Slow Growth Outlook: No Worries for Real Estate?

By Chris Nebenzahl, Senior Analyst, and Paul Fiorilla, Associate Director of Research, Yardi Matrix: While CRE prices have likely peaked for now, the market should hold steady in the near term, due to modest gains in fundamentals. Here's why.

By Chris Nebenzahl and Paul Fiorilla

Recent reports on a number of economic fronts–GDP growth, interest rates and Brexit, to name a few–have not been encouraging. Are these conditions a harbinger of the next downturn, or could they portend an extension of the “Goldilocks” economy that has been so good for commercial real estate?

Recent reports on a number of economic fronts–GDP growth, interest rates and Brexit, to name a few–have not been encouraging. Are these conditions a harbinger of the next downturn, or could they portend an extension of the “Goldilocks” economy that has been so good for commercial real estate?

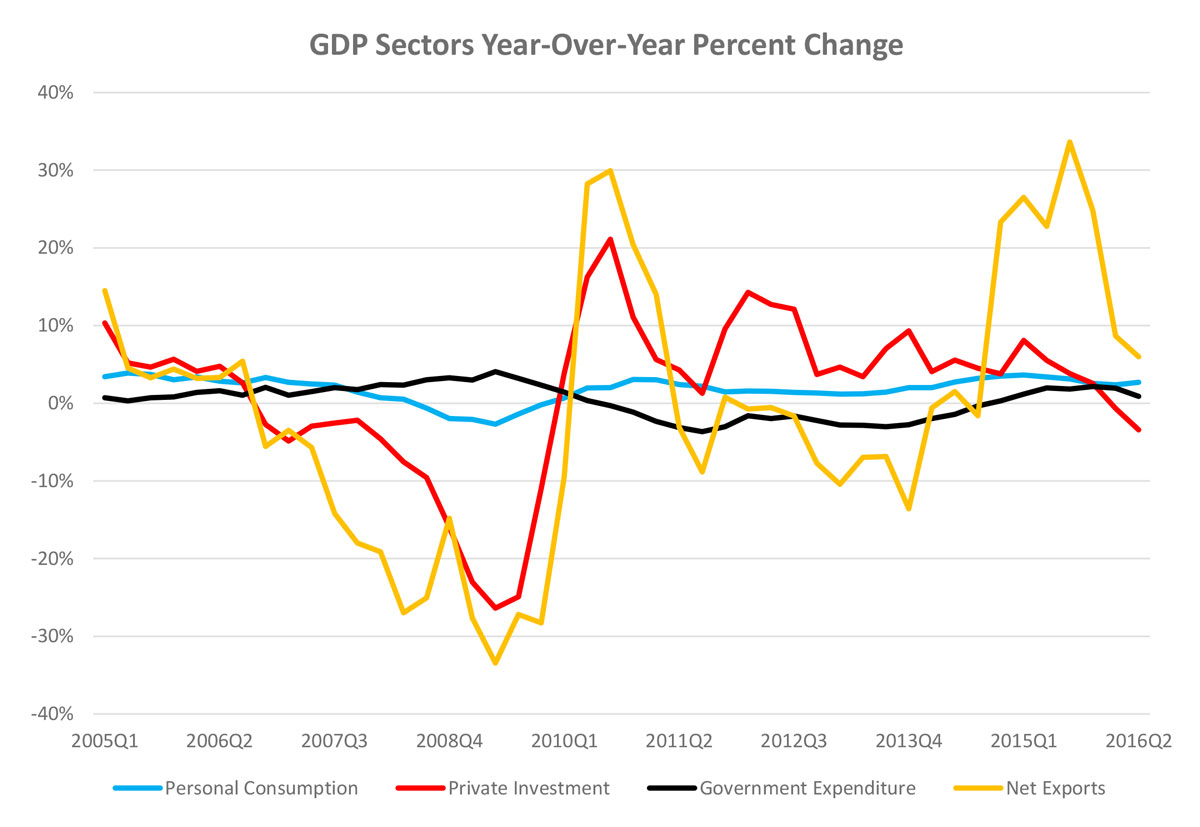

Maybe the most disappointing news was second-quarter GDP growth, which came in at a weaker-than-expected annualized rate of 1.2 percent, while consensus forecasts called for 2.6 percent. Plus, first-quarter GDP was revised downward to 0.8 percent, indicating that economic growth has averaged a meager 1.0 percent thus far in 2016.

