2025 Special Servicing Rates

Data from Trepp's latest report.

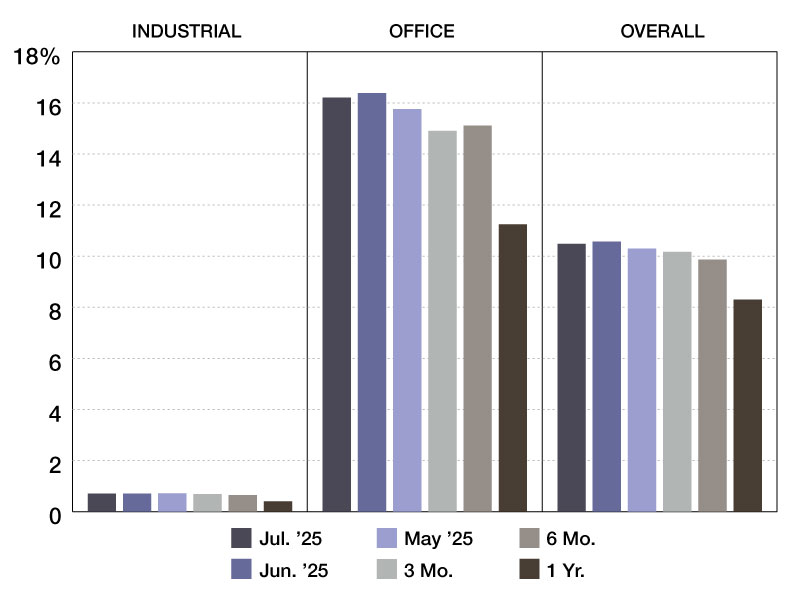

After peaking at a 12-year high in June, the Trepp CMBS Special Servicing rate receded slightly in July, decreasing 9 basis points to 10.48 percent.

This decrease broke a streak of three consecutive monthly rate increases, although the rate still remains

elevated compared to historical norms. The balance of loans in special servicing was little changed compared to June, but the overall balance of CMBS loans outstanding rose about $5 billion to $597.0 billion in July.

Breaking down movements by property type, the individual rates for four of the five major property types

declined in July, continuing a recent trend. The rate drops were relatively small, with retail’s 29-basis-point

retreat the largest of the bunch.

