Why Foreign CRE Investors Are Undeterred

Some property and location preferences are shifting, but the mainstay countries are staying in the game.

Despite high U.S. inflation and growing concerns about a recession, much of the world still sees the United States as a safe haven for investment.

Foreign investment in U.S. properties saw a steep decline in 2020, when many countries basically stood still. But it rebounded last year and continues to gain steam amid growing global tensions and a dimmer outlook for U.S. GDP growth.

“We saw a massive recovery in 2021,” said Aaron Jodka, director of research of U.S. capital markets at Colliers. “Foreign investment has returned to the U.S.”

Overall, foreign investment in CRE surged to $72.6 billion in 2021, nearly doubling the previous year’s figure. Foreign investment as a share of total U.S. sales volume, however, Jodka noted, is around 8 percent, or well behind the pace of 2014–18, when it averaged nearly 14 percent.

The second half of last year was particularly strong, and near-record investment volumes were seen during the fourth quarter, according to Riaz Cassum, executive managing director & global head of international capital for JLL. And while fundamentals continued to be strong in the beginning of the year, there has been a noticeable shift.

“The rising interest rate environment has been imposing near-term upward pressure on going-in yields,” Cassum said.

Will CRE Decline Significantly?

After the high volume of the previous quarter, foreign investment in U.S. CRE moderated during the first quarter of this year, according to Darin Mellott, CBRE’s senior director of capital markets research.

For historical perspective, he continued, the first quarter of 2022 was 38.1 percent below the first-quarter average for the five years prior to the pandemic. So, if volumes in 2021 were driven by strong economic growth that translated into CRE fundamentals that were attractive to investors, what changed?

“To understand foreign investment flows into the U.S. right now, you have to look at the value of the U.S. dollar and hedging costs, which have rocketed upward since the start of the year,” Mellott explained. “As a result, it’s more difficult for foreign investors to deploy capital in the U.S.”

Even given that, the U.S. is increasingly seen as a safe harbor.

“Dry powder from cross-border investors earmarked for U.S. commercial real estate remains historically high,” commented Cassum.

So, as market volatility subsides and investors get a clearer sense of inflation and Fed policy, foreign investment in U.S. properties should accelerate again. “We expect cross-border investors to continue to be active in the U.S. market,” he said.

The Association of Foreign Investors in Real Estate’s annual survey results backs that up. Three-quarters of AFIRE’s members (175 organizations in 23 countries) expect to increase their volume of investment activity this year. Most also anticipate boosting their U.S. real estate investment over the next three to five years.

AFIRE CEO Gunnar Branson cautioned, however, that the survey responses were given before Russia’s invasion of Ukraine. Investor concerns about geopolitical volatility are no doubt higher now.

CRE Markets Drawing Foreign Investors

The AFIRE survey—and the industry experts interviewed here—provide substantial insights on the places, properties and players central to the next wave of foreign investment.

Atlanta, Austin, and Boston are the top three cities cited for 2022 by investors, majorities of whom are also moving beyond traditional gateway metros and showing more interest in secondary markets (like Dallas, Denver and Seattle) and tertiary locations (such as Charlotte and Raleigh).

The flow of capital into non-gateway markets is expected to continue as investors target markets with the highest prospects for income growth. “Secondary growth markets, particularly in the Sun Belt, have captured a growing share of cross-border investment in 2020 and 2021,” Cassum said.

The report also adds that gateway cities are likely to maintain preferred status over the next decade, even though “investors largely agree that the pandemic has permanently altered cultural attitudes towards live-work preferences.”

Properties of Interest

Although there’s a reason for the stereotype of a foreign investor taking a 49 percent stake in a trophy downtown office building in a gateway city—and it’s not entirely invalid now—property types of interest too are evolving.

Respondents to the AFIRE survey overwhelmingly put multifamily at the top of the list of favored property types over the next three to five years (90 percent planned to increase their investment), followed by life sciences (77 percent planned to buy more) and industrial (75 percent planned to grow their holdings) properties.

These shifts, Cassim said, result from “cross-border investors becoming more knowledgeable about property types outside of the office sector” and are attracted to the secular drivers behind multifamily and industrial demand.

