2019 Special Servicing Rates

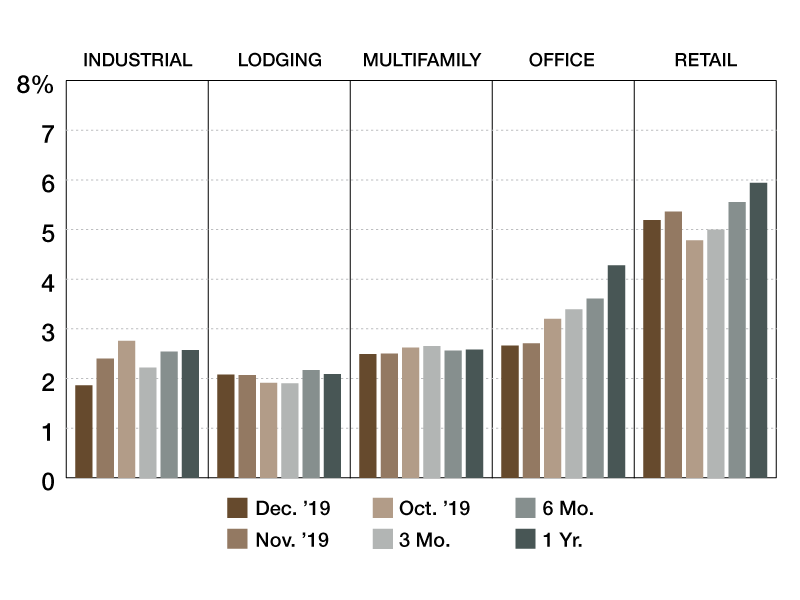

The Trepp Special Servicing rate came in at 2.9 percent in December, a decline of 8 basis points from the previous month.

The Trepp Special Servicing rate came in at 2.9 percent in December, a decline of eight basis points from the previous month. The special servicing rate for CMBS 2.0+ notes also saw a decline of six basis points. This was mainly on account of a 20 basis points drop in the office special servicing rates. In the legacy CMBS universe, office loans witnessed an opposite trend with the special servicing rates seeing an increase of 415 basis points. Additionally, legacy industrial rates saw a decline of 744 basis points. Since the balance of legacy office loans is more than 12 times the industrial loans, the result was a net increase of 82 basis points for legacy CMBS special servicing rates.

The number of loans newly transferred to special servicing slashed by half in December, with a total of 14 loans sent to special servicing in comparison to 29 the month before. Together, these loans hold an outstanding balance of $368.1 million, a sharp decrease from last month. The majority of the new specially serviced loans are in the office and retail sector, accounting for 34.4 percent and 31.9 percent of the total outstanding balance respectively.

