Brennan JV Buys 1.3 MSF Houston Manufacturing Campus

The transaction marks the first joint venture between the company and PCCP.

Brennan Investment Group has purchased a 1.3 million-square-foot, 16-building industrial property in Northwest Houston. The acquisition was a joint venture with PCCP, marking the first deal between the two companies.

The seller was Innovex, a manufacturer of subsea oil and gas equipment. The company had previously occupied the entire property and is currently vacating it, a Brennan spokesperson told Commercial Property Executive. The transaction’s dollar value was not disclosed.

The acquisition was arranged through KBC Advisors and CBRE.

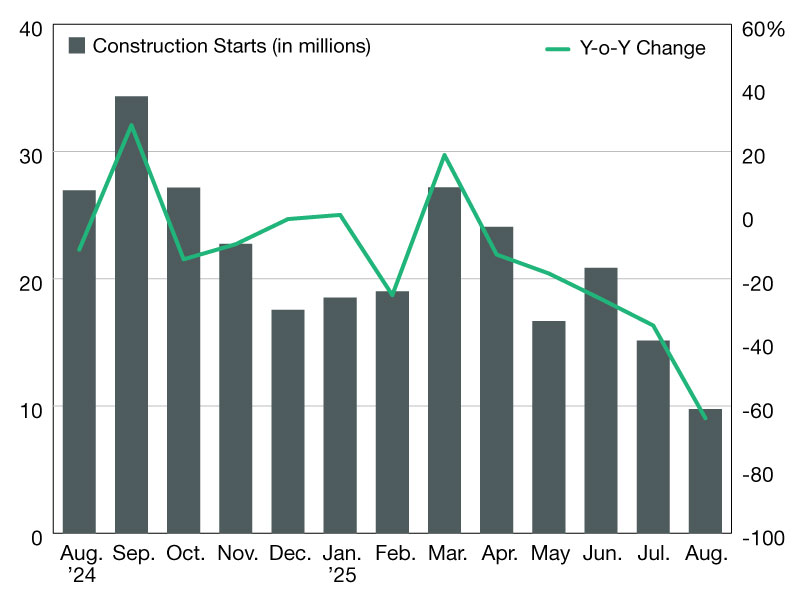

READ ALSO: Industrial Sales and Prices Rose Steadily in H1 2025

Completed between 1999 and 2018, the 126-acre campus is located within a master-planned business park and has buildings ranging in size from 11,000 to 450,000 square feet. The facilities were designed for manufacturing operations, offering HVAC-equipped warehouses, bridge cranes, heavy power, IOS yards, above-standard clear heights, and wide column spacing to accommodate diverse industrial requirements.

The site’s location provides connectivity to the greater Houston region. The campus is surrounded by a dense industrial area, with more than 780 manufacturing businesses within a five-mile radius and an ample labor pool alongside a limited supply of heavy industrial space.

Given the property’s size and complexity, it’s likely that the campus will eventually be re-occupied by multiple manufacturing tenants, the spokesperson said.

Brennan’s portfolio currently spans 29 states and encompasses approximately 57 million square feet. Since 2010, the company has developed and acquired industrial assets valued at a total of $6.5 billion.

Earlier this month, Brennan, in joint venture with Farallon, sold a 198,408-square-foot industrial asset in Jacksonville, Fla. Nuveen purchased the warehouse for $21.1 million.

Demand for manufacturing space

Recently, BCS broke ground on Grove Business Park, a 46-acre, 438,960-square-foot speculative industrial campus in the Houston suburb of Baytown, Texas. The park’s nine buildings will be marketed mostly for logistics users, but two will be 20-ton crane–ready manufacturing facilities.

Leasing activity for manufacturing space in metro Houston declined slightly in the second quarter, recording negative absorption, according to a Partners Real Estate report. On the investment side, however, there are expectations that demand for manufacturing space will grow. In fact, the average monthly rental rate for manufacturing space jumped from $0.73 to $0.92 per square foot over the quarter.

Metrowide, manufacturing space had a tight 2.7 percent total vacancy and 5.6 percent total availability, on an inventory of 98.3 million square feet. Second-quarter deliveries and space under construction were modest, totaling less than 600,000 square feet.

You must be logged in to post a comment.