—Posted on August 26, 2025

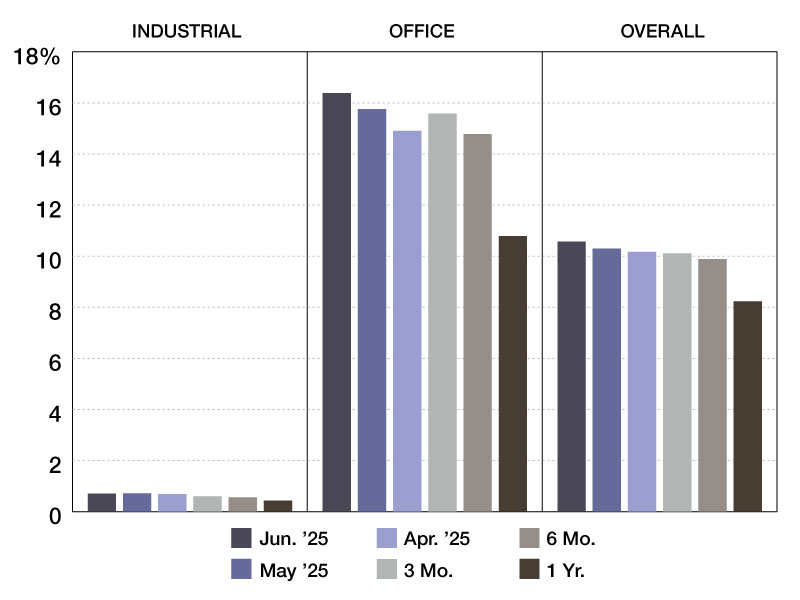

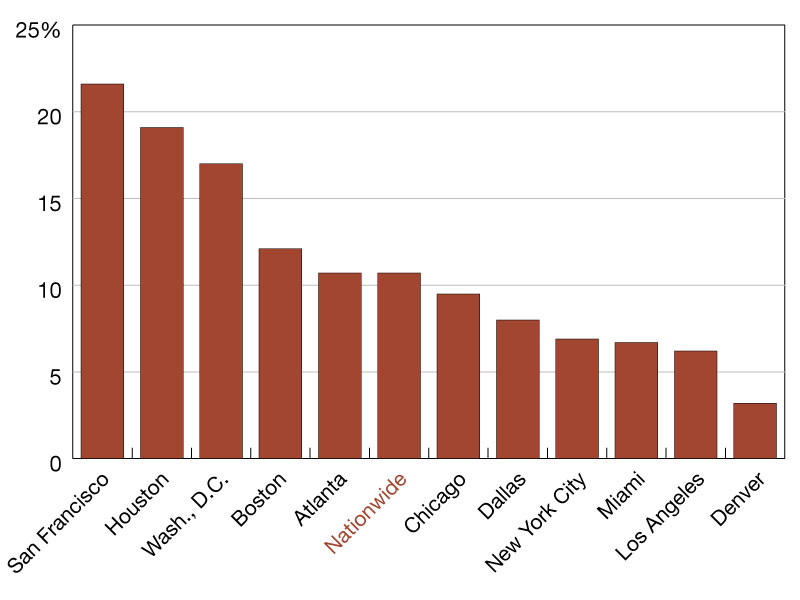

The Trepp CMBS Special Servicing Rate jumped 27 basis points to 10.57 percent in June, reaching its highest level since May 2013 when the rate was 10.67 percent.

This was the third consecutive monthly increase, and the rate is up nearly 225 basis points in the last year. The balance of loans in special servicing rose by $750 million over the past month, while the overall balance of CMBS loans outstanding fell by about $8.2 billion.

Across the different property types, the office special servicing rate rose the most, climbing 62 basis points to a record high of 16.38 percent. The retail rate rose 41 basis points to 11.94 percent, reaching its highest level since January 2022. After cooling by 64 basis points in May, the lodging rate was back up 54 basis points to 10.11 percent in June.

—Posted on July 25, 2025

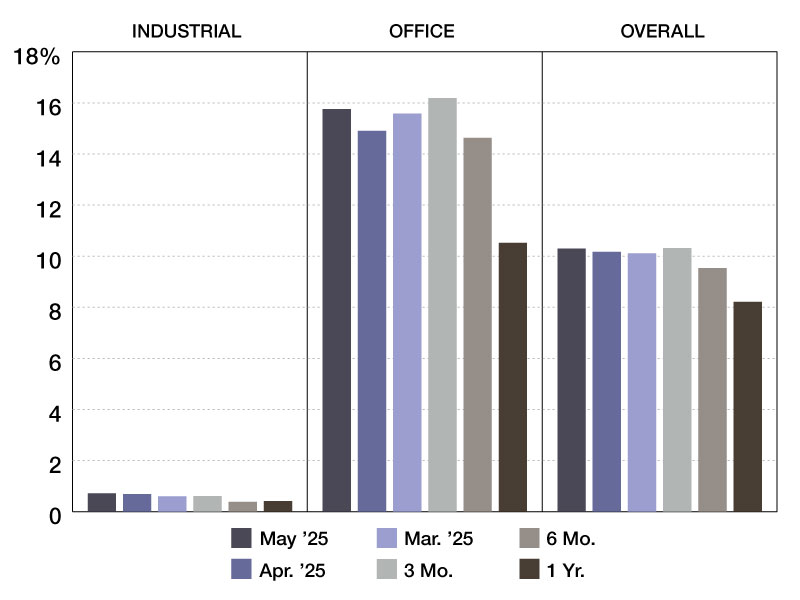

The Trepp CMBS Special Servicing Rate rose for the second consecutive month in May, up 13

basis points to 10.30 percent.

In 2025, year-to-date, the rate has risen 41 basis points and since the beginning of 2024, the rate has risen more than 350 basis points. In May, the balance of loans in special servicing rose by $1.3 billion, while the overall balance of CMBS loans outstanding climbed more than $5.6 billion as well.

When looking into property type specifics, four sectors were minimally changed, with monthly movements of five basis points or less. Only two property types saw substantial changes to their respective rates: lodging and office.

The lodging rate experienced some relief, receding 64 basis points to 9.57 percent, after spiking to a three-year high the month prior. On the flip side, the office rate surged another 86 basis points in May to 15.76 percent, pulling the overall rate higher along with it. Just one year ago, the office rate was over 500 basis points lower at 10.52 percent.

