US Cities Dominate Real Estate Transparency Index

The country claimed six of the top 10 spots in the biannual JLL-LaSalle report.

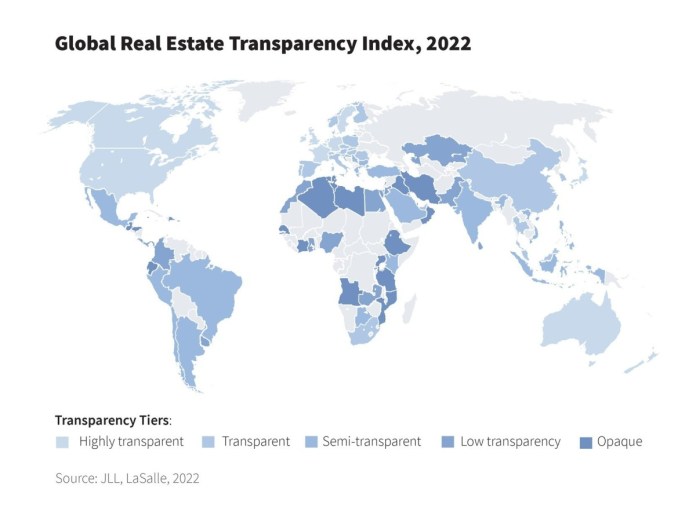

Across the globe, the leading commercial real estate markets continue to make strides in transparency, but smaller markets are struggling to maintain the pace of advancements, which has yielded one of the slowest rates of progress in the 23-year history of JLL and LaSalle’s Global Real Estate Transparency Index. North America, Western Europe and Australasia have been leading the way in the transparency race, with many U.S. markets ranking high at the city level in this year’s GRETI, which JLL and LaSalle publish every two years.

“This year’s survey reveals a widening gap between the most transparent countries and the rest,” Richard Bloxam, CEO of capital markets with JLL, wrote in the introduction to the report. “The highly transparent markets are forging ahead on the back of technology adoption, climate action, capital markets diversification and regulatory change. Meanwhile, many other markets are at best treading water, even regressing, or in some cases, regrettably disappearing completely off the radar.”

Of the 94 countries and territories assessed for the 12th edition of GRETI, the U.S. ranked as the second-most transparent in the world, with a composite score of 1.34; the U.K. came in first with a score of 1.25. Bolstered by local sustainability initiatives and deeper alternatives data coverage, the U.S. improved its score from the previous GRETI. Additionally, national measures, including the Corporate Transparency Act, have pushed the country forward.

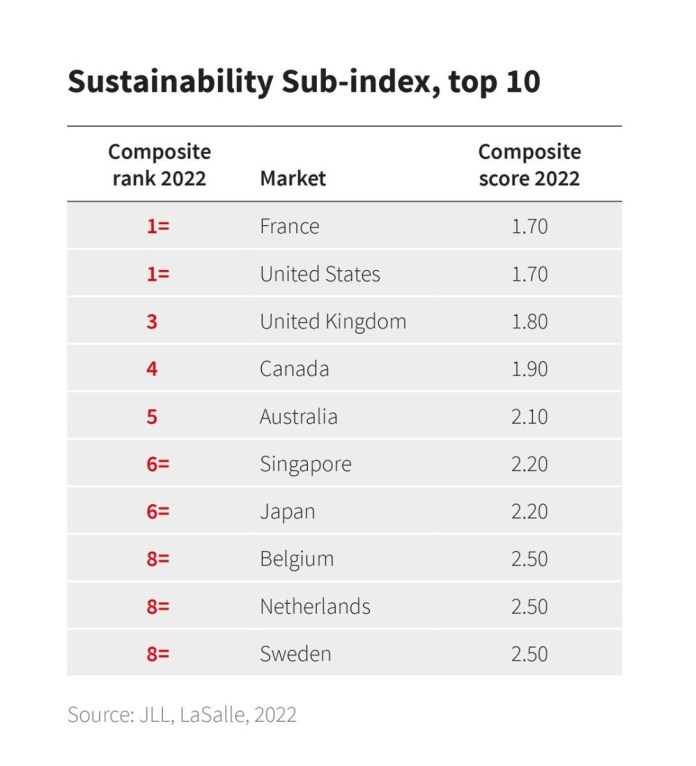

At the city level, the U.S. dominated the world, with six cities ranking in the top 10. New York, having implemented long-term building energy standards through such measures as Local Laws 84 and 97 and the Construction Codes Revision Bill, recorded the second-highest level of transparency, behind number-one London and tying Paris.

“With investors increasingly looking for clarity around sustainability commitments and standards, in addition to deep capital markets and extensive data coverage, these markets also have among the most ambitious and clear climate goals of any of the cities covered and all three also head the Sustainability Sub-Index,” according to the report. Washington, D.C., San Francisco, Boston, Los Angeles and Seattle ranked as the fourth- through eighth-most transparent cities in the world.

Global trends

It’s a new world for transparency in 2022 and one of the changes remarked on in the report is the fact that sustainability—and more specifically, the bid to achieve net zero emissions—has become the new marker for transparency. The number of countries and cities that are mandating energy efficiency and emissions standards for building is on the rise. Additionally, a growing percentage of building owners are embracing green and healthy building certifications.

The implementation of technology platforms in commercial real estate in the pandemic era has spurred an increase in transparency as well, offering such information as real-time occupancy levels and foot-traffic tracking. Furthermore, diversification has become a common thread among investors, as more institutional capital seeks out niche property types such as lab space and data centers, thus requiring new levels of transparency and information on operating and pricing fundamentals. As it stands, however, on the global level, more than 33 percent of markets lack reliable data on non-core property types.

The road ahead

Upcoming transparency issues will also place a greater focus on positive health and social outcomes, so ESG will take on greater importance for real estate companies. Cybersecurity and data protection are moving up the radar, as privacy risks become of increasing concern. Global alignment, however, will be of the utmost importance.

The report points to a great necessity for global synchronization of the transparency ecosystem across real estate markets, which would be a notable challenge considering there is no regulatory consistency even at the national level in the U.S. On the bright side, there are global initiatives in progress, such as the OSCRE Industry Model for building-level data standards, as well as the IFRS International Sustainability Standards Board on financial reporting.

We believe that a robust global benchmark is an essential tool for the real estate industry,” Bloxam wrote. “Transparency is the foundation which allows corporate occupiers, investors and lenders to operate and make decisions with confidence.”