Why CRE Investors Are Zooming In on Studios

These specialized properties are ready for their close-up.

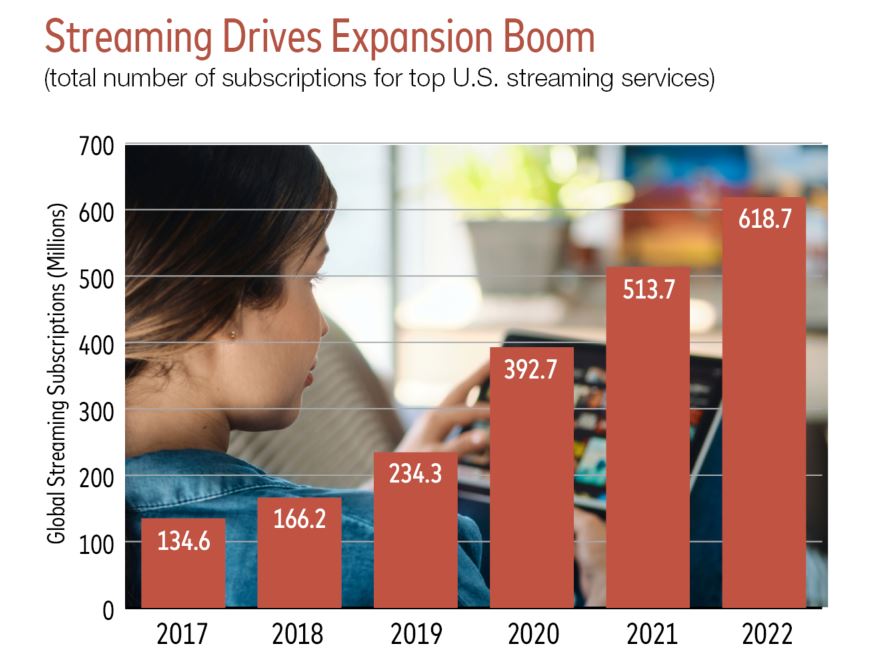

A new star is emerging on the commercial real estate scene. The up-and-coming headliner? Film and sound production studios. Soaring demand for content unleashed by the streaming wars is the big trend putting these specialized properties in the investment and development spotlight.

“Studio operators have increasingly sought out modern, high-quality spaces enabled with the technology for productions,” said Jacob Albers, head of alternative insights at Cushman & Wakefield. “This alignment between capital and media has led to major redevelopments of existing studios and large-scale new developments.”

Scripting incentives

Tax credits are among the biggest drivers of where the industry goes. “New Jersey just introduced its new tax incentive program last year, and then New York state increased its cap from $420 million to $700 million,” noted Anthony Jasenski, CBRE’s film studio practice leader for the Americas. Also on the radar: Buffalo, N.Y., and the state’s Hudson Valley. Philadelphia is also in the mix, said Jasenski, even though that metro isn’t yet ready to compete with the heavyweights.

According to the 2023 Tri-State Film & Television Report, published by CBRE Research in January 2024, leading states for film tax incentives are Connecticut and Georgia with no annual caps, California ($330 million cap), New Mexico ($110 million) and Texas ($45 million).

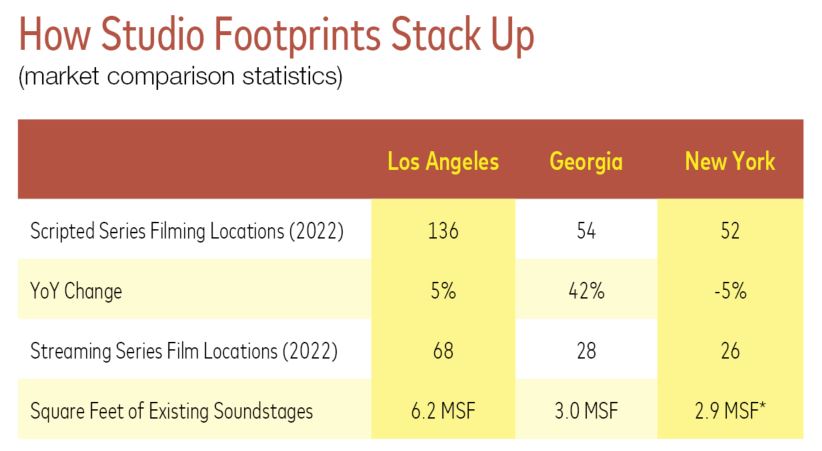

The traditional media capitals of New York City and Los Angeles are attracting plenty of attention, Albers said. When USAA and Square Mile Capital merged in 2023 as Affinius Capital, Square Mile brought its sprawling Radford Studio Center in Studio City, Calif., to the new firm. Square Mile had previously announced plans to spend more than $1 billion redeveloping the Radford Center campus, which it had acquired in 2021 for $1.9 billion in a joint venture with Hackman Capital Partners.