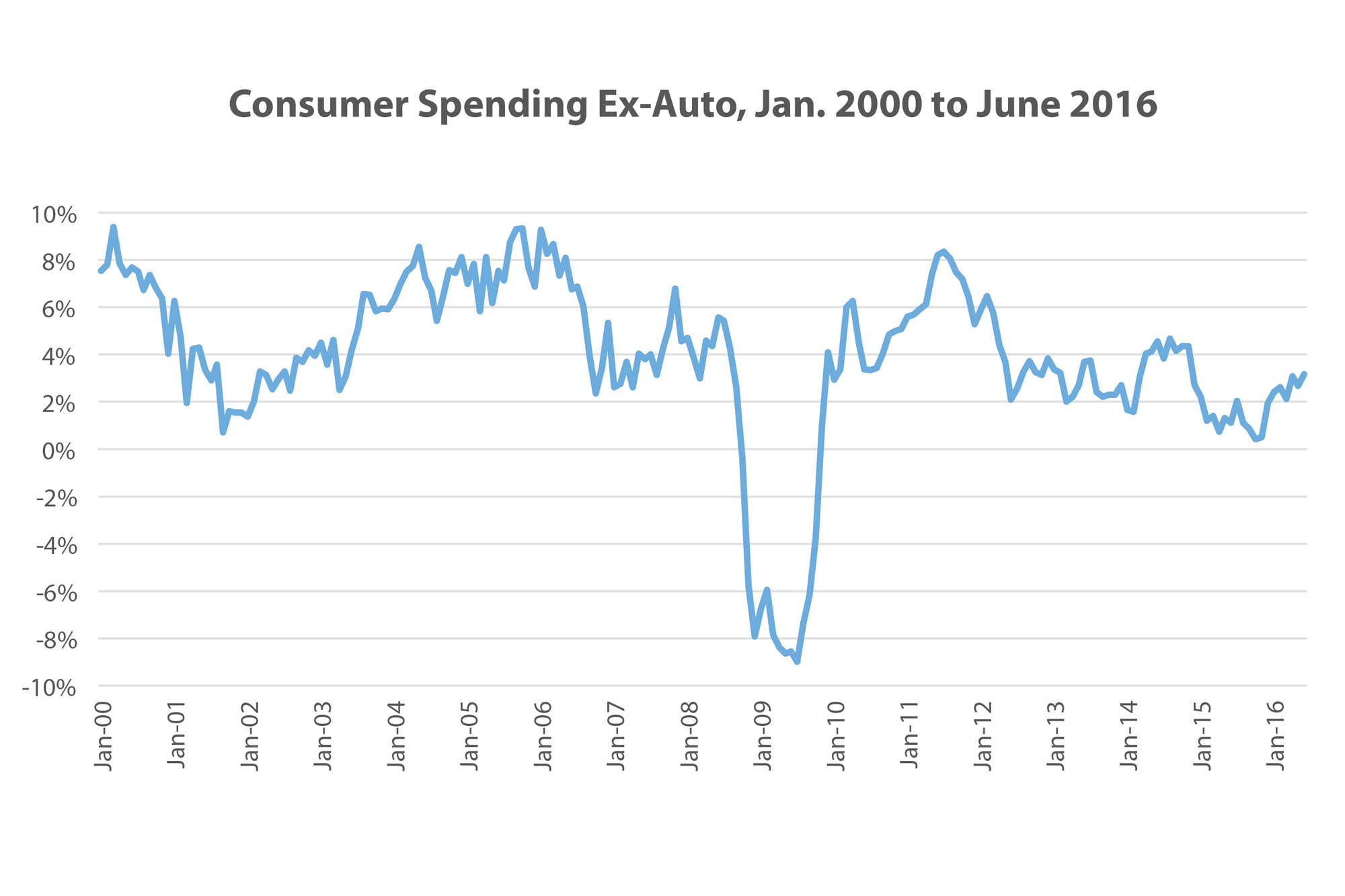

Weak GDP numbers were surprising because many components of the economy are doing well. Employment growth has been consistently strong, pushing unemployment below 5 percent, while workforce participation and wage growth are beginning to pick up steam. Meanwhile, consumer spending is rebounding, a sign that Americans are relatively confident and spending more freely this summer. As of June, consumer spending was up 3.2 percent year-over-year, the biggest increase since late 2014.