—Posted on Jan. 16, 2020

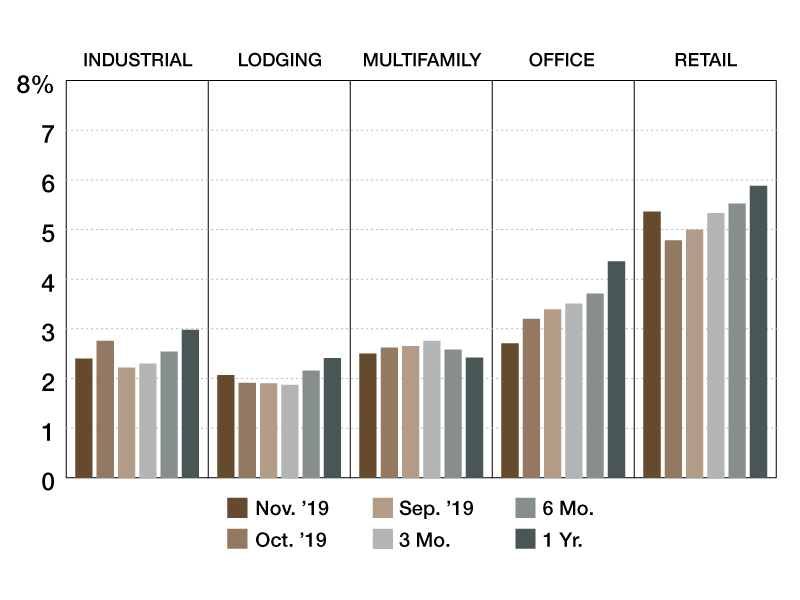

The Trepp Special Servicing rate came in at 3.0 percent for the month of November, witnessing no change from last month. The special servicing rate for CMBS 2.0+ notes grew by 20 basis points. Retail loans in CMBS 2.0+ universe saw a significant increase of 65 basis points in special servicing rates the past month, the largest of all property types. In the legacy CMBS universe, office special servicing rates saw a significant decline of 489 basis points along with a notable increase of 171 basis points in the industrial rates. This led to a net decline of 114 basis points for legacy CMBS special servicing rates.

The number of loans newly transferred to special servicing more than doubled in November, with a total of 29 loans sent to special servicing in comparison to 12 the month before. Together, these loans hold an outstanding balance of $1.22 billion, a ten-fold increase from last month. The majority of the new specially serviced loans are in the retail sector, accounting for a whopping 75 percent of the total outstanding balance. This was followed by lodging, which saw the second highest number of loans sent to special servicing but accounted for only 14 percent of the total outstanding balance.

—Posted on Dec. 16, 2019

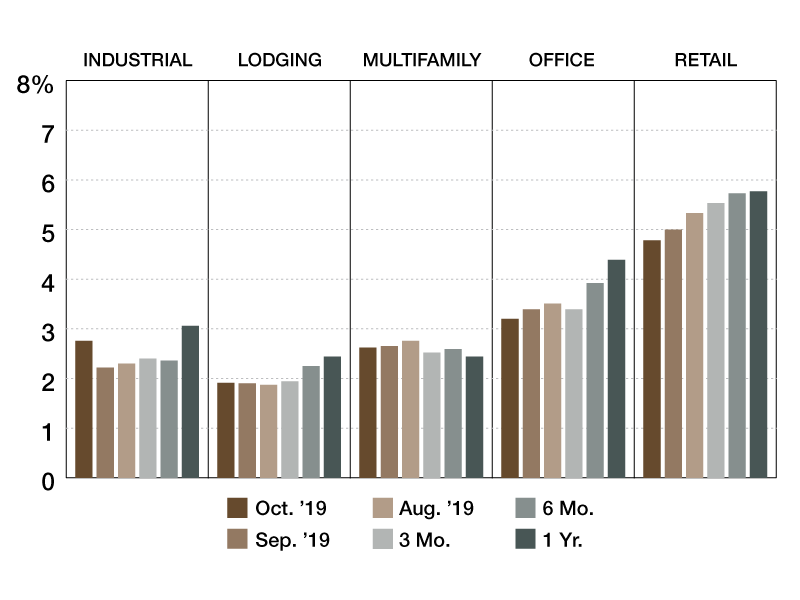

The Trepp Special Servicing rate declined by ten basis points to 3.0 percent in October, continuing the trend of falling special servicing rates over the recent months. The special servicing rate for CMBS 2.0+ notes fell by five basis points. In the legacy CMBS universe, industrial special servicing rates saw a significant increase of 570 basis points along with a notable decline of 112 basis points in the multifamily rates. This led to a net increase of three basis points for legacy CMBS special servicing rates.

The number of loans newly transferred to special servicing declined once again this month, with a total of 12 loans sent to special servicing. Together, these loans hold an outstanding balance of $119.8 million. Retail and office loans accounted for 72 percent of the total outstanding balance of the newly specially serviced loans. Additionally, the five largest loans sent to special servicing in October had a total balance of $84 million, a 43 percent decline from the last month.

