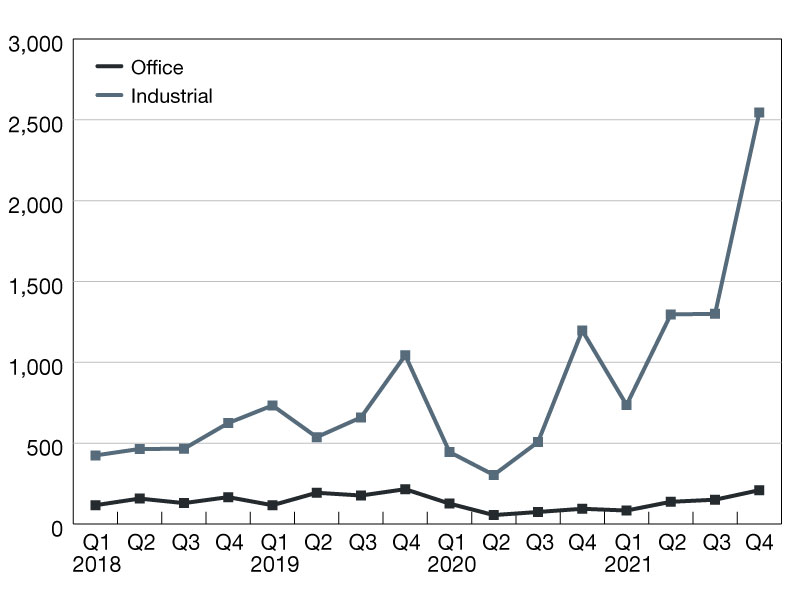

Strong Office, Industrial Originations

Loan originations took a remarkable jump during the fourth quarter, according to MBA’s latest report.

$ in billions

The fourth quarter of 2021 saw a remarkable increase in commercial borrowing and lending.

Loan originations were 79 percent higher in the final three months of the year compared to fourth quarter 2020, and increased 44 percent from the third quarter of 2021. This is according to the Mortgage Bankers Association’s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Commercial real estate lending volumes are closely tied to the values of the underlying properties. In 2021 those values rose by more than 20 percent, and those increases will fuel further demand for mortgage debt in the coming years. Continued increases in property incomes, and stability in the ways investors value those incomes, should also support solid demand for mortgage capital, even in the face of modest increases in interest rates.

Increases in originations for office and industrial properties led the overall jump in commercial lending volumes when compared to the fourth quarter of 2020. The increase was 122 percent and 113 percent, respectively.

2021 was a remarkable year for commercial real estate markets and MBA expects 2022 to continue that momentum. Total mortgage borrowing and lending is expected to break $1 trillion for the first time in 2022, a 13 percent increase from 2021’s estimated volume of $900 billion.

Jamie Woodwell is the Mortgage Bankers Association’s vice president of commercial real estate research.

You must be logged in to post a comment.