Structural Features Boost REIT Long-Term Performance

These companies' efficient, low-cost structure, as well as successful alignment of management incentives with shareholders’ interests, continues to provide tailwinds to the sector, according to Nareit Senior Vice President of Research & Economic Analysis Calvin Schnure.

By Calvin Schnure

Calvin Schnure

It’s pretty well known that REITs have enjoyed strong performance over the past 25 years, despite short-term zigs and zags along the way. What is less well known are the structural features that help deliver this performance. With the adage that past performance doesn’t guarantee future returns in mind, let’s examine two of these features, as they may continue to be a tailwind for REITs.

First, REITs are an efficient, low-cost structure for managing commercial real estate, and second, most REITs align management incentives closely with shareholders’ interests, motivating them to maximize value for the shareholders.

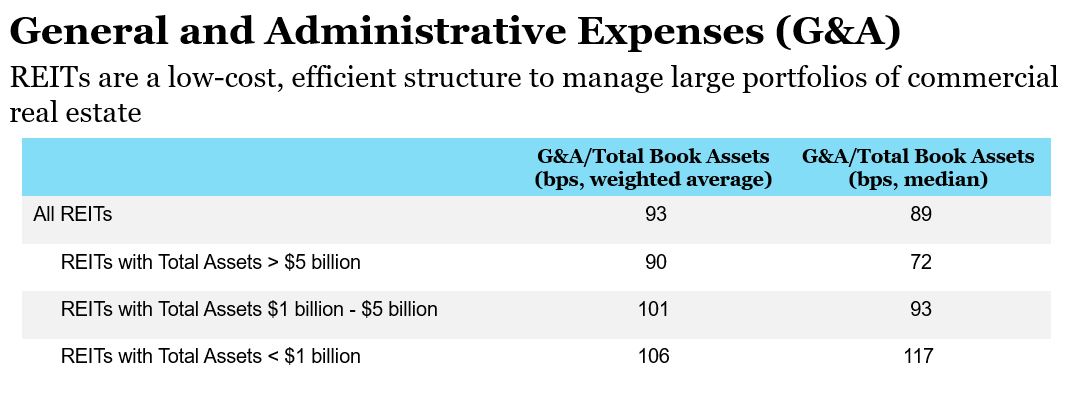

The general and administrative expenses (G&A) of owning and operating a portfolio of commercial buildings were less than one percent of total book assets for the typical REIT in 2017. This is a bargain, as compared to fees charged under the private equity real estate “2 & 20” model. Managers of these funds typically take fees of up to two percent of assets under management (AUM), plus an incentive based on performance—often 20 percent of the return above a hurdle rate.

Sources: Company reports, S&P Global Market Intelligence, Nareit

That is, private equity real estate funds charge two to three times what REITs require to manage the same types of properties. These cost savings of two percent of assets boost returns for REIT investors.

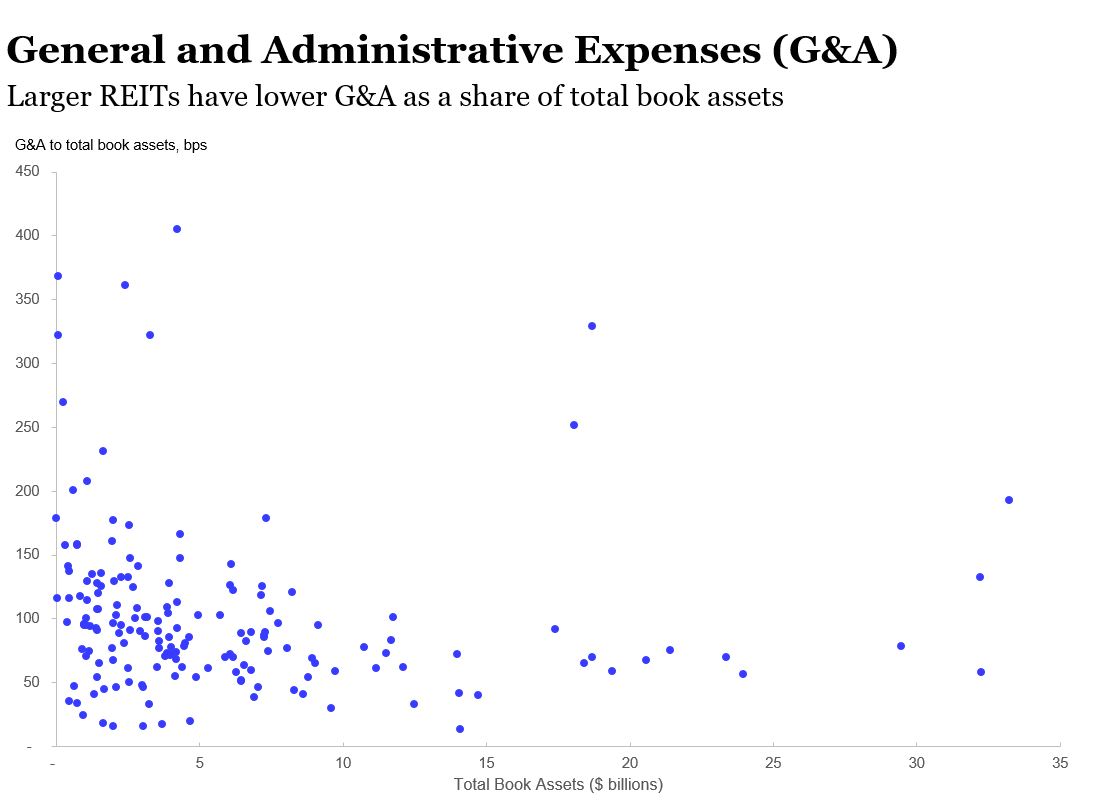

REITs also achieve significant economies of scale. Among REITs with book assets over $5 billion, the median G&A charges were 72 basis points of total assets, as compared to nearly 120 bps for the median REIT with assets below $1 billion.

