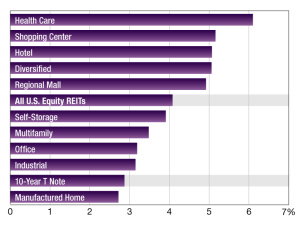

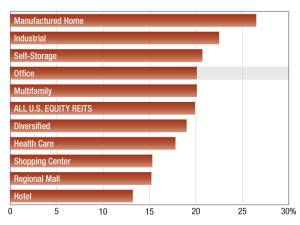

2018 REIT Dividend Yields

S&P Global Market Intelligence measures REITs’ one-year average dividend yield across asset categories, as of November 30.

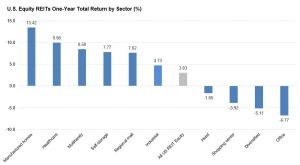

Manufactured Home Sector Beats U.S. Equity REIT Index

S&P Global Market Intelligence reports positive one-year total returns across property sectors, with the notable exception of office and retail.

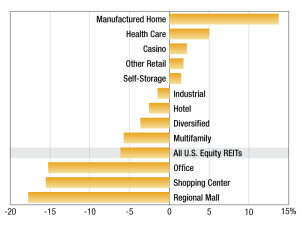

2018 REIT Returns

As of October 31, publicly traded U.S. Equity REITs posted a 0.98 percent one-year total return.

2018 REIT Trading Trends

As of Sept. 28, publicly listed U.S. equity REITs traded at a median discount to consensus net asset value of 6.14 percent.

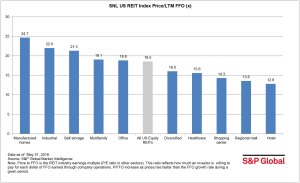

2018 REIT Values

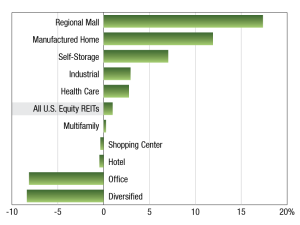

The multifamily sector had a 20.1x last 12 months funds from operations multiple as of Aug. 31, outperforming the broader US REIT index and six other REIT sectors.

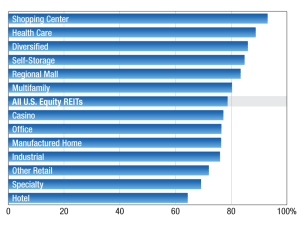

2018 REIT Results

The projected proportion of earnings to be paid as dividends, cycling among REIT subcategories.

Manufactured Home REITs Outperform Market

The sector had the largest last-12-months funds from operations multiple of all publicly traded U.S. equity REITs, at 24.7x, according to S&P Global Market Intelligence data.

Health-Care REITs Hit Highest Dividend Yields

The hotel and diversified REIT sectors also had strong one-year average dividend yields, according to S&P Global Market Intelligence data.