Economy Watch: IMF Ups Forecast for 2017 Global Growth

Gains in infrastructure and trade support the IMF's prediction for greater global economic growth than previously expected. However, risks to the forecast remain, such as widespread protectionism and a withdrawal from multilateralism.

By Dees Stribling, Contributing Editor

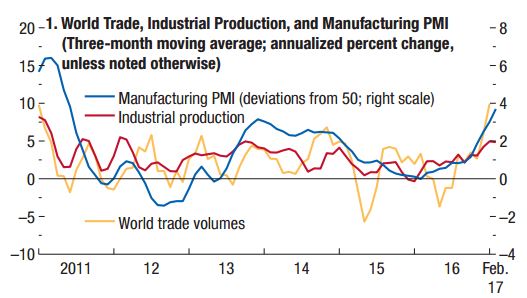

Global economic activity gained momentum in the fourth quarter of 2016. Manufacturing PMIs also increased in the last few months of 2016 and in early 2017. (Source: IMF World Economic Outlook, 2017)

The International Monetary Fund has tweaked its predictions for global economic growth in a positive direction. The organization now predicts that the world economy will grow at a pace of 3.5 percent in 2017, or 0.1 percent more than it predicted previously. Moreover, that’s up from 3.1 percent last year. The IMF also predicts growth of 3.6 percent in 2018. The acceleration will be broad based across advanced, emerging and low-income economies, building on gains seen in both manufacturing and trade.

Growth in the United States will be below the world average, coming in at 2.3 percent in 2017, after a considerably smaller 1.6 percent last year. That puts the U.S. ahead of the rest of the developed world. The euro zone will see 1.7 percent growth this year. Other growth estimates include the U.K. (2 percent), Canada (1.9 percent) and Japan (1.2 percent).

Whether the current momentum will be sustained remains a question mark, the IMF noted. A distinct set of threats in advanced economies stem from festering domestic political movements skeptical of international economic integration. That is, a resurgence in protectionism in the United States, Europe or other places.

“Broad withdrawal from multilateralism could lead to such self-inflicted wounds as widespread protectionism or a competitive race to the bottom in financial oversight—a struggle of each against all that would leave all countries worse off,” the report asserted. That would be the case no matter if damage to trade integration comes through stalling or wrecking multilateral rules-based systems for the governance of trade, regional arrangements such as the euro area or NAFTA, or globally agreed standards for financial regulation, such as the WTO.

You must be logged in to post a comment.