Yield Curve Concerns May Keep Rates Relatively Low

While the financial markets have been sending out alarm signals, the Federal Reserve is taking a wait-and-see-approach.

By the Editors of Commercial Property Executive

Concerns that an inverted yield curve could signal a pending recession—despite the seemingly prospering economy—has led the Federal Reserve to announce that further hikes in short-term rates will be “data dependent.”

The Mortgage Bankers Association’s “Chart of the Week” last week showed that the yield curve has recently inverted at several points along the curve, with shorter-term rates higher than some longer-term rates.

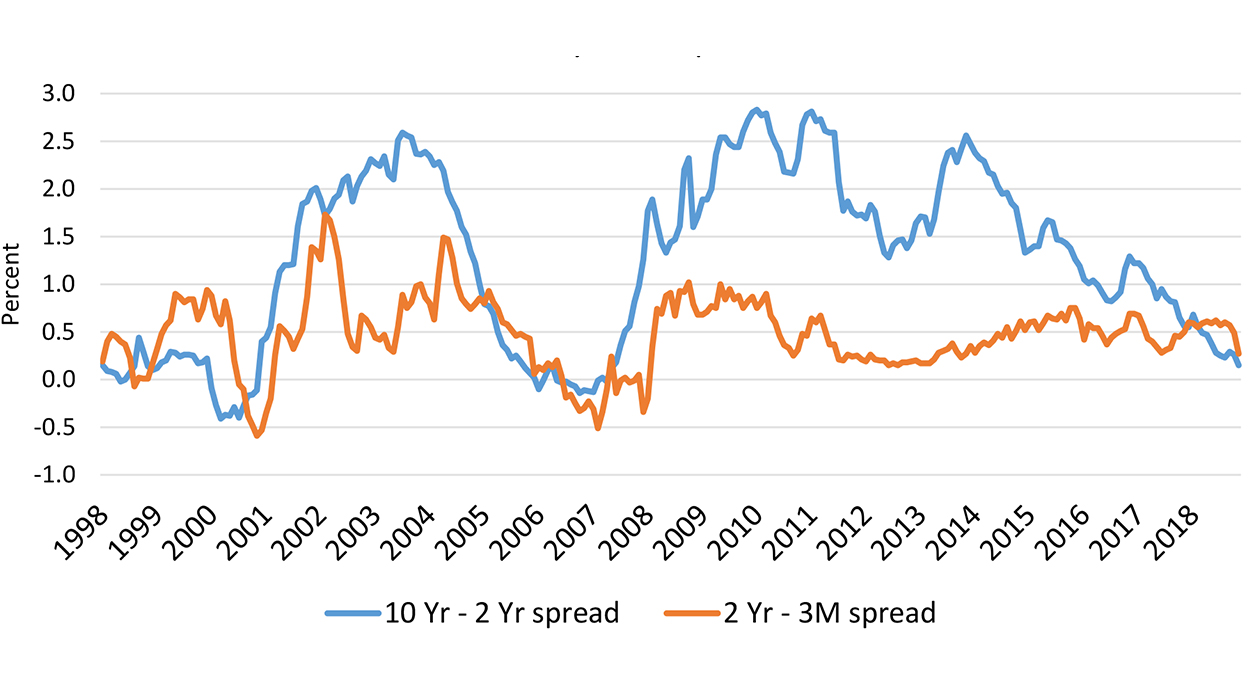

Treasury Yield Spreads

Mortgage Bankers Association/Federal Reserve

“The spread between the 10- and two-year has averaged around 120 basis points since 1998, with the 10-year rate typically higher than the 2-year rate, as investors are compensated for the higher risk of holding a longer term bond,” wrote MBA’s Chief Economist Mike Fratantoni and Joel Kan, assistant vice president of Industry Forecasts and Surveys. “Over the past two years, this spread has dropped below its average and continued to narrow, reaching a mere 15 basis points in December 2018. Similarly, the spread between the 2-year and 3-month bonds averaged around 60 basis points for the charted period, and for most of 2018, until narrowing sharply to 27 basis points in last month. This spread went negative at certain points in recent days.”

In addition to the inverted yield curve, the stock market was also showing signs of distress at the end of the year. But the economic data—including robust job growth in December—shows the economy is still strong.

“We believe that the risk of a recession is higher over the next year given these factors, but expect that the combination of relatively low rates and a still-growing economy should continue to lay the foundation for favorable commercial real estate fundamentals and strong lender demand in 2019,” wrote Fratantoni and Kan.

You must be logged in to post a comment.