The main drag on GDP, however, was a 2.2 percent decline in business investment. Companies spent less on plant, property and equipment during the second quarter, while also cutting back on inventories. Some of this is related to the strong dollar and a resulting reduction in exports of products such as farm equipment to countries dealing with low commodity prices. It also could reflect businesses putting investment plans on hold due to the uncertainty that comes with the abnormal (and sometimes bizarre) presidential race and concerns about the global economy. Given the potential changes in business climate, companies could choose to keep their powder dry and their resources liquid before making significant investment decisions.

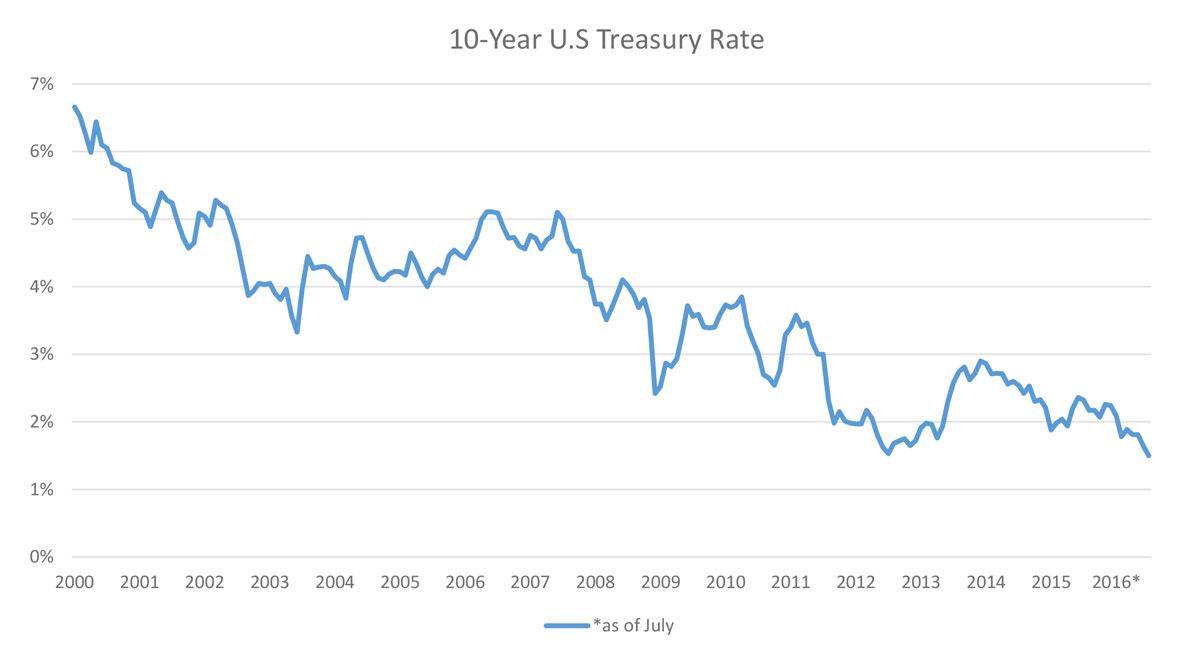

The general pessimism was reflected in the Federal Open Market Committee’s (FOMC) decision to maintain the federal funds target rate at 0.25 to 0.50 percent during its most recent meeting last week. The FOMC seemed more open to raising rates earlier in the year, but also seems unwilling to roil financial markets, which have reacted strongly this year to slowing growth in Asia and, more recently, the Brexit vote. What’s more, inflation remains under control and unlikely to top the Fed’s target of 2.0 percent. Inflation has been weak throughout the seven-year recovery, especially in the last 18 to 24 months, as the decrease in energy costs and oil prices has dampened inflation metrics.

Likely Scenarios and Commercial Real Estate

The recovery that started in the second quarter of 2009 is now the third-longest period of expansion in the post-World War II era, trailing only first-quarter 1991 to first-quarter 2001 and first-quarter 1961 to first-quarter 1969. At the same time, overall growth has averaged 2.1 percent during the current expansion, which is materially weaker than other modern-era expansions.

