Values Edge Prices—For Now?

By Ken Riggs, President, Situs RERC: What does the sense of the market suggest?

By Ken Riggs, President, Situs RERC

The sense of the market, which was reinforced by a recent article in The Wall Street Journal and by recent comments by the Federal Reserve, suggests that the huge increase in prices for investment property this year may be evidence of a bubble forming in the commercial real estate market.

It does not take much to become uneasy about prices outstripping values when looking at a few of the major commercial properties sold during the past few months that have made headlines—the sale of the Waldorf-Astoria hotel in New York for $1.95 billion, the sale of Chicago’s Willis (formerly Sears) Tower for $1.3 billion, or the sale of Seattle’s 79-story Columbia Center office building for $711 million. One can see why investors, as well as the Federal Open Market Committee, are concerned. “Valuation pressures in commercial real estate are rising as commercial property prices continue to increase rapidly, and underwriting standards at banks and in commercial mortgage-backed securities have been loosening,” Federal Reserve Chairwoman Janet Yellen stated during the FOMC’s semi-annual report to Congress.

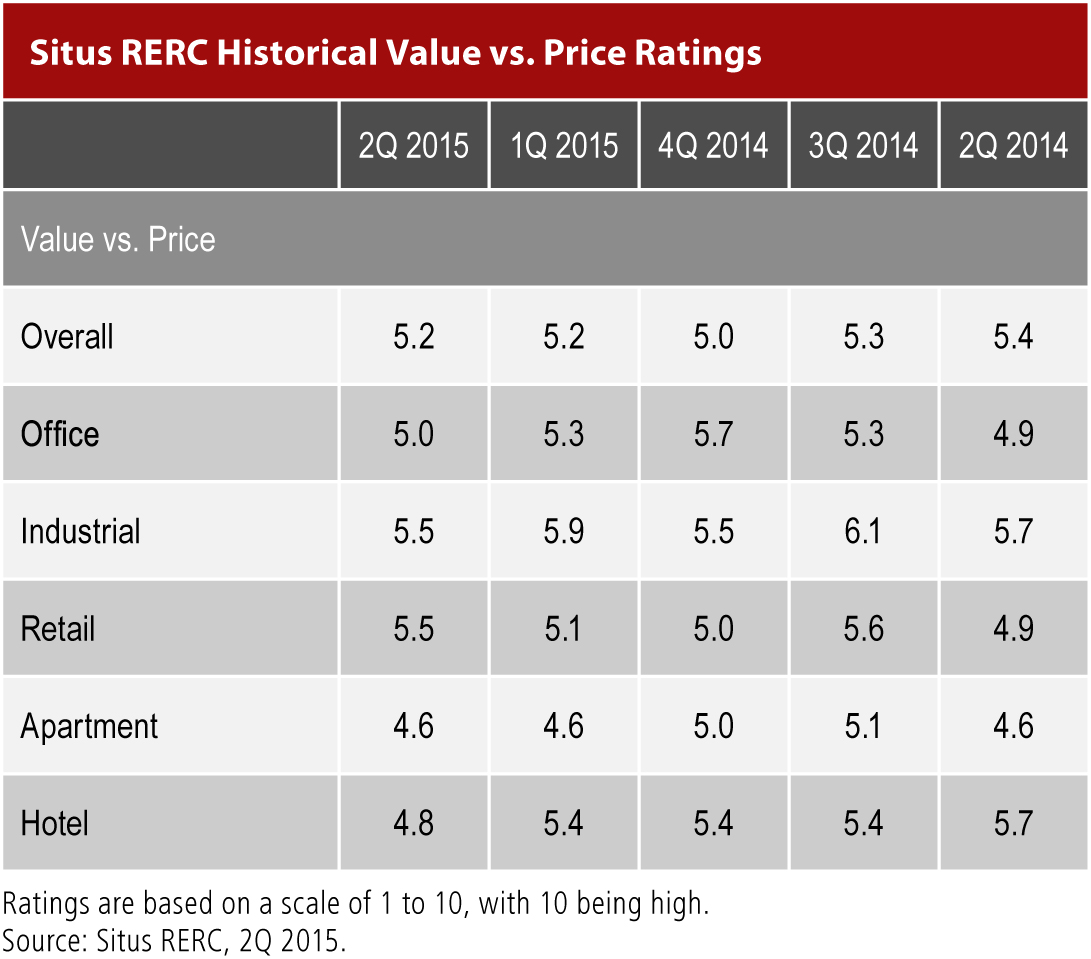

Although investors recognize that prices have outpaced values in some property sectors, this is not the case for CRE overall or in all property sectors. As shown in Situs RERC’s second quarter 2015 institutional investment survey ratings, the value vs. price rating for CRE overall was 5.2 on a scale of 1 to 10, with 10 representing excellent value compared to the price, and with 5.0 representing the midpoint of the scale. Clearly, investors believe there is value in CRE at present, although as shown in the table below, it was only two quarters ago that price had pushed value to such an extent that value and price were barely equal for this asset class.