—Posted on Nov. 18, 2019

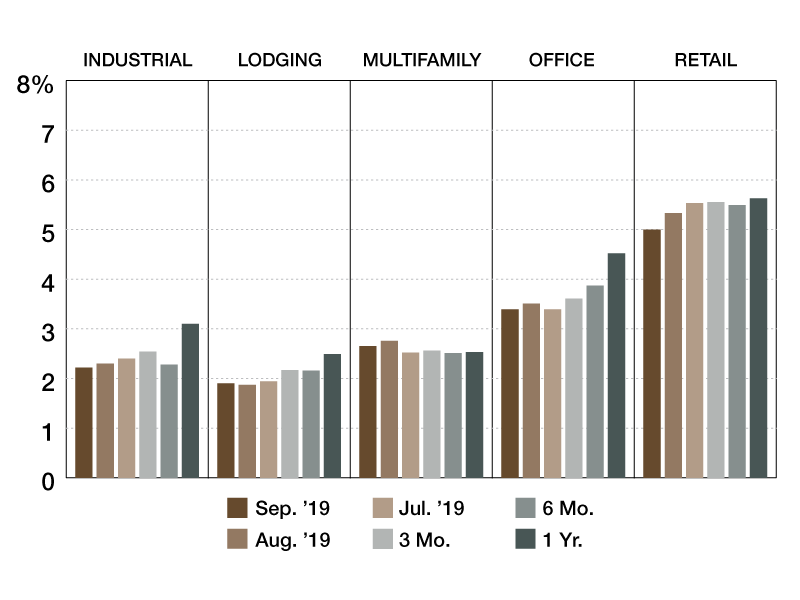

The Trepp Special Servicing rate fell once again in September by 12 basis points to 3.1 percent. Breaking down the rate by sector, the individual retail and multifamily special servicing rates for CMBS 2.0+ loans declined by 26 basis points and 11 basis points, respectively. We saw an overall bump in the legacy CMBS special servicing rate thanks to a 442 basis point bump in the legacy retail special servicing rate.

The number of loans newly transferred to special servicing significantly declined this week compared to last by 32. The 19 newly specially serviced loans hold a collective outstanding balance of $232.6 million. Retail and lodging loans accounted for 75 percent of the $232.6 million worth of newly specially serviced loans.

—Posted on Oct. 23, 2019

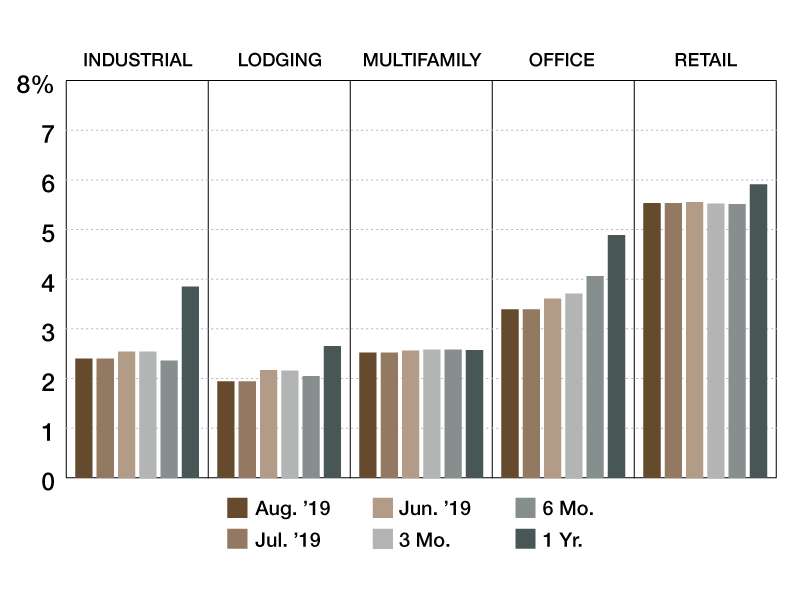

The Trepp Special Servicing rate fell once again in August by three basis points to 3.2 percent. While the rate continues to decline month over month, it’s worth noting that the decrease seen in August is nowhere near as substantial as the decrease that occurred in July (July’s Special Servicing rate declined by 11 basis points month over month). That’s because there was an eight basis point increase in the CMBS 2.0 Special Servicing rate between July and August. It’s worth noting that August’s eight basis point jump is the second largest jump in the CMBS 2.0 Special Servicing Rate in 2019, trailing behind March’s sixteen basis point bump. The number of loans newly transferred to special servicing doubled in August compared to what was recorded in July. Fifty-one loans were newly transferred to special servicing holding a combined balance of $1.08 billion. The retail and office property types accounted for 63 percent of the $1.08 billion worth of newly specially serviced loans.

