The View from the Peak: Winter is Coming

After a decade of economic expansion, prosperity continues. But tightening by the Federal Reserve is likely to weaken consumer and business buying power, thereby dampening growth, contends NAR's George Ratiu.

by George Ratiu

We closed the book on 2018 with an economy that posted the strongest rate of growth since the Great Recession. The economic expansion has been moving toward its 10th-year anniversary, benefiting from solid consumer confidence, low unemployment and excess capital. At the start of 2019, the mood is celebratory and optimistic. Yet, clouds are gathering on the economic horizon, foretelling of an upcoming change in seasons.

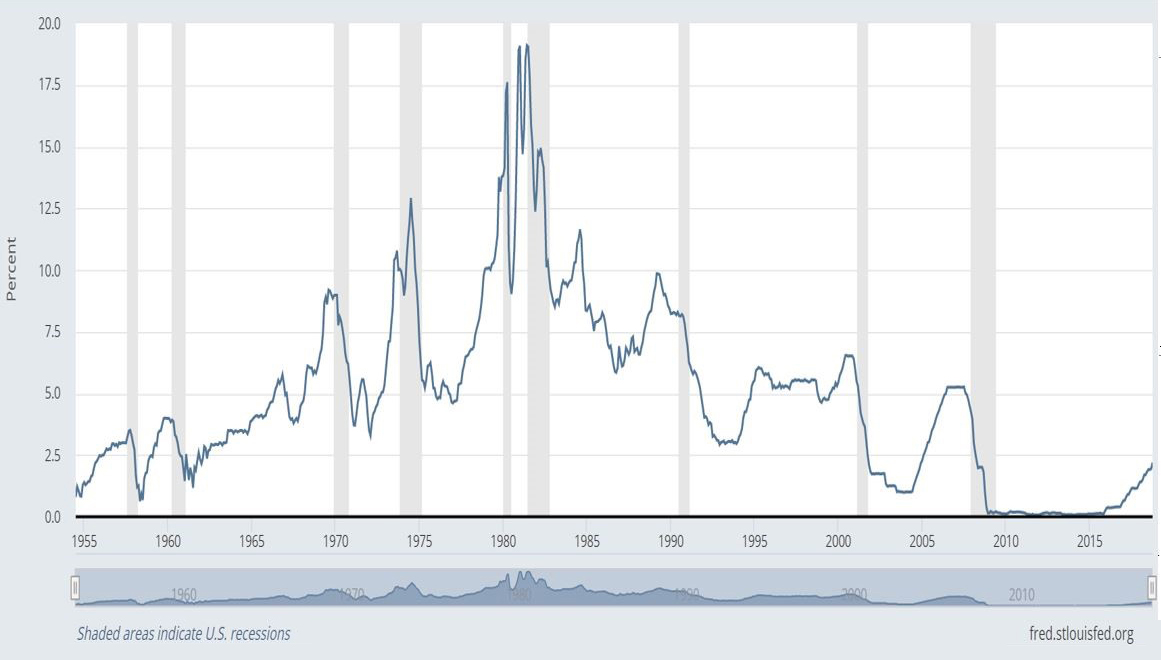

The seeds for the 2018 economic performance were sowed in 2008-09, when the Federal Reserve resorted to the unprecedented move of setting the short-term funds rate near the zero lower bound. The initial goal was to fund and stabilize banks on the brink of collapse in the wake of the Great Financial Crisis. The economy was further fueled by the ensuing years during which the funds rate remained near zero, as the central bank’s initial goal was expanded. The Fed maintained the cost of funds at historic lows to encourage bank lending to corporate entities and consumers, in a bid to stimulate investment and consumption, and elevate economic output.

The broad expansion of the money supply and credit led to an economic expansion which, barring unforeseen shocks, is expected to be the longest in United States history going back to at least 1850. Real gross domestic product clocked an average annual rate of growth of 2.2 percent during the 2010-17 period. Based on data from the first three quarters, combined with broad expectations of growth in the last quarter, GDP for 2018 was projected to post a solid 3.1 percent annual gain.

Lag in Wages

As monetary policy expanded available credit, consumers responded with higher spending. Personal consumption expenditures comprise 70 percent of GDP and provide the wind in the sails of economic expansions. During the 2010-18 cycle, consumers have increased their spending on goods and services by an average of 2.3 percent a year. Spending on durable goods—cars and light trucks, furniture and appliances, recreational vehicles—has seen particularly strong growth, with consumers spending an average 6.2 percent more each year during the recovery.

Consumer spending and a larger money supply filled corporate coffers, yielding record profits. As of the third quarter of 2018, real corporate profits after tax reached a total of $1.9 trillion. With increased demand and profitability, companies responded by increasing production and expanding the employment base. Following the massive 8.6 million job loss of the Great Recession, businesses hired new employees to the tune of 2.2 million per year over the past nine years, leading to a total of 20 million net new jobs. The unemployment rate dropped to 3.7 percent in 2018, a level not seen since 1969. However, companies remained cautious in their outlook, as evidenced by the significant level of cash on corporate balance sheets, still exceeding $2.0 trillion as of the latest available data.

