Year-Over-Year Changes in Commercial Property Values

An update on national pricing trends from MBA’s Jamie Woodwell.

Year-over-Year Changes

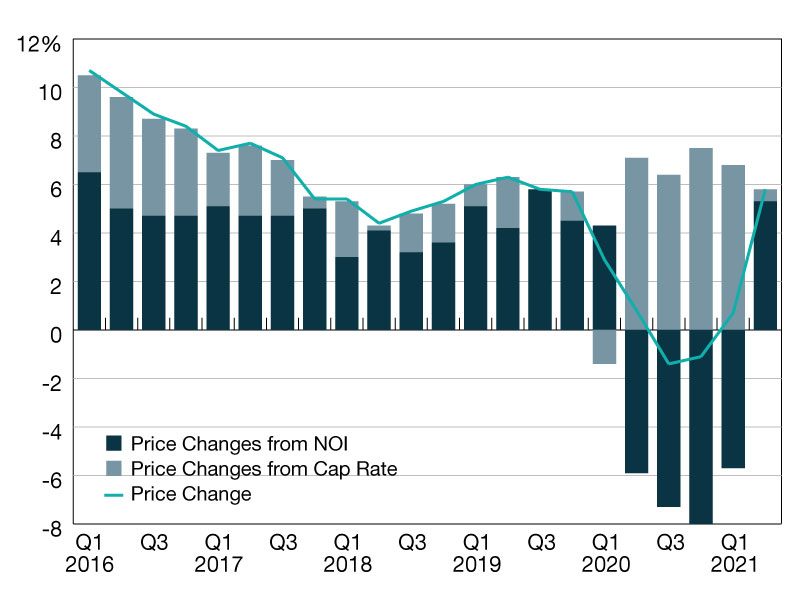

Commercial property prices are the product of two things: a) the net operating income (NOI) and property produces and/or is expected to produce and b) the multiple of that income (the capitalization of “cap” rate) investors are willing to pay in order to own that income stream. Thus, Property Value = NOI/Cap Rate. Property incomes and values tend to move in the same direction. When property incomes go up/down,–all else being equal—property values go up/down to a commensurate degree. However, property values move inversely with cap rates, so when investors’ cap rates go up/down—all else being equal—property values go down/up to a commensurate degree. During the Global Financial Crisis, investor sentiment shifted quickly, even with relatively little change in underlying property fundamentals. As a result, property values that had been bid up via rapid declines in cap rates reverse, falling on a year-over-year basis by nearly 30 percent at the worst point.

As the economy improved, NOIs did as well, but a return to move positive investor sentiment was the key driver in a rebound in property values. Fast forward to the COVID-19 pandemic. With the onset of the pandemic, property incomes—especially among the higher-density, higher-value properties tracked by the National Council of Real Estate Investment Fiduciaries, dropped—in many cases significantly.

But rather than sapping investor confidence, investors appeared to look past the pandemic to a return to normal. As a result, while falling NOIs, all else being equal, would have driven property values down considerably, investors’ positive sentiment led to cap rates falling in almost exact oppositions to NOIs. The result was a flattering, but no a decline, in aggregate property values during the worst part of the pandemic. Different property types have behaved differently, but with incomes rebounding and cap rates stable, commercial property values are once again on the rise.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.