So where does this leave commercial real estate? There’s concern that the fragility reflected in unexpectedly low GDP and slowing job growth numbers is a sign that the recovery has run its course and a downturn is on the way. Weaker growth would reduce demand for commercial properties, and possibly put an end to the ongoing recovery in property fundamentals.

That scenario would be problematic, and not just because property fundamentals are important in a general sense for the health of the market. Unlike the economy, which has had muddled success, commercial real estate has experienced buoyant growth during the recovery, largely due to capital markets forces such as investor demand and debt availability. But property yields are at all-time lows and investor demand is starting to wane, so returns over the next few years are likely to be driven by income gains, which are dependent on fundamentals. While inflation has remained low, rents and property values have steadily increased as the large population of Millennials entering the workforce has boosted demand for multifamily and office real estate.

If the economy doesn’t decline, the next most likely scenario is continued moderate economic growth. Commercial real estate has thrived in the low-growth environment, and there are reasons to think the sector would continue to do so in the next few years. Among the reasons:

-

Low interest rates = low cost of capital. Weak growth and uncertain sentiment in global markets are likely to keep interest rates low. Real estate is heavily dependent on the cost of capital. With the 10-year Treasury rate below 2 percent, the cost of debt in particular has declined significantly in recent years. Owners of Class A assets in top markets can get long-term mortgages in the 3 percent range, and even many assets in secondary markets or more-risky property types can get long-term debt in the 4 percent range. The downside is that cheap debt has helped drive property yields to record lows, and could produce another bubble if buyers are not careful.

- Mitigating refinancing defaults. Low rates will help mitigate the problems anticipated with the so-called “Wall of Maturities”—the 10-year loans originated at the height of the last bubble that are coming due over the next 18 months. In particular, this involves upwards of $100 billion of the $230 billion in CMBS loans that were securitized in 2007. Loans originated during that vintage had aggressive terms, and many can’t be refinanced with restructuring. However, the combination of rising property values, low interest rates and cheaper debt will enable the owners of those properties to borrow more than would have been thought in recent years. That could help property owners to refinance properties that seemed headed for a maturity default, or at least reduce the extent of restructuring needed to repair 2007-vintage loans.

- Stimulating investor demand. Low interest rates have drawn global investors to U.S. commercial real estate. Properties yield 6 percent on average, and even buying trophy assets at 3 to 4 percent, as many foreign investors do, seems logical in comparison to making negative returns for buying sovereign debt of some European countries or even U.S. Treasuries. What’s more, the U.S. economy seems a beacon of stability compared to Europe, Asia or emerging markets.

- Discouraging overdevelopment. Tepid growth helps to dampen exuberant sentiment, which in the past has led to overdevelopment during recoveries. Construction in the current cycle is relatively sparse–although some segments appear to be in danger of overbuilding, such as New York City hotels and apartments in Houston–and generally has been limited to markets with the most demand. There are other reasons for this, too, including the increasing use of analytics to determine demand and regulations that are making construction lending less profitable, but it’s fair to say that the weak growth curve has played its role.

- Supporting REIT values. Low interest rates often (but not always) provide a boost for REIT prices. That’s because dividends comprise a significant part of REIT returns, and rising interest rates make those distributions less valuable. Perceptions about the direction of rates are among the reasons for volatility in REIT values, which were up 15.9 percent through the end of July after returning a negative 0.7 percent in 2015. However, it should be stressed that the reason interest rates rise is more important to REITs than the fact that they are rising.

Slow and Steady Growth?

There are a good number of questions about the direction of the economy. Positives such as strong job creation, low unemployment, improving consumer balance sheets and near-record auto sales are counterbalanced by worries about global growth, the strong dollar cutting into exports, persistent underemployment and weak business inventory growth. Given that the recovery is already well into its cycle, that leads to the conclusion that growth is more likely to maintain its current middling level or even shrink than it is to expand rapidly.

While the likely slow-growth scenario is not ideal, commercial real estate has thrived during the recovery for a variety of reasons, such as low cost of capital, bullish investor demand and slowly improving fundamentals that have kept a lid on development. Worries about the economic future, along with the number of new regulations that have left many in the industry frustrated, have served to ward off the type of aggressive behavior that was common near the peak of the last cycle. The bottom line is that while price appreciation is likely to have peaked for the time being, the commercial real estate market should hold steady in the near term, led by modest gains in fundamentals.

You must be logged in to post a comment.