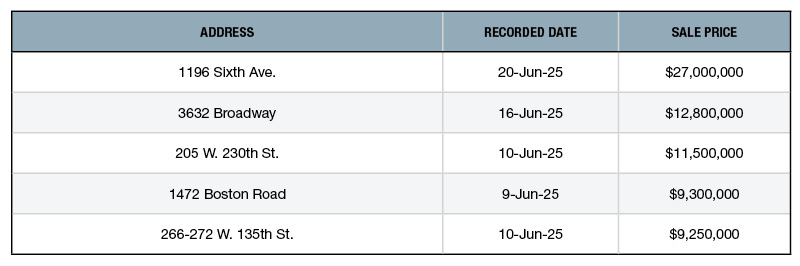

Top 5 NYC Retail Building Sales—June 2025

A roundup of recent major transactions put together by PropertyShark.

Sale Price: $27 million

A private entity linked to celebrity jeweler Avi Davidov acquired the 4,620-square-foot retail property in Central Midtown. The buyer is affiliated with Pristine Jewelers, located nearby on 47th St., and it is unclear if it will occupy the newly acquired property.

A private investor affiliated with 47th Street Diamond Exchange sold the property after owning it since the 1960s. The three-story Diamond District building dates back to 1930 and includes 18,480 square feet of unused air rights.

Sale Price: $12.8 million

CKMR Corp., formerly known as Sloan’s Supermarkets, sold the 9,540-square-foot property in Harlem to a private investor. The buyer also secured a $14 million loan provided by JPMorgan Chase.

Dating back to 1970, the single-story property includes 50,659 square feet of unused air rights and currently serves as a CTown Supermarkets location.

Sale Price: $11.5 million

Westbridge Realty Group purchased the 8,215-square-foot retail property in the borough’s Kingsbridge neighborhood from a private seller affiliated with the Ashkenazy family. The buyer secured a $11.5 million loan from a private lender.

There are plans filed for a 12-story residential building with 99 units at the site by Westorchard Management, according to Crain’s New York Business. It is unclear if the buyer, affiliated with developer Andrea Gjini, will move forward with the project. The property last changed ownership for 47 million in 2017, dates back to 1951 and includes 34,810 square feet of unused air rights.

Sale Price: $9.3 million

Civic Builders acquired the 17,281-square-foot, two-story retail building from a private seller. The property was built in 1925 and has been vacant during recent years.

Bold Charter appointed the company to redevelop the property into a new permanent school facility that will serve nearly 700 students. The project is expected to be delivered in 2027 and is backed by multiple tax exemptions and funding forms, including a $9.4 million loan from The New York City Regional Center and New Markets Tax Credits. Additionally, the project includes nearly $51 million in tax-exempt revenue bonds.

—Posted on July 29, 2025

You must be logged in to post a comment.