Why Southern California’s Crystal Ball Is Cloudy

Commercial real estate executives are confronting a mix of market signals, according to Avison Young's Jerry Holdner.

The commercial real estate world continues to prove it is not one story, but a myriad of factors including the property itself, location, and macro/micro economic influences. While we all attempt to underwrite the markets based upon detailed analytics using the best information we have, real estate is subject to external factors that can cloud our crystal ball. The only real constant is change.

There is a complex web of dynamics and circumstances at play in the Southern California market today. Below are some of those that have risen to the surface as we wrap up the first quarter of this year.

- Flexible workplaces are here to stay. We will continue to see the resistance of many to return to the office as we still have not found equilibrium. This has created an uncertain picture of our office market going forward. And our downtowns are suffering because of it.

- We are still uncertain about a recession, and if it will be short and shallow like many are predicting. Or are we in for a period of monumental headwinds.

- The rise and future uncertainty of the pace of inflation has caused many to take a “pencils down” approach, slowing, pausing or stopping deal-making, growth, capital investment and development. We expect to see a continued slowdown in new development in most asset classes.

- The tech industry has been experiencing significant layoffs and resulting in unprecedented office sublease space coming back to the market. Tech has been a substantial driver of the office market especially in Southern California. We have yet to see how things will play out in the sector and if companies will require employees to return to the office.

- The supply chain continues to attempt to sort out the challenges that have caused both a shortage of many goods and subsequently sharp increases in prices.

- For many organizations, ESG has become a must-have to compete successfully in the marketplace.

- Office tenants are on a flight to quality while prioritizing flexibility and more affordable office .

- The resilience of the American consumer may come to halt will or significantly slowdown in the event of a recession.

- So far, a major correction has not happened in the apartment market, but it is looming in the distant or not so distant future.

By examining Southern California on a more granular level, the commercial real estate market has begun to plateau this year. The level of deal activity was inconsistent in 2022. The first half of the year was robust, while the second half of 2022 slowed down as interest rates increased. Unemployment in Southern California remains low, but it is important to highlight, that job creation has been uneven – leisure and hospitality jobs are still underwater, for example. The bright spot is that high-value-added jobs in a broad range of sectors such as aerospace, scientific research, medical products, and pharmaceuticals development, continue to grow. This bodes well for the region.

Below are a few key market highlights/indicators from Avison Young’s Q4 Insights report:

- Retail: Tenant demand has surged, construction has picked up, absorption will remain positive, lease rates will continue to increase, vacancies/availability will decrease, and investment sales should continue to increase.

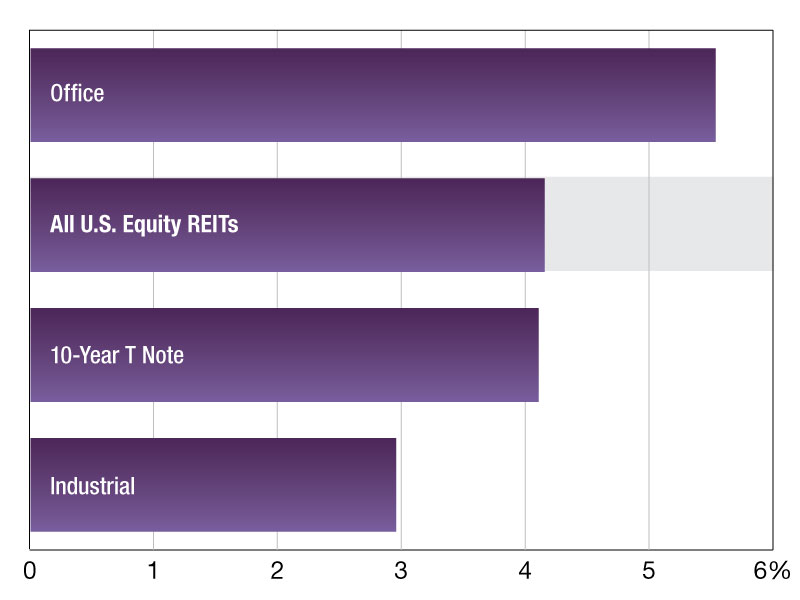

- Office: Investment sales retreated in 2022 as interest rates increased and office workers were reluctant to return to the office. We should see construction slowing, more negative absorption and increases in vacancies/availability, and very little if any lease rate growth as companies “right-Size” their space requirements going forward.

- Multifamily: New construction projects will continue to break ground, absorption will remain positive, asking rents will begin to flatten out after years of double-digit growth, vacancies/availability will increase, and investment sales activity will return to normal levels.

- Industrial market: We’ll see construction activity slow down, absorption will be positive, capitalization rates will increase, vacancies/availability will begin to increase from the record lows we’ve seen recently, lease rate growth will return to single digits and investment sales activity will come back to normal levels.

Based on the current environment and what we have learned over several economic cycles, we believe that 2023 will see office leasing demand that is below the 10-year average. Industrial lease rates will show signs of stabilization after setting all-time highs in 2022, vacancies will rise slightly from the record low levels seen in recent past quarters. We are also observing that for the first time in a long time, development is outpacing absorption, which is not a bad thing being that for so long demand outpaced supply which was the catalyst of the aggressive rise in pricing. It is notable that land is becoming harder to find. As a result, we will have increased developer competition for available sites, and subsequently upward pressure on land pricing. From a capital markets standpoint, we anticipate that sale transactions will remain low, and at similar levels as the second half of 2022.

Jerry Holdner is Avison Young Southern California Region Lead, Innovation & Insight, Avant

You must be logged in to post a comment.