Blackstone and Hudson Pacific Properties are pursuing large-scale projects under the Sunset Studios banner. The largest is the $350 million Sunset Pier 94 Studios, a partnership with Vornado Realty Trust to develop a 266,000-square-foot studio on Manhattan’s Far West Side. (About 2,500 miles to the west, Blackstone and Hudson Pacific Properties are planning a 130,000-square-foot expansion of Sunset Las Palmas in Hollywood, incorporating four soundstages, Albers noted.)

The partners are also approaching completion on a 257,000-square-foot, seven-soundstage development, Sunset Glenoaks, in Shadow Hills, Calif., a community in the eastern San Fernando Valley. Meanwhile, East End Studios plans a 275,000-square-foot Queens, N.Y., studio space, on the strength of a $193 million loan originated by J.P. Morgan and Canyon Partners.

Production facilities are also generating a flurry of deals. Last September, Stockbridge Capital Group and Worthe Real Estate Group acquired Warner Bros. Studio Ranch in L.A. for $175 million. As part of a $500 million investment in the property, Stockbridge and Worthe will build 16 new soundstages, more than 300,000 square feet of office space and other facilities, which will be leased to Warner.

And in a $17 million deal, Cinespace Films Studios purchased sound stages in Atlanta and Wilmington, N.C., from EUE/Screen Gems Studio. Among other credits, Netflix’s Stranger Things was shot on these locations, Albers reported.

Upsides, downsides

Among the advantages of investing in studio assets is that they offer exposure to the media or content production side of the business. Previously, barriers to entry prevented gaining that exposure, Jasenski noted. Another plus is that the studio development pipeline shows no signs of outpacing the growing demand to produce new content, despite possible industry cutbacks.

Delivering specialized services can boost revenue, too. Production companies must hire catering services to feed the cast and crew, rent office space for script development and lease equipment. “When I was at NBCUniversal, it was seen as a one-stop shop,” said Sonnet Hui, vice president & general manager of Project Management Advisor. “You can rent costumes, have someone build the set, have it catered on site, rent all the lighting on site. The studio owner is making a profit on all these services they’re offering the production company.”

Lease structure is also reason to be circumspect. The typical 12-month deal exposes the owner to occupancy risk. “These are shorter-term rentals. There’s a lot of feast or famine,” Hui noted. “When you have it booked up, it’s great.” After buying Culver Studios in Culver City, Calif., a decade ago, Hackman Capital Partners made a major investment in the property and then signed Amazon to a 15-year lease. “But that doesn’t happen every day,” she added.

Another industry trend bears watching. As production dollars have shifted from theatrical releases to streaming, some streaming companies are racking up big losses. “Even Netflix is starting to retrench and relying more than ever on reruns,” said Glenn Brill, managing director at FTI Consulting.

Investment outlook

The actors’ and writers’ strikes, and more conservative budgeting, augur a substantial drop in output in 2024, Albers predicted. Despite these headwinds, production facilities will be in high demand. “Consolidation will lead to fewer, more well-capitalized tenants,” he said. “As film studios merge and fall under the umbrella of larger media conglomerates or tech companies, there will remain massive amounts of capital seeking to produce content over the next year.”

Another factor driving demand for studio space: the increasing technical sophistication of content, according to Hui. As an example, she cites The Mandalorian, a part of the Star Wars franchise that was filmed entirely at Manhattan Beach Studios. “That technology has gotten so much better, and it saves (the production) from having to go out on location or out of state.”

Jasenski’s outlook for 2024 is optimistic. New studio facilities will be delivered, but at the same time, the larger media companies will be competing to release attention-getting new content. “In the near term, I feel the market will reach equilibrium necessary for it to operate successfully,” he said.

You must be logged in to post a comment.