Street Retail Surges Toward Full Recovery

A return to pre-pandemic foot traffic levels is expected, according to CBRE’s latest report.

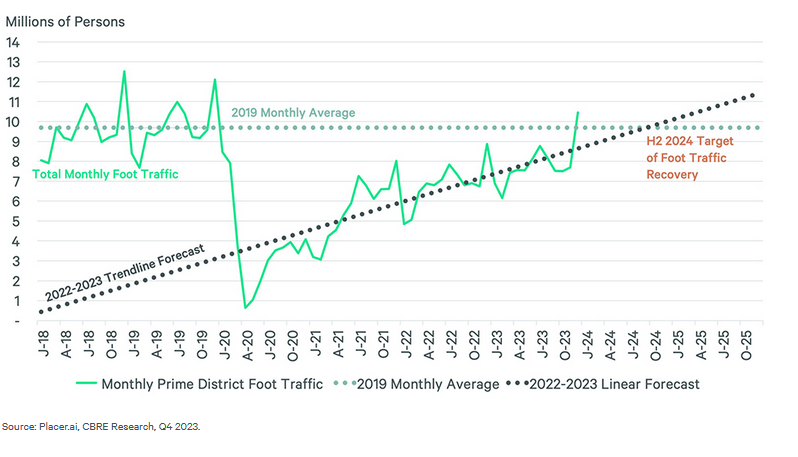

Despite the pandemic’s serious disruption of prime retail districts across the U.S., not only has a strong recovery of street retail been underway for a few years now, but it’s on pace to fully recover by the third quarter and even to surpass pre-pandemic levels by the end of 2025.

That’s the verdict of a new report from CBRE, aptly titled Reports of Street Retail’s Demise Are Greatly Exaggerated.

By the fourth quarter of 2023, the report states, foot traffic in 10 prime trade areas tracked by placer.ai had reached 81 percent of 2019’s levels, demonstrating a significant recovery.

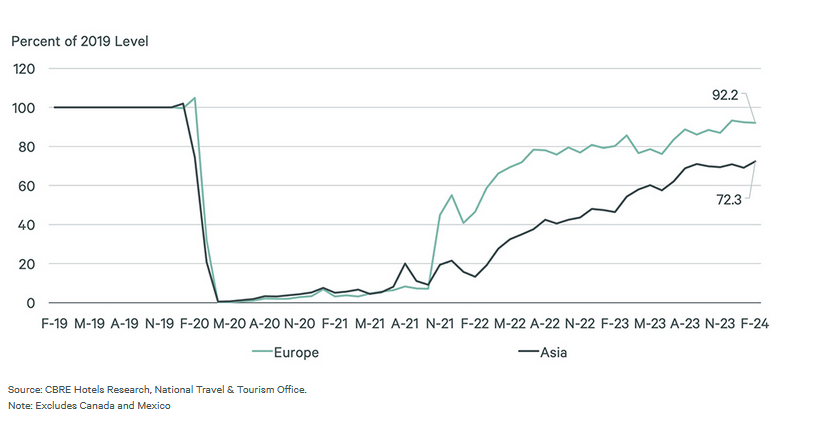

One of the reasons for current improvements and for optimism about the future, at least for high-income metros, is a steady return of foreign tourism to the U.S. As of February, tourism from Europe had reached 92 percent of 2019/pre-pandemic levels, and tourism from Asia had reached 72 percent.

READ ALSO: Retail’s New Logistics Logic

Though demand for prime retail space in high-street districts is strong, it’s often selective. In Chicago, for example, retailers that can’t find space in the Gold Coast/Oak Street submarket often will decline space elsewhere. CBRE notes that anecdotally, some tenant/landlord negotiations are now beginning three to four years ahead of lease expirations.

Little wonder, then, that after substantial decreases in 2020 and 2021, rents for prime retail space have increased by roughly 9 percent in the Americas, versus only about half that much elsewhere.

In response to all this, there has been an increased interest in alternative street-retail districts, CBRE notes. “Retailers that can’t find space in the ideal location may opt to establish multiple locations in alternative street-retail districts with lower rents and fewer build-out restrictions and hurdles to secure space.”

Examples include retailers having stores on both Rodeo Drive and Melrose Avenue in Los Angeles, and on Madison/Fifth Avenue and in Williamsburg in New York City.

Co-evolution solution

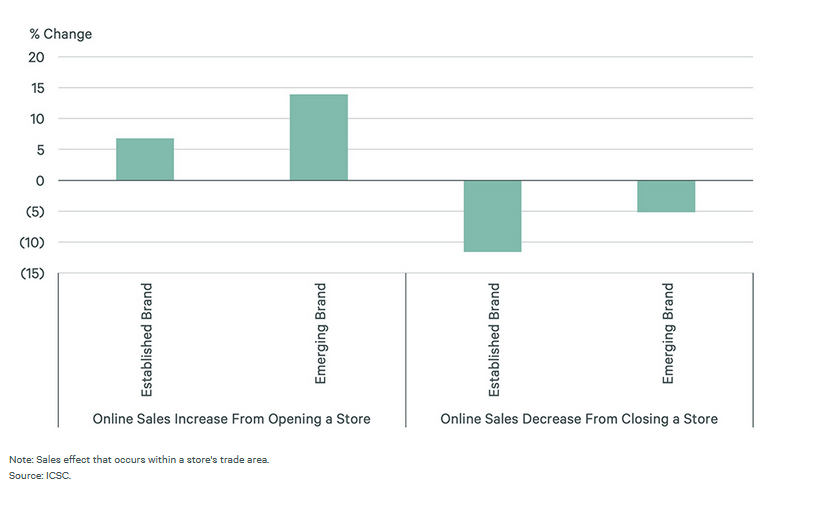

All of this is happening as retailers have gained a better understanding of the current omnichannel environment, with physical stores and e-commerce supporting, not undermining, each other.

Citing Forrester, the report notes that in-store retail sales accounted for 78 percent of sales growth in 2022, a major jump from 46 percent in 2019.

Further, the International Council of Shopping Centers has estimated that opening a store can raise a retailer’s digital sales by almost 7 percent, while closing a store can pull them down by 11.5 percent.

CBRE concludes that even though e-commerce was once believed to eventually eclipse brick-and-mortar shopping in popularity, e-commerce and in-store sales have become so interconnected that they lead to demand for additional physical space.

You must be logged in to post a comment.