In the office sector, Jodka remarked, while the typical choice for foreign investors had been CBD office assets, it’s now closer to 50/50 CBD vs. suburban. This is in part for better diversification, he said, but it’s also because suburban properties are seeing a stronger return-to-office trend because the offices themselves are seen as safer and more spacious and often involve what office workers see as safer commutes.

But, while there will be some changes in appetite, the strategy will generally be the same. “Even as favored property types shift year-to-year, a focus on core remains as the prominent investment strategy for half of all investor strategies, while value-add activity could see a 62 percent increase in the next five years,” the report states.

CRE’s Most Active Foreign Investor

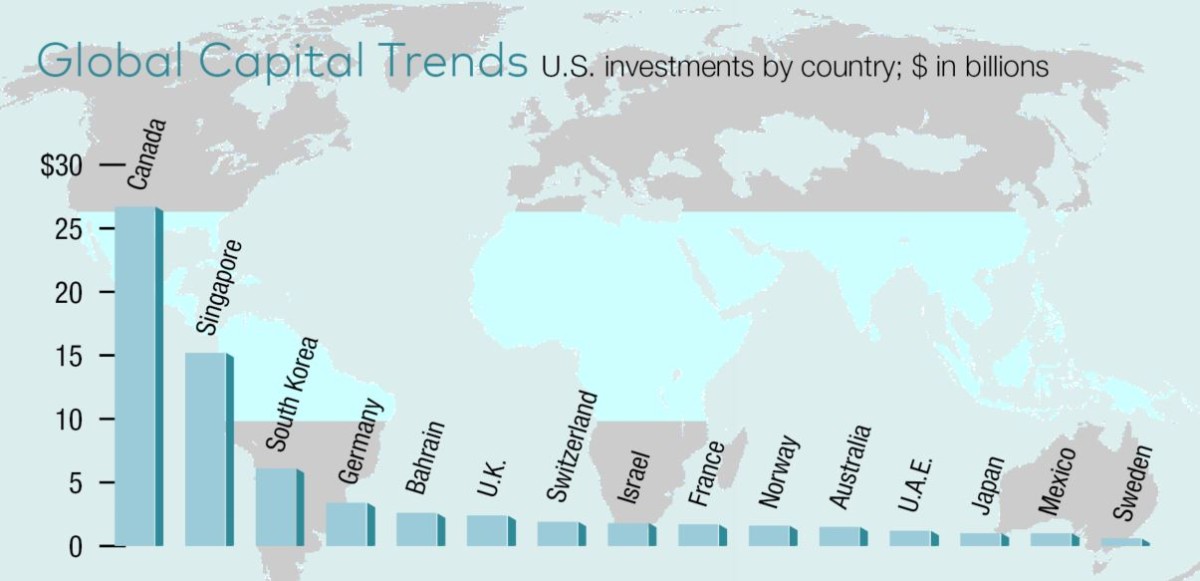

Who, exactly, will be doing all that investing is largely unchanged from the recent past. Canada remains the biggest investor in U.S. CRE, accounting for 37 percent of total foreign investment activity in the 12 months ending in the first quarter, or slightly higher than Asian capital sources over the same period, according to Jodka. It was followed by Singapore, South Korea, Germany and Bahrain.

Mellott, however, calls out a somewhat different top five: Canada, followed by Germany, Switzerland, Australia and Singapore.

Though there has been little change in the mix of countries, Cassum notes increasing activity by private investors deploying capital into the United States. These include high-net-worth family offices, as well as syndicators, including German open-ended funds like Union Investment, Deka and Commerz Real.

Will the U.S. Always Be a Safe Haven?

One of the reasons the United States is still considered a safe haven is its population growth, Jodka noted. “We have stronger demographics than many nations around the world,” he said. “At the end of the day, real estate is driven by people.”

Still, hazards remain, perhaps in part because of that growth. Jodka pointed to a presentation on “Climate Migration and Future Population Centers,” at the Urban Land Institute conference this past April. Author and futurist Dr. Parag Khanna cautioned that, given its latitude and thus its vulnerability to climate change, the United States is doing very little to mitigate that vulnerability.

So, especially for investors that measure their time frames in decades if not generations, the U.S. response to climate change could well be the next factor pulling foreign capital here—or scaring it away.

You must be logged in to post a comment.