Cap Rates Versus Interest Rates: When Will the Other Shoe Drop?

Market cap rates tend to increase during periods of rising interest rates, but Avison Young Principal Jay Maddox explains why this may not be the case for commercial real estate anytime soon.

By Jay Maddox, Principal, Avison Young

Last week, the Federal Reserve increased interest rates for the third time this year, raising the benchmark federal funds rate from 1.25 percent to 1.50 percent. Further increases are anticipated next year, as the central bank remains confident in the U.S. economy’s strength. The Fed also reduced its holdings of long-term notes and bonds, which were purchased during the Quantitative Easing programs implemented as a consequence of the Great Recession. These policy changes translate to higher interest rates on consumer loans, some types of mortgages and corporate loans.

Last week, the Federal Reserve increased interest rates for the third time this year, raising the benchmark federal funds rate from 1.25 percent to 1.50 percent. Further increases are anticipated next year, as the central bank remains confident in the U.S. economy’s strength. The Fed also reduced its holdings of long-term notes and bonds, which were purchased during the Quantitative Easing programs implemented as a consequence of the Great Recession. These policy changes translate to higher interest rates on consumer loans, some types of mortgages and corporate loans.

Meanwhile, cap rates on most types of commercial real estate have stayed flat and multifamily cap rates have actually decreased. We have seen a sustained improvement in commercial real estate prices since the market bottomed in 2009. After peaking in August 2007, at 100.0, Green Street Advisors’ closely watched U.S. Commercial Property Price Index fell dramatically to a low of 61.2 in 2009, and has since more than doubled to 125.9 this month. So the question is: Will the other shoe drop, and if so, when?

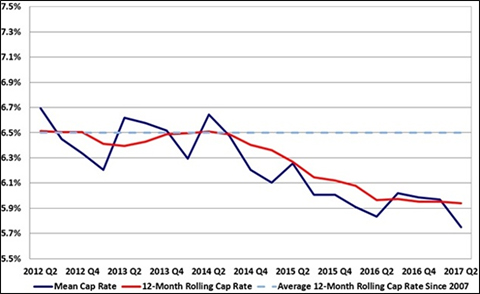

Multifamily Cap Rate Trends

Market cap rates do tend to increase during periods of rising interest rates; however, this is far from a direct cause and effect relationship. While interest rates can be a factor, cap rates are primarily driven by supply/demand and risk/return considerations. Generally speaking, the higher the cap rate, the greater perceived risk for investors. For example, investment capital is flowing into apartments, which are also experiencing strong income growth, causing cap rates to decrease to historic lows. Consequently, this sector is perceived as a relatively safe haven in the current rising rate environment.

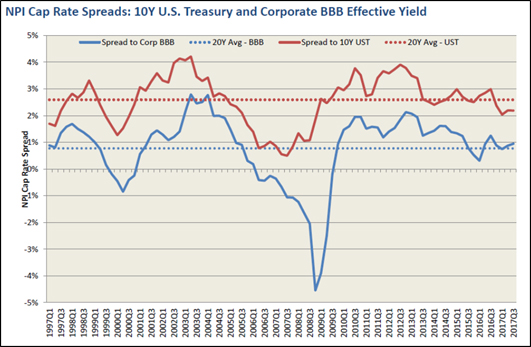

Commercial Real Estate Cap Rate Spreads

The industrial and office sectors have performed well, while the retail sector has experienced more volatility and pressure on valuations due to the disruption caused by the Internet.

Source: National Council of Commercial Real Estate Fiduciaries (NCREIF) 2017 3rd Quarter Presentation

As the above chart reveals, cap rate spreads were at record lows before the Great Recession, and they were also well below historic averages prior to the 2001 recession. However, spreads have exceeded historic averages since early 2009, and have only recently trended downwards, with spreads now very close to their long-term historic averages. Additionally, according to the NCREIF, rental income and NOI growth remain above average for most property types, except for retail, and overall occupancy remains steady. This data would tend to support the conclusion that commercial real estate values may be insulated from rising interest rates, at least over the near term. So, it may be another year or more before “the other shoe drops.”

You must be logged in to post a comment.