—Posted on Sep. 24, 2019

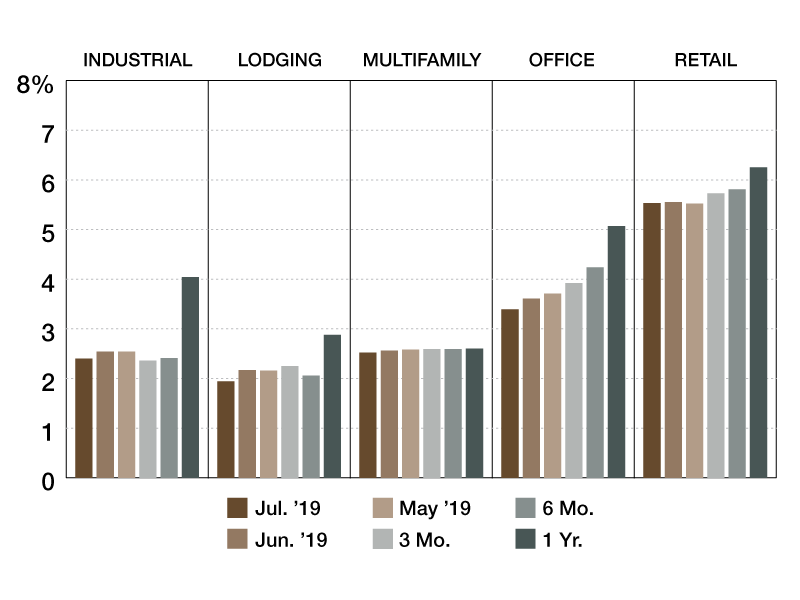

Over the past few months, we’ve seen a return to normalcy as the Trepp Special Serving rate continued to drop to a new post-crisis low. Back in April, the rate broke its month-over-month trend when it jumped up by 0.11 percent. However, May’s special servicing rate saw an immediate correction after the rate dropped to 3.4 percent. Since May’s correction, the rate has continued to decline month-over-month reaching 3.23 percent in July. The special servicing rate for CMBS 1.0 loans dropped by 45 basis points and the rate for CMBS 2.0+ notes fell by two basis points in the month of July. Both the lodging and office sectors were significant factors this month in pulling the overall rate down–both sectors saw a 22 basis point drop in their respective special servicing rates.

While the overall special servicing rate decreased in July, a total of 25 loans with a collective balance of $346.7 million were newly transferred to special servicing, which was $129.3 million greater than what was added in June. Retail accounted for 45 percent of the newly transferred notes thanks to loans such as the $79.6 million Park Plaza note and the $38.0 million Sarasota Square loan.