—Posted on June 30, 2025

Trepp CMBS Special Servicing Rate was back on the rise in April, up by a modest 6 basis points to 10.17 percent.

One year ago, the overall rate sat at 8.11 percent, and in April 2023, the rate was 5.62 percent. Though the balance of loans in special servicing increased by $800 million last month, the overall balance of CMBS loans outstanding also rose by $4.2 billion.

Breaking it down by property type, there was a substantial discrepancy across different sectors. Once again, it was the lodging rate that had the highest increase in April, jumping 126 basis points to 10.21 percent. This followed the sector’s 64-basis-point jump the month prior, bringing the lodging rate above 10.00 percent for the first time in three years.

Two other sectors that advanced month-over-month, albeit by smaller margins, were multifamily and retail, by about 30 basis points each. At the other end of the spectrum, office experienced more relief in April, with its rate dropping another 68 basis points to 14.91 percent, after peaking north of 16.00 percent two months prior.

—Posted on May 28, 2025

The Trepp CMBS Special Servicing Rate retreated 21 basis points in March 2025 to 10.11 percent, after surging 45 basis points the month prior.

The reduction in the overall special servicing rate was mostly mirrored across property types, with four of the five main property types experiencing decreases in their respective rates. Most notably, the office rate shed 61 basis points down to 15.58 percent following its peak of 16.19 percent in February – the highest level in over 25 years.

A large driver of the drop in March was the balance of overall CMBS loans outstanding, climbing nearly $10 billion, from $580.4 billion in February to $590.3 billion in March. Additionally, the net balance of loans in special servicing retreated very slightly (new transfers minus loans that returned to the master servicer or were paid off), causing the resulting ratio to recede.

The multifamily rate shed 20 basis points to reach 8.31 percent, while the retail and industrial rates both inched back by negligible amounts. Conversely, the lodging rate soared in March, jumping 64 basis points to 8.95 percent, marking a nearly three-year high.

