The Growing Trend Toward Investing in Alternative Real Estate

Affinius Capital's Karen Martinus examines the pros and cons of alternative property sector investment.

In recent years, the real estate industry has undergone significant transformations driven by evolving economic conditions, demographic shifts, technological advancements and changing consumer preferences. One of the most notable trends is the rise of alternative real estate strategies, which encompass various non-traditional sectors. These strategies have gained traction as investors and lenders seek diversification, higher returns and resilience in an increasingly dynamic market landscape.

The emergence of alternative real estate sectors

Growing investor interest in alternative property types is driven by both the recent underperformance of several traditional real estate sectors and the strong demand for alternatives like senior housing, data centers and self-storage. Long-term structural trends—such as demographic shifts, e-commerce expansion, persistent housing shortages and technological advances—have favored alternative sectors over certain office and retail segments. While traditional sectors remain fundamental to the industry, alternative real estate segments have expanded rapidly, offering new opportunities for investors:

- According to NCRIEF, alternative assets make up less than 10 percent of institutional investors’ commercial real estate portfolios, but they constitute a significant share of the broader investable universe and have long been a core component of the listed REIT sector.

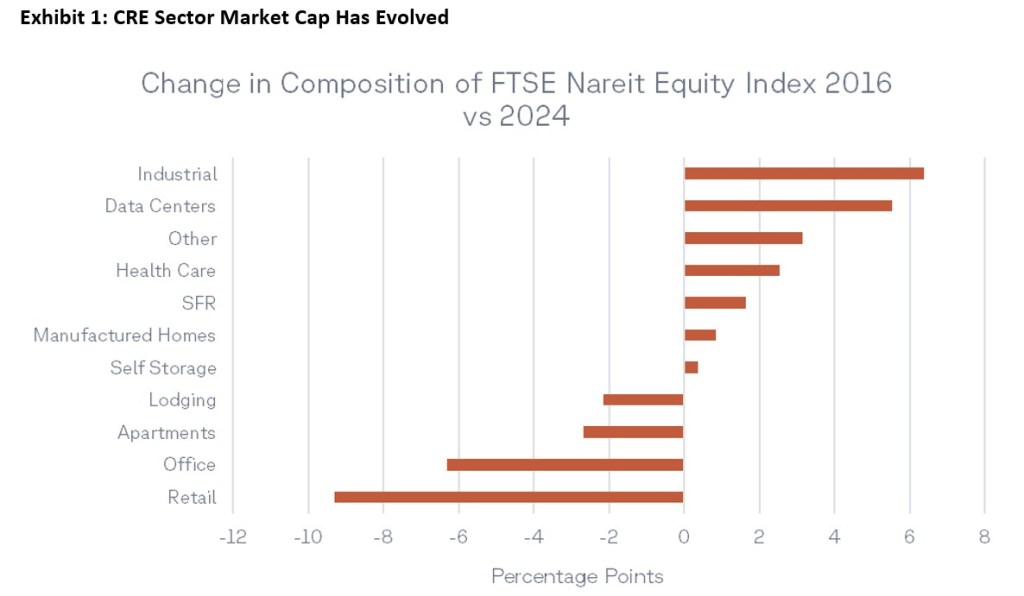

- Outside of the traditional CRE sectors (retail, apartments, office, lodging and industrial) and the “other” sector, alternative sectors have grown their presence in the FTSE Nareit All Equity Index—from 24 percent in 2016 to 34 percent in 2024 (Exhibit 1).

Structural tailwinds advancing alternative investment

Several key drivers have contributed to the growth of these sectors. The digital revolution has created substantial demand for data centers, which support cloud computing and the exponential growth of online services.

- Hyperscalers are driving the surge in demand for data centers. As of 2024, cloud revenues for the big three were still growing at an impressive annual rate of 22 percent, and since 2016 the compound growth rate has been a staggering 27 percent.

- Both AWS and Microsoft have crossed the $100 billion global annual revenue run rate just from their cloud businesses.