That was the place that we found the office sector in the second quarter, with the value vs. price rating for the office sector at 5.0, indicating that the value of office properties was generally equal to the price. In addition, at 5.5, the ratings for the industrial and retail sectors indicate that the value for these property types were higher than the price, although we should note that the rating for the industrial sector declined to 5.5 from 5.9 in the previous quarter, while the rating for the retail sector as a fairly consistent cash flow generator increased. And for the apartment sector, whose value vs. price rating has been 4.6 for two consecutive quarters, price has already outpaced value. This is not surprising, given the growing supply pipeline for apartments. Finally, with some of the record prices we have seen for hotel properties, it is also not surprising that the rating for the hotel sector dipped to 4.8.

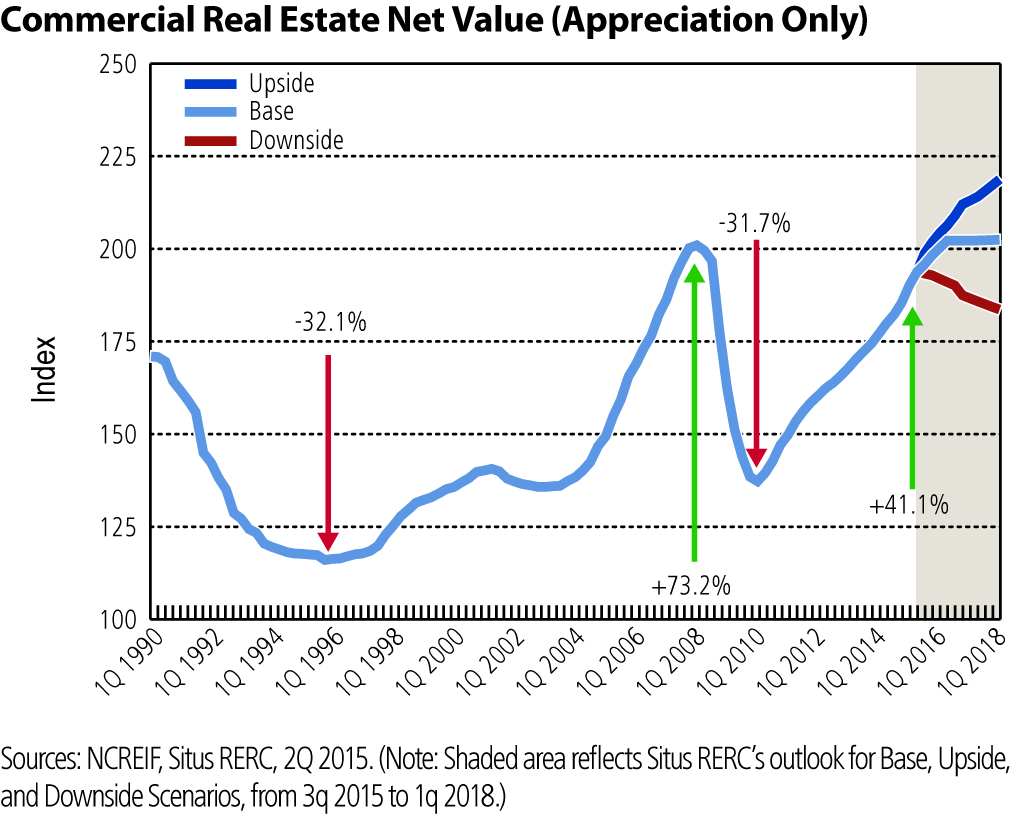

It is important to remember that on a net-value basis (appreciation only) returns remain relatively skimpy for this asset class. As shown below, CRE declined 32.1 percent in the 1990s, and by the time prices reached a new peak in first quarter 2008, value had increased 73.2 percent. However, the net value of CRE dropped 31.7 percent in the 2009 trough, while prices have increased 41.1 percent so far today. Even though the increases during the recoveries over the past 25 years appear significant on the graph and in comparison to their decline, the net value of CRE increased only 13.3 percent  from first quarter 1990 to present, and as of second quarter 2015, net values had not yet reached their previous peak.

from first quarter 1990 to present, and as of second quarter 2015, net values had not yet reached their previous peak.

Given how long we are into the cycle, it will not be a shock when prices again overtake values. But in view of this very low interest rate environment, we anticipate several more quarters or possibly up to a year that investors will be able to find value in this tangible and transparent asset class. Meanwhile, investors can enjoy minimal volatility, generally improving fundamentals, and a little more appreciation before the price of CRE exceeds its intrinsic value.

You must be logged in to post a comment.