—Posted on Aug. 22, 2019

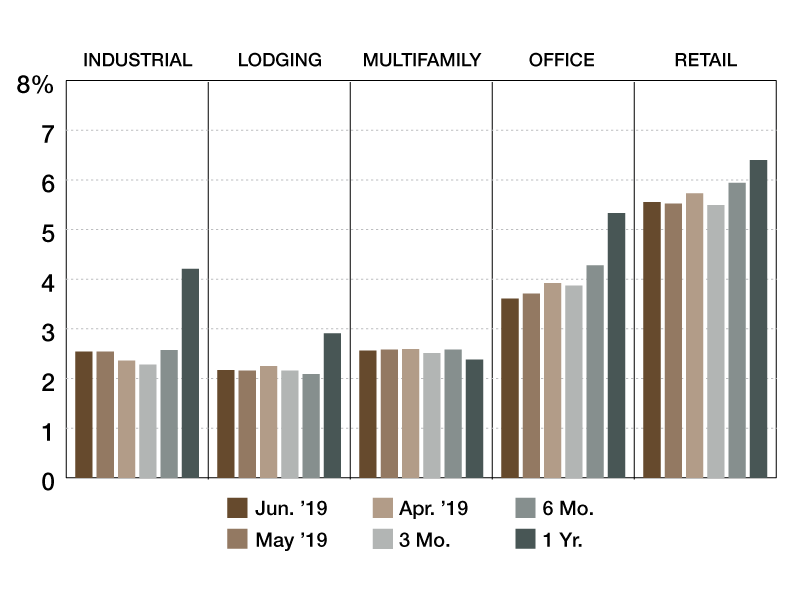

After two rollercoaster months of relatively large movements in Trepp’s Special Servicing rate, the market has settled in June with a single basis point drop. Trepp’s Special Servicing rate now sits at 3.4 percent.

A total of 15 loans with a collective balance of $217.4 million were newly transferred to special servicing in June. June’s month-over-month balance was nearly identical to May’s reported value, differing by a mere $0.1 million.

The $69 million Regent Portfolio note was the largest loan transferred to special servicing in June 2019. The loan is secured by 13 mixed use properties situated in New Jersey and Florida. The underlying note was transferred to special servicing after remittance data showed the borrower was 60+ days delinquent.

—Posted on July 23, 2019

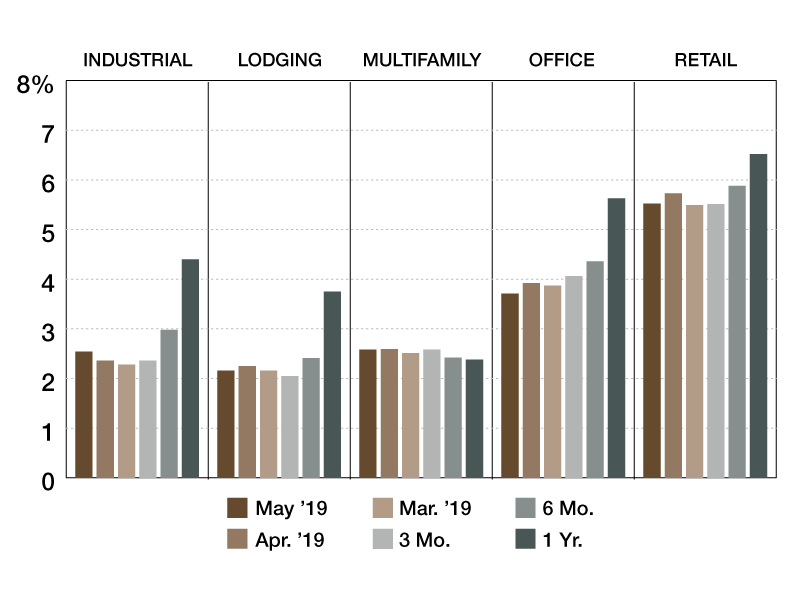

In April, we reported an 11-basis-point spike in the Trepp Special Servicing rate to 3.5 percent, the first month-over-month increase in the rate since May 2017. However, the reading returned to its previous trend in May as it clocked in at 3.4 percent (lower than both March and April’s respective rates).

Breaking the rate down by property type, all sectors experienced a decline in their respective special servicing rates except industrial, which grew by 18 basis points. However, the decline in the office, retail and lodging rates overcame the growth in the industrial reading, pushing the industry-wide average rate down.

A total of 16 loans totaling $209.2 million were newly transferred to special servicing in May. Two loans backed by Shopko properties—the $49.6 million Shopko Industrial Portfolio and the $27.2 million Shopko Oregon Portfolio—were transferred to special servicing during May.