—Posted on April 25, 2025

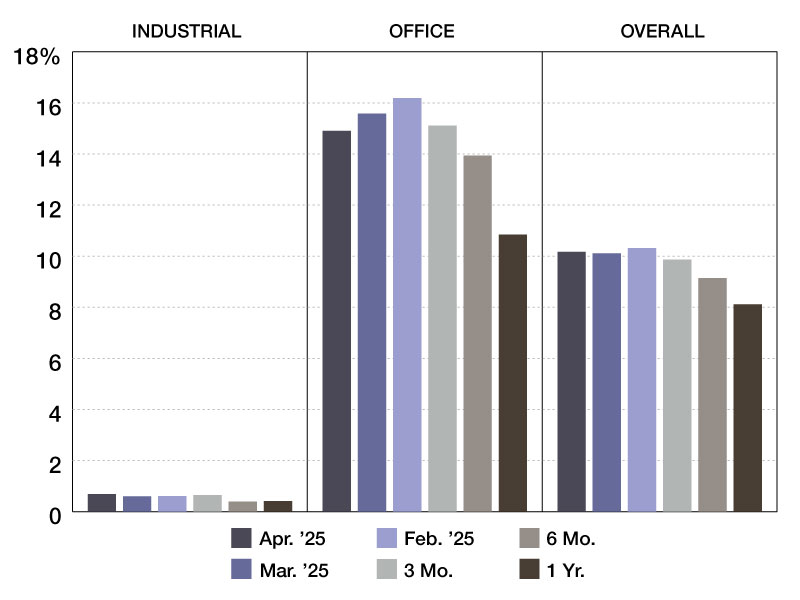

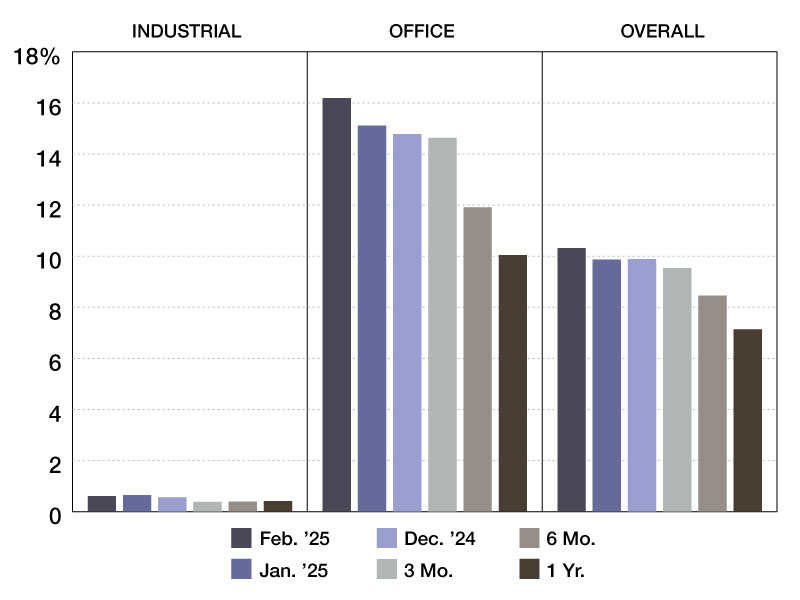

The Trepp CMBS Special Servicing Rate rose 45 basis points in February 2025 to 10.32 percent. This jump followed the rate’s slight decline in January, which was its first drop in over a year.

The big increase to the overall rate in February was caused by two main factors: first, the net balance of loans in special servicing increased by $1.8 billion (new transfers less loans which returned to the master servicer), and the overall balance of loans outstanding fell by $8.8 billion.

Thus, a comparatively larger numerator divided by a comparatively smaller denominator led to the substantial jump in the monthly rate.

Breakdown by sector

With respect to property types, there were two that contributed most heavily to the increase in the overall rate: first, the retail rate climbed 59 basis points to 11.26 percent after shedding 100 basis points the month prior; second, the office rate soared 108 basis points to 16.19 percent, marking yet another 25+ year high.

Additionally, the mixed-use rate rose 33 basis points to 13.04 percent, clearing the 13% mark for the first time since early 2013. Outside of those three, none of the remaining property types were changed by more than 15 basis points in either direction.

—Posted on March 26, 2025

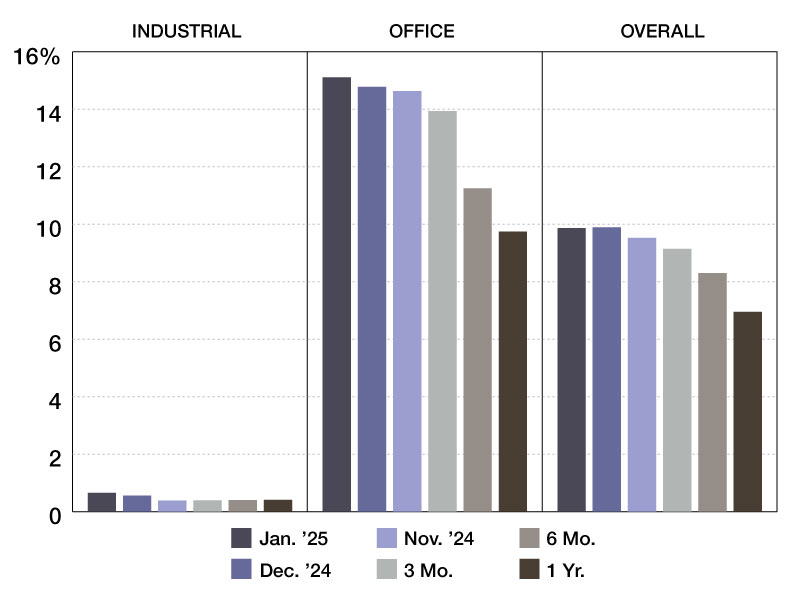

The Trepp CMBS Special Servicing Rate pulled back 2 basis points to 9.87 percent in January 2025. This was the first decline in the monthly rate since December 2023.

The main driver of the rate’s decrease was the increased overall balance of all CMBS loans outstanding. Compared to last month, the balance of loans in special servicing rose by $843.0 million, but the balance of all outstanding CMBS loans also increased by $9.5 billion.

Broken down by property type, two sectors experienced substantial changes to their individual rate. The retail rate was down most significantly, falling just shy of 100 basis points to 10.68 percent. The sector with the biggest increase in special servicing rate was mixed use, which rose 98 basis points to 12.71 percent. This is the largest jump in the mixed use rate since March 2013. Two other sectors that sustained material change were multifamily and office. The multifamily rate fell 31 basis points to 8.42 percent while the office rate rose 34 basis points to 15.11 percent. This is the first time the office rate has cleared 15 percent since Trepp began publishing these rates in the year 2000.

—Posted on February 28, 2025

You must be logged in to post a comment.