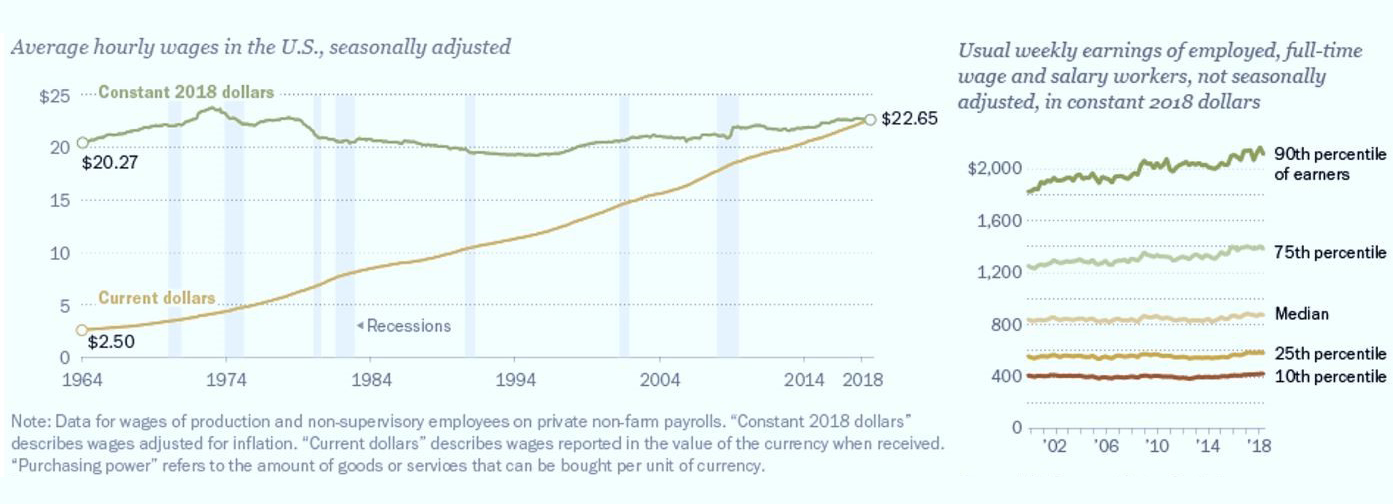

Despite a growing economy, strong employment growth and low unemployment, one important part of the economy has not benefited as expected from the expanded monetary policy—real consumer wages have seen meager gains. Based on analysis by the Pew Research Center, while paychecks were larger in 2018 than prior decades, when adjusted for inflation, consumers’ purchasing power was at the same level as in 1978. In addition, most of the gains have flowed to the top-tier earners over the past couple of decades.

Moreover, the share of Americans who have experienced no wage growth remained elevated. In 2018, close to 14 percent of workers did not receive a pay raise. In comparison, the share of employees with no wage gains was close to 10 percent in 1998 and reached over 16 percent during the Great Recession.

Compounding slow growing wages, housing costs outpaced earnings during the 2010-18 period. The median home price in the third quarter of 2010 was $169,867, based on data from the National Association of REALTORS®. By the end of the third quarter of 2018, the median home was priced at $263,933, a 55 percent increase. And with mortgage rates closing on the 5.0 percent mark during 2018, the NAR Housing Affordability Index declined to 146.7 at the end of September, a level similar to that of 2008-09.

As the economy advanced and inflation crossed the 2.0-percent threshold, the Federal Reserve moved toward tightening its monetary policy. Starting in December of 2015, the Fed has steadily increased the funds target rate, 25 basis points at a time. While Fed Chairman Powell moderated expectations for the number of rate increases in 2019, he left the door securely open to a continuation of the current monetary policy.

Economic Outlook

Writing at the dawn of a new year, the celebratory mood lingers, casting a luminous glow over economic expectations for 2019. Against a backdrop of slowing global economic gains, the U.S. economy is expected to remain on an upward trend, with GDP projected to post a 2.5 percent annual increase for the year.

But as the Federal Reserve continues to tighten the monetary stimulus, the era of cheap money has come to an end. With banks facing a higher cost of funds, companies and consumers also face a higher cost of borrowing. With rising inflation squeezing the purchasing power of consumers facing declining housing affordability, spending will moderate.

Viewed from a longer, historical perspective, we are likely standing on the latest economic peak. Assuming that the economy reaches the midpoint of 2019 with continued growth, we can throw a memorable party for the longest economic expansion in U.S. history. However, as the former Fed Chairman Paul Volcker stated: “About every 10 years, we have the biggest crisis in 50 years.” For the economic outlook, I will borrow the motto of House Stark from the Game of Thrones television series: “Winter is Coming.” Now is the time to prepare.

George Ratiu is the director of Quantitative & Commercial Research for the National Association of Realtors.

You’ll find more on this topic in the CPE-MHN Guide to 2019.

You must be logged in to post a comment.