—Posted on June 20, 2019

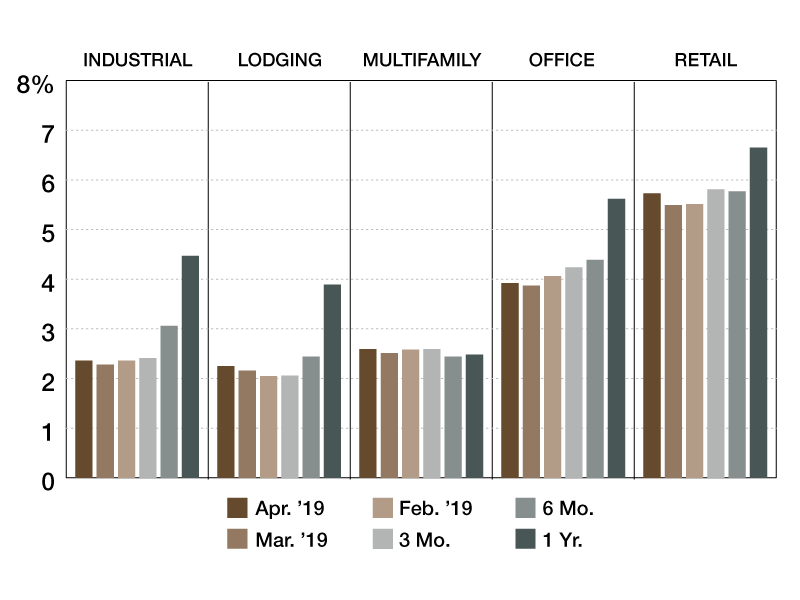

The Trepp Special Servicing rate jumped 11 basis points higher to 3.5 percent in April. This is the first month-over-month increase in the special servicing reading since July 2018 and is the largest rate hike in the last two years. A key culprit for the overall bump was the 24-basis-point jump in the retail sector’s rate. The special servicing readings for the other four major property sectors also increased. A total of 26 loans totaling $910.2 million were newly transferred to special servicing in April.

The largest notes that were transferred to special servicing in April were the $300 million Destiny USA Phase I loan and the $130 million Destiny USA Phase II loan. Both pieces are collateralized by the Destiny USA superregional mall in Syracuse, New York.

—Posted on May 20, 2019

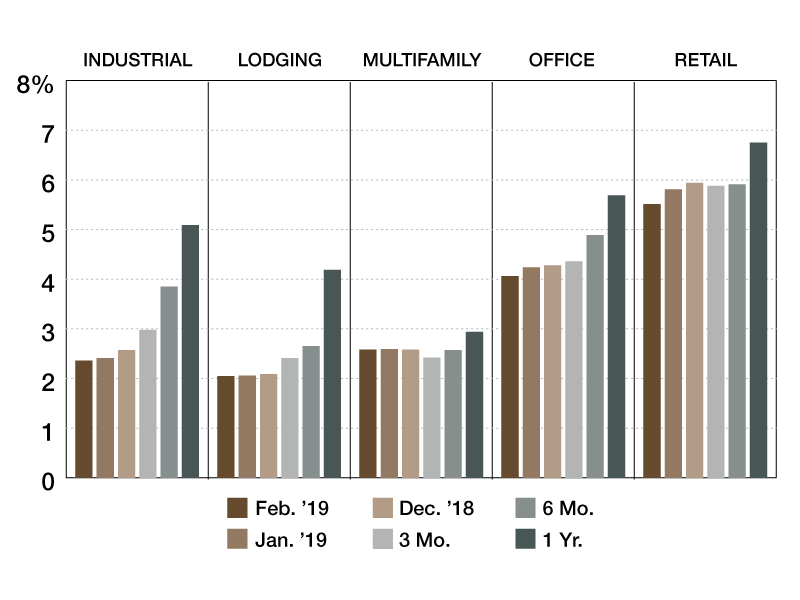

The Trepp Special Servicing Rate fell by 14 basis points to 3.5 percent in February, as we continue to see a steady reduction in the volume of CMBS loans that are in default. An important driver in the decline of the special servicing rate can be attributed to the CMBS 1.0 universe, while the special servicing rate for CMBS 2.0 loans remained relatively stable (down just two basis points month over month).

A total of 30 loans which were flagged as specially serviced in January 2019 were no longer classified as such in February 2019. Those loans were removed from the list because they were either returned to the master servicer or were retired. The special servicing rate is 136 basis points lower year over year. Major reductions in the volume of loans in special servicing occurred in Q3 2018 and Q1 2019.

—Posted on Apr. 19, 2019

You must be logged in to post a comment.