US Property Deals Slumped, Price Growth Withered in Q4

2022 was the second-strongest year for sales on record, behind 2021.

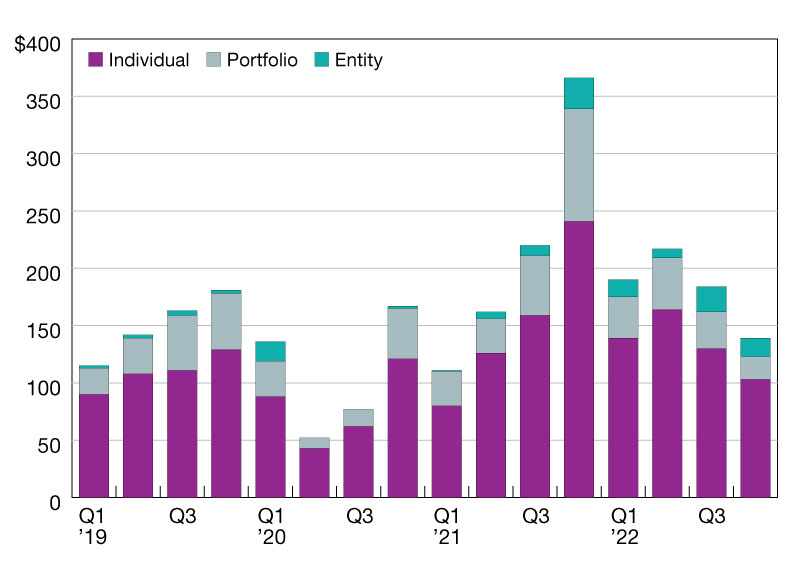

Sales of US commercial property and annual price change

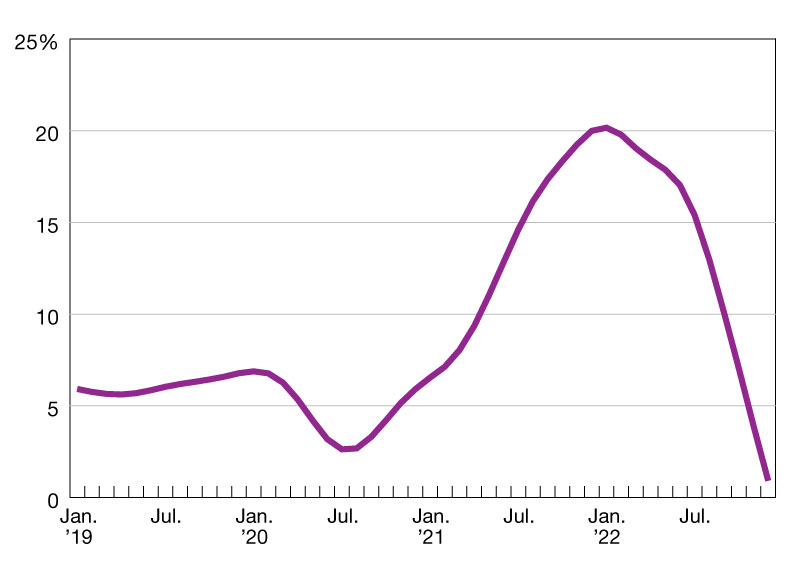

RCA CPPI National All-Property Index, Year-Over-Year Change

Transaction Volume ($b)

Sales of U.S. commercial property fell 62 percent from a year prior in the fourth quarter of 2022, and annual price growth decelerated to the slowest rate of gain since 2011. Still, for the year in total, 2022 was the second-strongest year for sales on record, behind 2021.

Trading of properties such as offices, apartment buildings and warehouses slowed over 2022 as investment conditions became more uncertain. The surprising leader in investment sales for the year was the retail sector, showing a 4 percent year-over-year increase. Deal volume in the office sector fell the most across the major property types, dropping 25 percent.

Prices under pressure

Annual growth in property pricing slowed further in December. The RCA CPPI National All-Property Index rose just 0.9 percent from a year ago, and compared to November, prices fell 1.2 percent. Prices began to decline on a monthly basis in September.

The apartment sector showed the greatest deceleration in price growth in 2022. The annual growth rate slowed to 1.8 percent in December, down from annual rates greater than 20 percent seen through the first half of the year. Prices for apartment assets dropped 1.9 percent in December from November, the largest monthly price decline across the property sectors.

Jim Costello is chief economist on the MSCI Real Assets team and is based in New York. He is the principal author of the US Capital Trends report series and a frequent speaker at commercial real estate conferences. At Real Capital Analytics, which MSCI acquired in 2021, Jim was a leader for analysis across the commercial property universe. Jim also spent two decades at Torto Wheaton Research working on issues of real estate risk and forecasting. He is a member of the Commercial Board of Governors of the Mortgage Bankers Association and a member of The Counselors of Real Estate.

You must be logged in to post a comment.