What Lies Ahead for Financial Markets and the Global Economy

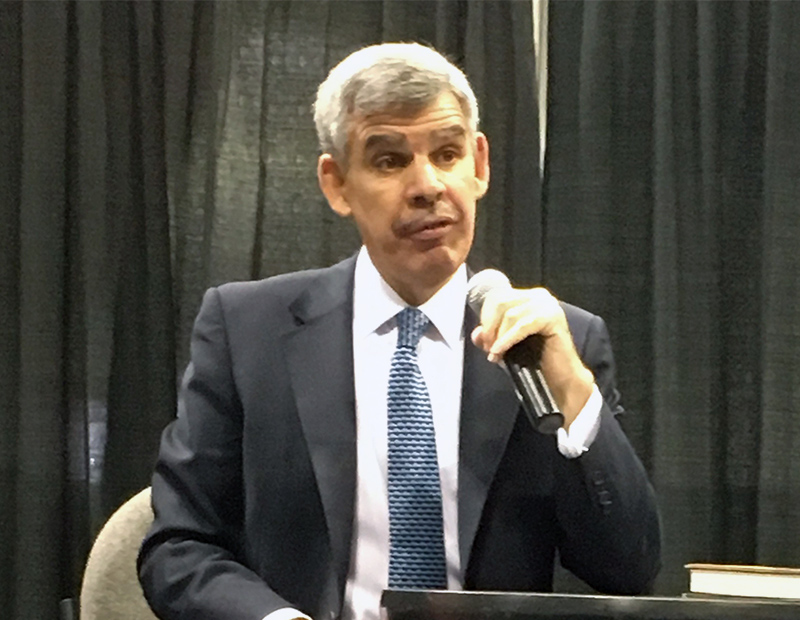

Mohamed El-Erian, chief economic advisor at Allianz, opened the recent 2017 MBA Annual Convention and Expo in Denver by outlining his views of the key issues to monitor in the short term as well as the long-term traits that will help guide firms through the next recession.

By Chris Nebenzahl

Mohamed El-Erian, chief economic advisor at Allianz and former CEO & Co-CIO of PIMCO, opened the recent 2017 MBA Annual Convention and Expo in Denver with his overview of what lies ahead for the domestic and global economies and financial markets. While not taking an overly optimistic nor pessimistic approach, El-Erian outlined his views of the key issues to monitor in the short term, as well as the long-term traits that will help guide firms through the next recession.

El-Erian urged his listeners not to worry about the often-discussed appointment of a new Fed Chair. While the identity of the next Fed Chair has drawn significant scrutiny and debate, El-Erian believes that the next 12 months of monetary policy has already been scripted, and a new Chair is very unlikely to deviate from the steady rate increases and the very slow unwinding of the balance sheet. Financial markets are very stable, and volatility is essentially non-existent, which is exactly what the Fed has tried to accomplish by their transparency in terms of telegraphing their moves to tighten monetary policy. As a result, stock prices have quickly and steadily increased, as have real estate markets in most of the country.

Filling Positions

According to El-Erian, it is not the next Fed Chair that will affect our economy, but rather the combination of the Fed Chair and Vice Chair, given Stanley Fisher’s recent departure. It is important for President Trump to appoint two people that complement one another in each of the two positions. Of the candidates currently being considered, El-Erian believes the right choice would be to pair an economist such as Jerome Powell or John Taylor with a more business oriented candidate such as Kevin Warsh or Gary Cohn. The combination will likely lead to the smoothest transition within the Fed.

Again deflecting the conversation away from the Fed, El-Erian stressed the importance of monetary policy in Europe and the actions of the European Central Bank (ECB) in the coming months as it too searches for a new leader. Mario Draghi has more than a year left in his term as president of the ECB, however the transition will be an important one to watch, especially given the rise in anti-establishment politics occurring throughout Europe. El-Erian noted, “It is challenging to normalize monetary policy in one country, let alone normalizing it in 19 different nations at once.”

The Future

Looking forward, how should financial market players prepare for an eventual downturn? According to El-Erian, there are two keys to handling the next phase of the economic cycle; be resilient and agile when making business decisions. As a result of new technologies, traditional economic measures such as inflation and productivity have lagged. Growth will be harder to achieve, and firms will be forced to make quick and flexible decisions in order to navigate through the next downturn.

One of the ways firms can get ahead is to maintain strong cognitive diversity, which El-Erian describes as the combination of racial diversity, ethnic diversity, gender diversity, socio-economic diversity and educational diversity. Bringing a rich mix of people together within an entity will help guide the organization through economic cycles. The current expansion has not had an equal impact on all demographics, but handling what lies ahead will require input from a variety of different types of people.

While the conversation remained mostly apolitical, El-Erian did acknowledge how today’s political climate is is affecting the economy. Financial markets have been bolstered by the prospect of faster growth and less regulation. The so-called “Trump Trade” pushed interest rates higher, strengthened the U.S. Dollar, and continues to push equity markets to all-time highs. The prospect of swift legislative change in Washington, has given way to a more muted reality as Congressional Republicans and the White House have differed on key policy issues thus far. According to El-Erian, if political tensions abate, and congress can pass a legislative package that promotes growth inclusive to everyone, then the potential for strong economic growth becomes a reality. However, if political divides remain, the results would lead to less reregulation, little meaningful tax reform, low growth, a continued hollowing of the middle class, and eventually a recession.

You must be logged in to post a comment.