The Latest on Rent Growth

The apartment rent picture reflects strength, but …

By Scott Baltic, Contributing Editor

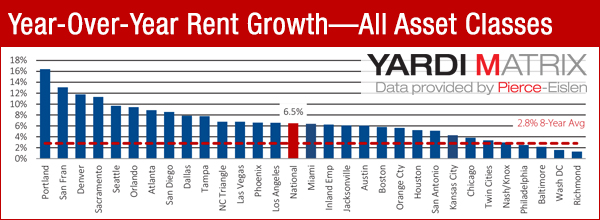

U.S. multi-family rent growth remains strong, with average nationwide rents rising by $7 in August to a record-high $1,162, according to the August edition of Matrix Monthly, a report on U.S. multi-family market trends from Yardi that was released Monday. The increase matched the 6.5 percent year-over-year increase in July.

Such good news for landlords might not necessarily last too much longer, however. While the report notes that nothing in the raw data collected by the Yardi Matrix business unit (formerly Pierce-Eislen) indicates major trouble for multi-family fundamentals, the recent volatility of the financial markets does warrant some caution.

“Multi-family rent growth in the U.S. remains exceptionally strong, but the stock market volatility is a warning sign that above-trend increases are not likely to continue,” Paul Fiorilla, associate director of research at Yardi, told Commercial Property Executive. “Even though the drop in equity prices was caused by outside factors — such as slower growth and currency devaluation in China, and worries that U.S. stocks were overvalued after a long bull run — recent history has shown that exogenous events can impact commercial real estate.

“The multi-family market is positioned well, with historically low vacancy rates and favorable demographic trends that are likely to keep producing strong demand over the next couple of years” he added. “However, with global conditions that portend slower growth going forward, market players need to be careful and temper expectations.”

Though most apartment markets remain in their same relative positions as to rent growth, those in Texas, including Dallas, Houston, Austin and San Antonio, have seen slower growth and could be facing weaker job growth. The report notes that falling crude oil prices, which are near six-year lows, look “likely to remain low for at least the rest of the year.”

Overall, the report commented, “The demographic and demand trends that have produced historically low apartment vacancy rates will not be easily turned around.”

You must be logged in to post a comment.