SPECIAL REPORT: Greenburger Reveals How Time Equities Prices Real Estate

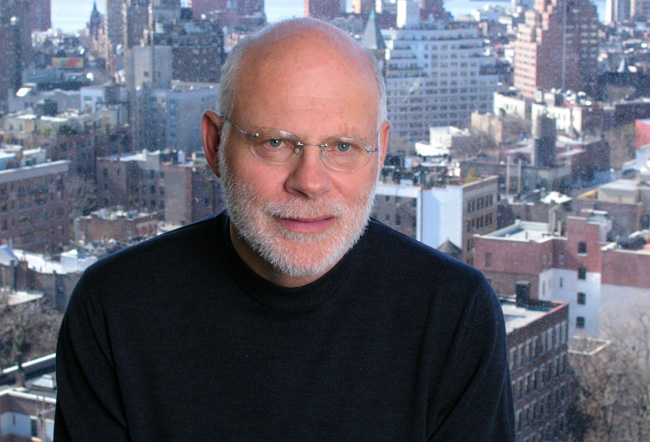

New York City real estate may be susceptible to the effects of current global economic developments, but it is likely to continue to rank among the world's top-performing investment markets long into the future, suggested Francis Greenburger, chairman & CEO of Time Equities Inc.

September 16, 2011

By Keat Foong, Contributing Editor

New York City real estate may appear to be susceptible to the effects of current global economic and political developments, but it is likely to continue to rank among the world’s top-performing investment markets long into the future, suggested Francis Greenburger, chairman & CEO of Time Equities Inc.

Greenburger, who has guided Time Equities for 40 years, addressed professionals in real estate and finance at an inaugural event sponsored by the Real Estate Principals Group. In his presentation, “Buy It Right, It’s Your Only Chance,” Greenburger provided a perspective into his company’s approach to investment, pricing, due diligence and underwriting.

Greenburger noted that Manhattan real estate prices, both for condominiums/cooperatives and apartment buildings, are close to levels achieved in the late-2000s market peak. The market, he noted, is being driven in part by foreign investors. In response to a question from the audience, Greenburger said that in the short-term, the developments such as the European debt crisis may affect real estate investment conditions negatively. However, unlike many other investments, real estate investments have a longer, one- to three-year timeframe, and in the long-term, macro trends take over.

“We know New York City is pretty much number one on every international investor’s shopping list,” said Greenburger. He surmised the reasons could be the international nature of the city, or its democratic institutions. He said New York City “is still a place the world looks up to.” In the long term, “the characteristics of New York City that appeal to international investors will still be there” despite short term fluctuations in global conditions.

Greenburger pointed out that distress in other parts of the world does not necessarily dampen enthusiasm for New York City real estate, as it will also motivate more people to invest in New York City as a safe haven. He noted, though, that because the New York City market is extremely competitive, it is difficult to obtain good pricing. “You have to find opportunities between the lines. We occasionally do, but it is very competitive,” he said.

In his presentation, Greenburger described Time Equities’ careful investment approach and noted pitfalls to avoid in the due diligence process, warning that “if you make a mistake going in, it is really hard to cover.” A well-priced property will easily absorb negative developments that are all too common in real estate projects. Whereas if an investor overpaid for a property, not only will there be difficulty absorbing any project problems that arise, but also generating adequate returns to investors and lenders.

There are two essential questions that separate a “good” from a “bad” deal in pricing real estate: “What is the property NOI today, and what is the NOI likely to be in the future?” and “What is the property value today, and what is the property likely to be in the future?” said Greenburger. He warned that sellers can obscure or marginalize some of the owner’s greatest costs, such as cost of capital improvements, tenant work and commissions.

He said this practice is so prevalent that when industry practitioners discuss the cap rate for a property, it is before calculating these costs.

Other underwriting issues that are not obvious include deflationary rent, taxes that become the owner’s responsibility when the lease rolls, and in-place rents that are in actuality outperforming the market — in which case the market rent needs to be taken into account in the underwriting.

Greenburger said his investment approach is marked by a drive to diversify geographically and including different asset types and sizes. And he added that when he purchases a distressed property, he is more likely to want to pay all-cash, whereas he is fully willing to leverage with a fully performing asset. “This is the TEI way — cover the downside and the upside will take care of itself,” said Greenburger.

You must be logged in to post a comment.