Sources: Company reports, S&P Global Market Intelligence, Nareit

The second feature favoring REITs is an incentive structure that motivates management to pursue investors’ interests. Consider first the private equity “2 & 20” model. Managers receive 2 percent of AUM, but only if they actually deploy investors’ capital by buying properties. What if a fund raises money but has concerns that property values are overheating? The fund managers could hold the money in cash until they believe property values were more reasonable. But then they don’t get paid! Alternatively, they could buy properties despite concerns about overpaying. This creates the risk that private equity real estate fund managers pay top dollar to buy at the peak of the market.

The “2 & 20” model has another potential conflict between the interests of managers and the investors in the fund. Management gets 20 percent of the upside over the hurdle rate, but don’t lose out for declines below the hurdle rate. This “heads-I-win, tails-you-lose” compensation may lead to excessive risk in the fund investments, as fund managers get a chunk of the upside but investors lose if the gamble doesn’t work out.

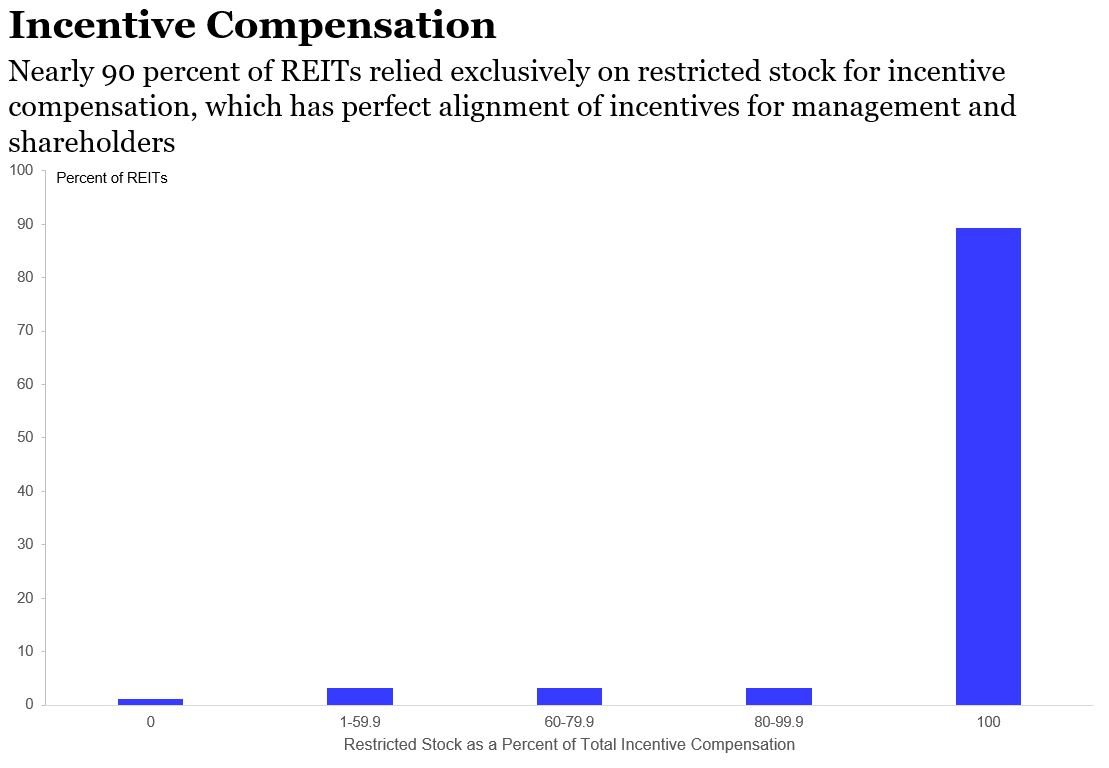

Most REITs do not suffer from these types of conflicts between management and investors because they offer compensation that aligns the interests of management with investors. Instead of pay packages based on AUM or offering stock options—which have the same “heads-I-win, tails-you-lose” incentive for choosing riskier investments as the “2 & 20” model—most REITs offer shares in the company to the CEO and management team. Management thus gets the same payoff as outside investors and is motivated to act in their best interests. These stock grants typically must be held for several years, keeping management in the game for the long haul.

Sources: Company reports, S&P Global Market Intelligence, Nareit

Nearly 90 percent of REITs provide incentive compensation to management exclusively through restricted stock (the right bar in the final chart). This ensures that management acts in the best interests of investors. Efficient management and alignment of incentives are features boosting the long-term performance of REITs.

You must be logged in to post a comment.