Scott Baltic

Scott Baltic has been a contributing editor with Commercial Property Executive since 2011 and also wrote for its predecessor, Commercial Property News. He started writing about CRE in 1988 for a group of Chicago-based publications and in 1989 became the editor of Midwest Real Estate News. After moving on from there in 1991, Baltic continued writing occasionally about real estate, for publications like the Chicago Sun-Times, National Real Estate Investor, Urban Land, Shopping Center World and Architect’s Newspaper. He earned a master’s in journalism from Northwestern University’s Medill School of Journalism and has a bachelor’s from North Park University.

Blackstone’s 6 MSF Industrial Portfolio Deal Closes

Newmark represented Crow Holdings in the $718 million recapitalization.

Bain Capital JV Buys Retail Trio for $212M

The Oklahoma City assets previously traded in 2014 for $52 million.

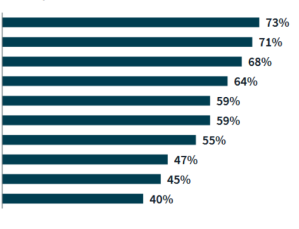

Office Users’ Top Priority Today

There’s been a shift in corporate real estate objectives, according to JLL’s research.

JBG Smith Picks Up DC-Area Campus at Steep Discount

One of the property’s buildings is slated for conversion.

New Growth on the Horizon

Bright spots are emerging for several property types, according to PwC’s midyear outlook.

Cohen & Steers Invests $300M With Hudson Pacific Properties

The move will support HPP’s balance sheet recapitalization.

Bridge Logistics Secures $355M Portfolio Refi

The properties are spread across multiple states, including California, Florida, Texas and others.

6 Key Trends Shaping the Life Science Sector

And what’s behind these shifts, according to JLL’s latest research.

Transwestern Investment Sells Houston Office Building

The asset last traded more than a decade ago.

Lendlease Debuts 350 KSF Boston Life Science Project

FORUM is opening in a market that has slowed noticeably over the past 12 months.