Why Prime Urban Retail Corridors Are Thriving

One key factor: improved foot traffic driven by the performance of other property types.

Solid growth in consumer spending, a resurgence of tourism and the return of foot traffic to pre-pandemic levels in many prime retail corridors across the U.S. are among the key trends highlighted in JLL‘s brand-new city retail report for 2024.

Other central themes as we head into the new year include the dominance that apparel retailers have in prime corridors; the staying power of luxury retailers, among which numerous brands are absorbing space; and the extent to which rising office attendance and increasing hotel occupancy levels are undergirding urban retail growth.

READ ALSO: Retail Leasing’s Space Race

Examples of the prime retail corridors the report focuses on include Fifth Avenue in New York City, Michigan Avenue in Chicago, the Beverly Hills Triangle in Los Angeles and Newbury Street in Boston. All of these and roughly two dozen more in the U.S., plus another five in Canada, are characterized by mixes of high-street, national and international tenants.

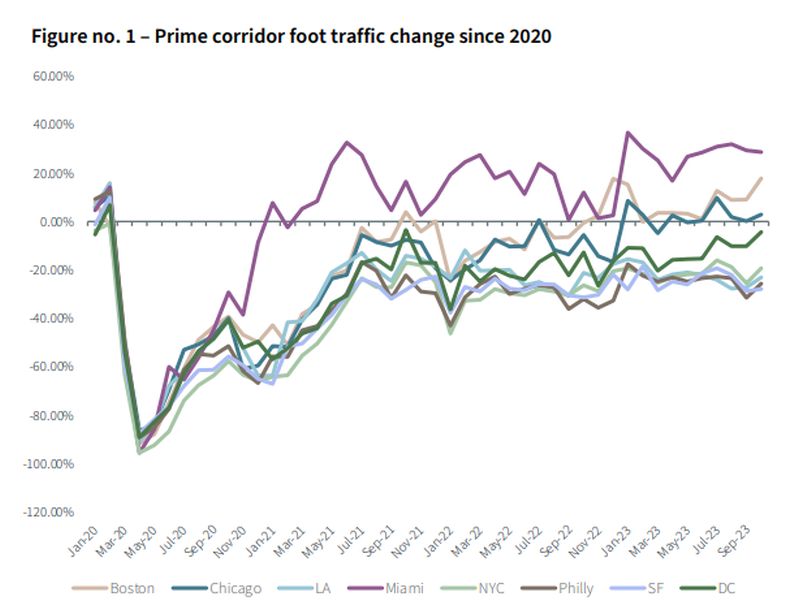

“In 2023, the trajectory of prime urban retail leasing has been closely tied to the performance of other property types. Office populations have surpassed 50 percent across all major metros, hotel occupancy is at pre-pandemic levels, and residential population outflows from major cities have stabilized,” JLL reports.

Diving a little bit into the main trends, the rebound in foot traffic results from “consumers’ persistent desire for in-person shopping experiences,” JLL says.

“Thanks to the combination of increased tourism, stabilized population outflows, and the gradual return of office workers to the CBD, half of the prime urban cities highlighted in this report have seen footfall completely recover as of October 2023,” the report states.

Adding to this is a boom in international tourism. Boston and New York City, for example, are seeing major surges in overseas visitors.

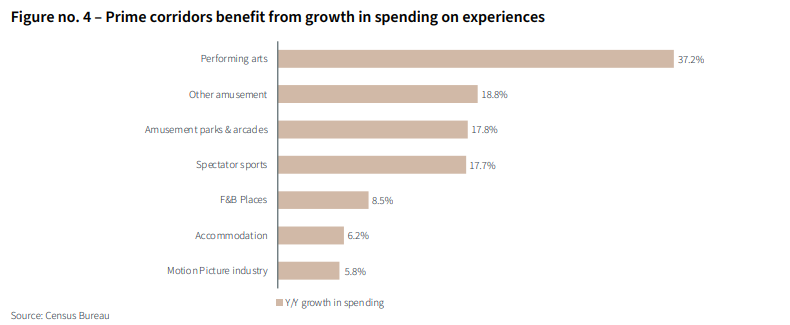

Prime corridors benefit from growth in spending on experiences. Chart by the Census Bureau, courtesy of JLL

Prime retail corridors are part of the experiential retail trend, with performing arts venues being a significant driver of consumer behavior. Spending on performing arts was up about 37 percent year-over-yer as of September.

The tenant side

In prime retail corridors, leasing by apparel retailers surged from 35 percent in 2022 to 48 percent in 2023. Athleisure has been the star among apparel retailers; chains such as Lululemon, ALO Yoga, Vuori and Hoka have all been expanding in upscale locations.

Luxury retailers in general have contributed to strong absorption in almost every corridor. These include Burberry, Bottega Veneta, Cartier, Dolce & Gabbana, Chloe, Longchamp and Anine Bing. Luxury boutiques have expanded into some of the space vacated by Barney’s and Neiman Marcus. Two of the most prominent are Kith and Kirna Zabete.

Jewelry retailer Breitling has opened two prime corridor stores recently, and Mejuri opened twice as many in the past year.

You must be logged in to post a comment.