Walker & Dunlop Structures $120M for Miami Portfolio

Graham Cos.—which owns 1.2 million square feet of retail, industrial, office and multifamily space in Miami Lakes, Fla.—will use the proceeds to fund additional development projects in the area.

By Barbra Murray

Graham Cos. has recently obtained a $120 million loan for a 1.2 million-square-foot group of properties in Miami Lakes, Fla. Acting on behalf of the diversified company, commercial real estate services and finance company Walker & Dunlop structured the financing through a correspondent life lender, AIG.

The collection of high-quality Graham properties, referred to as the Graham Portfolio, consists of a range of property types, including retail, office, industrial, flex, multifamily and land lease assets.

Financing for the 29-property portfolio came in the form of a 15-year non-recourse loan with a fixed rate. The lending community responded well to the opportunity. “Thanks to the experienced ownership and the portfolio’s great performance, the Graham project received aggressive bids with flexible terms for the borrower,” Marty McGrogan, an assistant vice president with Walker & Dunlop, said in a prepared statement. McGrogan was accompanied on the transaction by colleagues Al Rex, a managing director, and Ariel Zucker, a senior analyst. Graham plans to use the proceeds from the loan to fund additional development projects at Miami Lakes.

A big little town

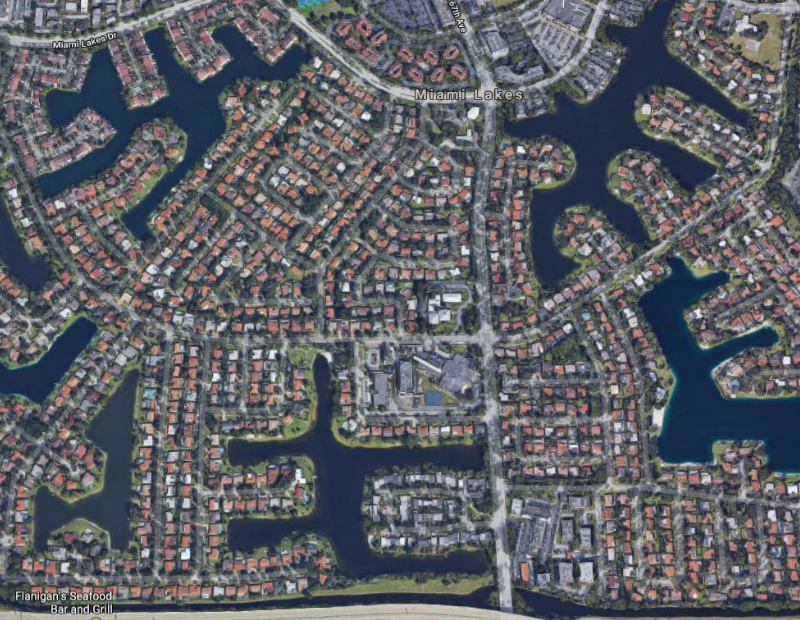

Sited roughly 20 miles outside of Miami, Miami Lakes was incorporated as Miami-Dade County municipality in 2000. Graham began developing the master planned community 50 years ago and today, the 3,000-acre locale is home to a mix of residential and commercial properties—including retail centers like the approximately 59,900-square-foot Red Palmetto Shoppes—spanning roughly seven miles.

Image via Google Maps

You must be logged in to post a comment.