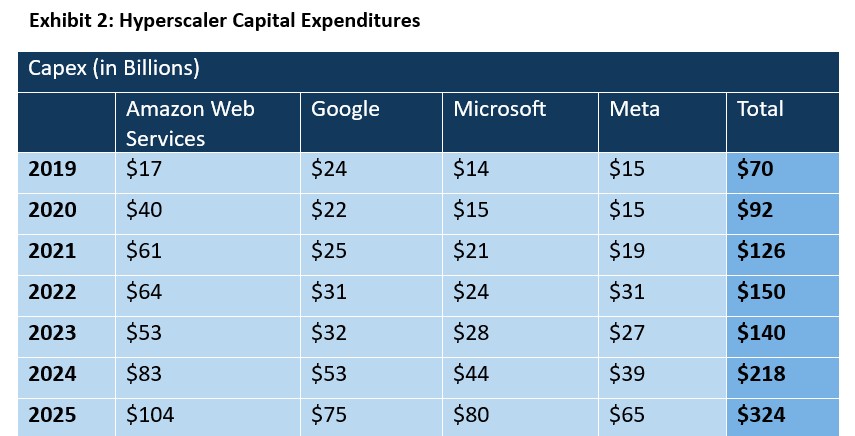

- Capital expenditures by hyperscalers have surged in recent years (Exhibit 2), primarily to expand digital infrastructure. Spending more than doubled in the past two years and projects point to further increases throughout 2025.

The apartment sector, once considered an alternative asset class, has now firmly established itself in the mainstream. However, the sector continues to evolve, expanding into specialized subsegments such as senior housing, student housing and single-family rental (SFR). These property types are gaining visibility and accessibility, offering investors opportunities for portfolio diversification and growth. According to Green Street, the growth in 80+ year olds is expected to remain above 3 percent between now and 2030, which suggests a sustained runway of demand for senior housing. Similarly, it predicts roughly 1.9 million new households will rent single-family homes in the next five years. Despite this increasing diversification, multifamily remains the most preferred asset class for commercial real estate investors in 2025, thanks to its strong fundamentals and sustained demand, according to CBRE.

- Household formation is projected to climb by an additional 1.2 million new households annually through 2030, a 30 percent increase from the past seven years, according to Moody’s.

- Single-person households are the fastest-growing segment of the population and now comprise 30 percent of all U.S. households (U.S. Census Bureau). This demographic increasingly prefers multifamily living for affordability and community.

READ MORE: Beating the Dutch Auction Fallacy

Demographic changes and the rising cost of homeownership have also spurred demand for different forms of rental housing, such as SFR. Institutions continue to expand their presence in the SFR space; however, the sector remains fragmented. According to Green Street, institutions own some 5 percent of total SFR stock, with individual owners of one to two homes representing the majority of landlords.

-

- With the average cost of homeownership, a record 82 percent higher-than-average apartment rents as of Q4 2024, many U.S. households continue to rent rather than buy a home. This is more than double the post-2000 average of 34 percent (Bloomberg).

-

- Even if mortgage interest rates decline, the spread is likely to remain elevated, as modest rate reductions are unlikely to offset the benefit of historically low fixed-rate loans.

-

- According to CBRE, nearly 80 percent of all current homeowners have mortgage rates below 5 percent and will remain reluctant to sell in an ongoing high-interest-rate environment. This will make homeownership even more difficult for renters.

Shifts in financing strategies

Alternative assets are typically more operational in nature, meaning there is a strong correlation between return to the asset owner and the underlying operational performance of the operator or occupant. This typically entails a different risk-return profile (operational, financial or both) when compared to traditional investments, although traditional sectors are also becoming more operational in nature.

The evolution of financial structures has enabled access to these markets with varying levels of exposure and risk. Such investments may be accessed via a variety of structures, including, but not limited to, operational services agreements, strategic partnerships, joint venture arrangements or taking an equity stake in an operating business. This type of collaboration can help investors share risk, pool resources and unlock larger or more lucrative opportunities.

Karen Martinus is senior vice president of research & investments for Affinius Capital.

You must be logged in to post a comment.